You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Baseball Advent Calendars and Other Guilty PleasuresThere's a 100% chance that I open up this baseball card advent calendar before December 1.Dear Fellow Traveler: So… Fanatics… a company that has weaponized my love for baseball cards… has released a Holiday Advent Calendar. It’s exactly what you think it is… You get a pack each day leading up to Christmas… I clearly bought one… and I think I demanded the right to pay more than the MSRP. So, I showed it to my daughter… and she was really excited. That’s a thing we do together… and she always ends up pulling the best cards ever… The very first pack she ever opened was a 2022 Aaron Judge 1 of 25 card that’s worth a small fortune… Well, the Advent calendar was sitting on the counter… and my wife says…

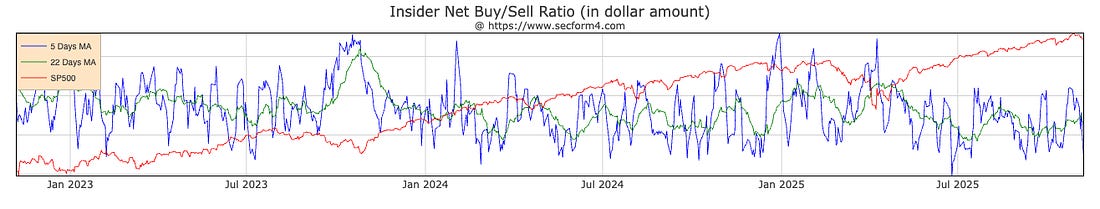

Meaning, she’d get upset and want to open the cards. Um… She’s not the problem… Amelia has an incredible ability to delay gratification. Like the Marshmallow kids… I lack that skill… I tell myself that I’m good at delaying gratification… but it lasts about 24 hours. She still has unopened boxes of baseball cards that I gave her a year ago… and she is waiting for the right time to open them when “we need something to do…” I don’t know where that comes from… because it’s not a Baldwin trait. There’s a very good chance I’m going to “Bad Santa” this Advent calendar and have to buy a new one. Then, she’ll be opening cards that I already opened… and I might even have to put a Candy Corn or two in there…  Yes… I’m 44 and I enjoy the dopamine and the “hope” of baseball cards… What an incredibly boring… and safe… vice. Your Weekly Reading List“Money Printing” By The Fed: Fact Or Fiction? - Lance RobertsLance Roberts graciously took the time to reply to my critique of his debasement argument in October. He also - graciously - invited me on his show this week to discuss. It will make for an interesting conversation, as he emphasized the Fed’s side of the “money printing” framework. I hope we discuss the second part… how Treasury operations interact with those reserves to create systemic leverage through rehypothecation. There are different ways to “print money.” More coming this week… There’s something worse than a recession, and we’re already in it.Josh Brown brilliantly captures something most people missed about the recent elections… Inflation isn’t just an economic statistic. It’s a universal solvent that corrodes social stability by hitting everyone at once, unlike recessions, which primarily hurt the unemployed minority. Josh nails why voters chose outsider candidates like Trump and Mamdani despite their obvious flaws… when you’re drowning in rising costs, even potentially wrong answers beat no answers at all. WatchTobias Carlisle joined Tim Melvin this week to discuss his new book… And all we could do was say, “Why didn’t we think of that…” The book combines the investing lessons of Warren Buffett and the military strategy of Sun Tzu. I’ve ordered a copy of the book… and it arrives on Monday. Investors who are new to this work should also pick up a copy of Carlisle’s brilliantly short The Acquirer’s Multiple.  As always… head over to The Off Wall Street Wanderings of a Curious Mind with Tim Melvin for more insight on banks and credit… This is his time to shine… The Week in ReviewThis was a very odd week for the stock market. Our signals turned Red on Tuesday and Thursday… and remained red into the close on Friday… We’re expecting more chop in this environment, so it’s time to do a few things. First, go through your portfolio - and if you own something, and you don’t know why… sell it. Did you buy it because it’s a great business, or did you buy it because it was a speculative story told by someone else? Did you buy it because you understand the capital flows… the F score… or the business model… or was this something that you read about on a blog by a guy you couldn’t pick out in a crowd? Now is the time to ask these questions… And to reframe your allocations accordingly… Second… keep a very close eye on the FNGD. I read an incredible statistic by Michael Howell today… effectively arguing that the number of value arbitrage allocators has declined immensely over the last 35 years in the stock market. The people who were buy-and-hold and actively managing disappeared, while passive flows exploded to about half the market. He said that about one-third of the capital now comes from leveraged funds that rely on repo and momentum… That share has doubled in that time frame. If those figures are correct… they show why the FNGD cleanly represents the market's evaporation of that leverage. When that thing spikes over its 50-day moving average… be EXTREMELY cautious… This daily chart shows the last two big drawdowns in the S&P 500… The Nikkei Crash in August 2024 and the Trade Crash in 2025. The warning sign was there… well ahead of the worst part of those short-term panics. Third… keep an eye on aggregate insider buying to selling… Here’s the five-day moving average of aggregate buying to selling in DOLLARS. This BLUE line represents EXECUTIVES BUYING STOCK WITH THEIR OWN CASH… When this spikes toward the top of the chart (the red line is the S&P 500)… that is INCREDIBLY bullish. You can see a few big spikes in recent years… that’s executives calling a short-term bottom. The most recent spike came on April 8, 2025, when Trump canceled Liberation Day. In December, we saw something similar after a little bit of worry in the money markets. And back in October 2023, that coincided with the 10-year hitting 5%… In case you missed any articles this week… here’s the roster. I highly recommend - if you read anything - that you check out the November 7 piece on Julius Caesar… Monday, November 3:Plumbing Problems (S&P to Yellow, Russell Redder...) Tuesday, November 4:Michael Burry’s Impeccable Timing... and Movie Night... Wednesday, November 5What Mamdani’s Win Means... And Things I Think I Think Thursday, November 6Make It a “BlackRock Night”... Friday, November 7The Man Who Mastered The Debt Game and Still Lost His Life Playing It Saturday, November 8Bring the Ruckus... Bring the Chart Party... Buy Me More Toast... All right… I’m off to take my daughter bowling… to the Maryland Irish Festival… and to lunch… This will be a very long day… but a wonderful one. Have a great Sunday… and I’ll be back tomorrow. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Baseball Advent Calendars and Other Guilty Pleasures"

Post a Comment