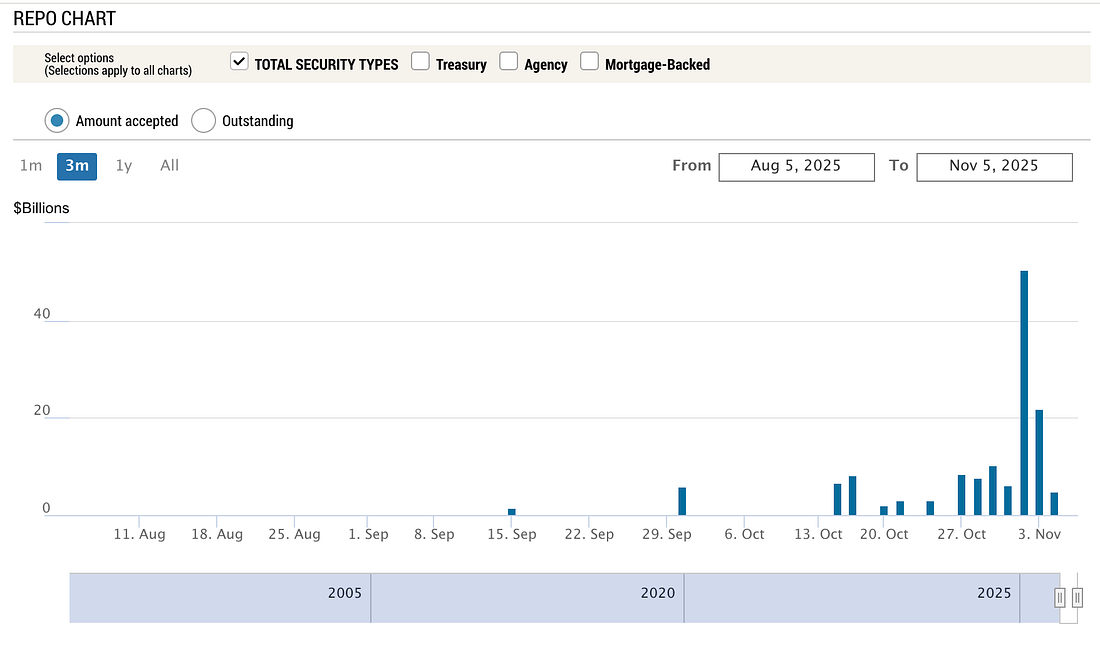

Good Morning: Well… it appears that the national nightmare of private lending and market reverberations is temporarily on hold. The Fed’s Repo efforts have done what was necessary for now - and calmed markets. Yesterday, the bank didn’t have to do much… and we’re still in the dark on why all these efforts were necessary… Banking stocks are trading sideways, with the regionals trying to break back above their 20-day moving averages. If there is a storm, we’re technically in the eye of it… If the storm is past… well, we apologize for interrupting the next liquidity burst higher. Once again… It’s unclear if this was related to Japan… again. But SoftBank stock is up 17% this morning (after a sharp decline in recent days), thanks to an agreement with Marvall. Funny how this keeps happening… This is the FIFTH time since April that we’ve seen pullbacks take us into a negative reading on the equation (daily reading during market hours). Selling pressure remains strong in these markets - especially on the VERY RED Russell 2000 - but the S&P 500 remains resilient with dip buyers during trading sessions… Yesterday’s tech resurgence in names like Seagate (STX), Micron (MU), and Lam Research (LCRX) is a reminder of how momentum works and what narrative dominates - AI. A modest dip in the dollar is also front and center. The greenback is trying to push above its 200-day moving average… but has met resistance. If it runs back down, this will be bullish for commodities and equities. I’ll be live at 8:45 ET this morning to discuss… You can join me right here…... Continue reading this post for free in the Substack app |

Subscribe to:

Post Comments (Atom)

0 Response to "Fed Does Its Job... For Now..."

Post a Comment