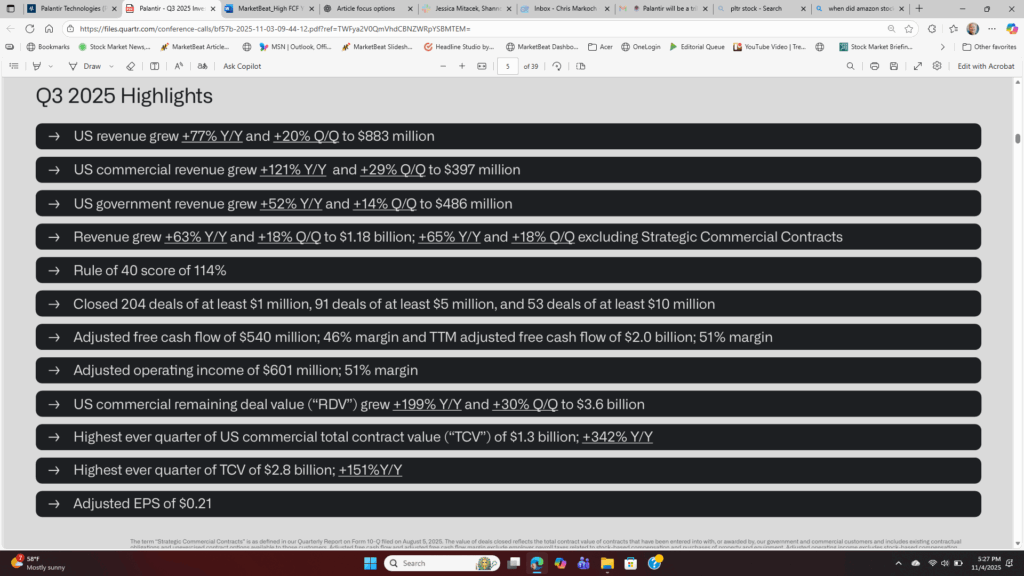

| Below is an important message from one of our highly valued sponsors. Please read it carefully as they have some special information to share with you. Dear Reader, Early investors who bought shares during Amazon's 1997 IPO have had the chance to make a fortune. In fact, Amazon has climbed more than 255,000% in the time since – enough to turn a $100 bill into more than $250,000! But if you missed out, don't kick yourself… According to a report from Capital.com, Elon Musk could be gearing up to take his internet satellite giant, called Starlink, public… in what Fortune magazine says will be the biggest IPO in history! And here's the kicker… With an estimated value of more than $100 billion, that means Starlink's potential IPO could be a staggering 287 times bigger than Amazon's 1997 IPO. It'll also be 55 times bigger than Apple's IPO, 128 times bigger than Microsoft's IPO, and 177 times bigger than Nvidia's IPO, to name just a few. But that's not all… For the first time ever, James Altucher – one of the world's top venture capitalists – is sharing how ANYONE can get a pre-IPO stake in Starlink… with as little as $100! That means you have the first-ever chance to skip the line, and position yourself BEFORE the IPO takes place. Sincerely, Doug Hill VP of Publishing, Paradigm Press This ad is sent on behalf of Paradigm Press, LLC, at 1001 Cathedral St., Baltimore, MD 21201. Today's editorial pick for you Palantir Has an Amazon Problem That Illustrates the Long-Term OpportunityPosted On Nov 05, 2025 by Chris Markoch  Palantir Technologies Inc. (NYSE: PLTR) stock dropped nearly 8% the day after its Q3 2025 earnings report, and the reaction was as predictable as it was shortsighted. Critics who've been calling Palantir stock "overvalued" since 2021 are getting their running shoes and getting ready to take a victory lap. Table of ContentsYet the company just posted some of the strongest growth and profitability metrics in its history. It's the kind of report that usually defines category leaders in the making. To understand why the market might be wrong again, let me explain what I've termed Palantir's "Amazon problem." It's an idea I got from legendary analyst Keith Fitz-Gerald. It starts with the idea that visionary growth stories are dismissed when "traditional" valuation metrics can't fully assess a stock's potential. Let's look more closely at how this applies to Palantir. Palantir and the Amazon ProblemIn the late 1990s, Amazon.com Inc. (NASDAQ: AMZN) traded at a price-to-earnings (P/E) ratio north of 3,700. At the time Amazon was just an online bookstore with large aspirations. Analysts said it was absurdly overvalued, and that it would never grow into its valuation. Yet Amazon did exactly that, transforming retail, cloud computing, and media. In the process, it's rewarded long-term holders with life-changing gains of over 150,000%. The point isn't that Palantir is Amazon. But the dynamic is familiar: a company with massive disruptive potential looks "too expensive" to those using backward-looking valuation models. As Fitz-Gerald has argued, "Visionary growth tends to outrun temporary metrics." Palantir's Q3 2025: Growth and Profitability in TandemPalantir's third-quarter results made one thing clear: the company's growth engine is firing on all cylinders. Total revenue climbed 63% year over year and 18% sequentially, reaching $1.18 billion. Excluding strategic contracts, revenue was up 65% year over year. U.S. revenue rose 77% year over year and 20% quarter over quarter to $883 million, driven by broad-based strength across both government and commercial customers. The U.S. commercial segment — a critical piece of Palantir's long-term thesis — surged 121% year over year and 29% sequentially to $397 million. Even the government side, often seen as mature, grew 52% year over year to $486 million. Perhaps most impressively, Palantir achieved a Rule of 40 score of 114%, meaning its revenue growth plus free cash flow margin exceed the 40% threshold that defines elite software performance. The company also posted adjusted free cash flow of $540 million (a 46% margin), and adjusted operating income of $601 million (a 51% margin). It was the company’s seventh consecutive quarter of GAAP profitability — a milestone many high-growth peers have yet to reach. Adjusted EPS came in at $0.21, 23% above consensus estimates.  Why Palantir Stock Dropped AnywayGiven those numbers, the post-earnings drop looks less like a referendum on the company’s performance and more like an emotional reaction to valuation. Even after the pullback, PLTR stock trades at roughly 204x forward earnings and a price-to-sales (P/S) ratio of over 129x. These are exceptionally high by traditional standards, but they're not unprecedented for a company delivering triple-digit commercial growth and expanding profitability. The near-term bear case is easy to summarize. Growth will slow, and the multiple will compress. But that argument ignores the structural tailwinds behind Palantir's business. The world's most complex organizations — from defense agencies to industrial giants — are racing to operationalize artificial intelligence. The AIP platform isn't just another AI model; it's the connective tissue that turns data into decisions. From Government Roots to Global EnterprisePalantir's long-term value creation lies in its transition from government contracts to enterprise scale. The company closed 204 deals of at least $1 million, 91 deals above $5 million, and 53 above $10 million in Q3. The commercial pipeline is exploding — U.S. commercial remaining deal value grew 199% year over year and 30% sequentially to $3.6 billion. The total contract value reached a record $2.8 billion, representing a 151% year-over-year increase. This is not a company scrambling for growth; it's one that turns pipelines into durable, high-margin relationships. Palantir's approach — onboarding customers through "boot camps" that show immediate AI use cases — is proving sticky. Once embedded, clients often scale deployments across divisions, making Palantir's software mission critical. That's how recurring revenue compounds quietly while skeptics focus on the stock chart. The Pain of Being EarlyVisionary companies rarely reward investors in a straight line. Amazon fell more than 90% during the dot-com crash before its fundamentals caught up. PLTR stock has already had several sharp drawdowns, including a 40% slide earlier in 2025. This is where the bears are right. PLTR stock is likely to be volatile in the short term. However, volatility is the price of admission for exponential returns. Palantir's business model — asset-light, cash-flow positive, debt-free — gives it the financial durability to withstand macro pressure. As long as it continues compounding revenue at 20–25% annually and expanding margins, its valuation will normalize with time. The AI Edge: Execution, Not HypeWhat truly differentiates Palantir from other "AI plays" is its focus on execution over experimentation. While foundation model companies like OpenAI and Anthropic build the brains, Palantir builds the nervous system that helps enterprises deploy those brains at scale. Its AI Platform (AIP) is being adopted across manufacturing, energy, healthcare, and logistics — sectors where uptime, compliance, and decision accuracy are non-negotiable. That's why Palantir's relationships with the U.S. government, NATO allies, and Fortune 500 firms create a moat few startups can match. In a field crowded with hype, Palantir's advantage is that its AI is already in use. Visionary Growth Always Looks ExpensiveThis takes us back to Palantir's Amazon problem. Every great growth story has been labeled a bubble at some point. Tesla. Netflix. Nvidia. Amazon. Investors who waited for "the right valuation" often missed the run entirely. Palantir's valuation debate will continue, but focusing on the multiple misses the forest for the trees. The company is scaling faster, earning more, and building a deeper competitive position than most software firms of its size. The market will eventually price that in. The Bottom LinePalantir is not a stock for traders chasing quarterly beats (although it's doing just that). It's a long-duration growth story for investors who understand that paradigm shifts take time to be appreciated. Yes, it's volatile. Yes, it's richly valued. But so was Amazon when it looked like a bookstore with a website. Palantir is doing for decision-making what Amazon did for commerce — building the infrastructure that will define the next decade of enterprise AI. That's the essence of the "Amazon problem." The market calls it overvalued until, one day, it's the benchmark everyone else is measured against. For long-term investors, that disconnect might just be the opportunity.

This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above. Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc |

Subscribe to:

Post Comments (Atom)

0 Response to "Forget Amazon’s 1997 IPO… This Could Be 287 Times Bigger"

Post a Comment