You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Good afternoon: If you “discovered” me on Substack, there's a good chance you came from Josh Bellanger’s publication, Belanger Trading. He’s been kind enough to recommend my work over the last two years, and the guy has basically broken Substack with 333,000 followers… He’s an old school CME floor guy… running in the pits at 19 years old, working for multiple trading shops. On Thursday, a few of us at TheoTrade were talking about how much we missed the floor on reversal days… then we’d all go to one of the nearby “trader bars” and try to make sense of what the hell just happened. Josh has a little better taste than the Loop bars like Stocks and Blondes (which always smells like bleach), Cactus, or Ceres - where you were almost guanteed to wake up with your shoes on after an evening there… He’d tell me to catch up with him somewhere else. I’m indebted to him because he introduced me to one of the best-kept secrets in Chicago. The lobby bar of the Thompson Chicago, which is one of my favorite places to write in the country… I said all this because… Josh just had one of his most widely opened emails in a long time… Two nights ago, he wrote an article that referenced me (I’ll let you read the headline). We were chatting about Liberty Energy (LBRT). Someone had made a massive bet on the company, picking up thousands of contracts on a $25.00 call. Someone’s bullish… I emailed him and told him only what I knew… Christopher Wright is the former CEO of LBRT and is now the Energy Secretary. That they’re neck deep in the Forge project that I visited in March… and that I don’t believe AT all in coincidence when it comes to aggressive call buying on anything linked to a company linked to the current administration… So… someone in the know… I assume… is betting big… Here’s the thing… I didn’t know the calls were being bought. I wouldn’t have picked up… That’s what he’s good at, as he’s looking at this action and then the homework… Josh wrote…

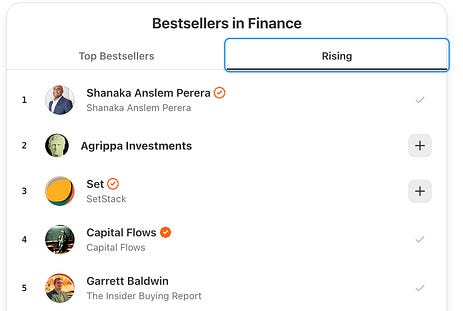

I appreciate the writing style… It’s got some Gonzo to it… the mind of a trader… seeing patterns in the data… a hard thing to do… then putting it all together. You can see how fast a thesis forms… and how the quantitative mind works to tell the story… It’s a reminder to meet people who look at the markets differently than you… and also to bounce narratives off them. This whole thing is a giant puzzle… Trading’s impossible to do alone because you need to know all sides of the story before you build conviction… This was a good example of collaboration in markets… If I can return the favor… I will. Check out Belanger Trading… It’s a great read… No. 2: Thanks, Hunter…I’ve had a tough few months… but this quote has helped… My magazine journalism professor, Craig Vetter, was very close to Thompson for a while. He took writing very seriously and said that Hunter told him that “every sentence had to be a brick to the head.” Vetter was the subject of a book I never published… because I thought too much… That guy put way too much pressure on me… but he was the best… It got me to this writing style… and this voice… No. 3: Do I Look Like I’m Negotiating?I have officially won Black Friday… I bought the film Michael Clayton on Amazon Prime for $1.99 last night. One dollar… and 99 cents… At that price, Amazon is almost paying me to watch one of the greatest final scenes of a film in cinematic history… This is a great film… and I had a thought today… I must say that I’m intrigued when a film is named directly after the main character. You know exactly what you’re going to get… Hollywood could have really screwed this film up by calling it something stupid like “The Fixer” or “The Devil’s Retainer…” But the producers stuck to “Michael Clayton…” And that honestly makes the film better. No. 4: Insider Buying… Is Awesome…I’ve joked that my Capital Wave Report is a letter that can’t be sold… Well, it gets better… because it was a few months ago that someone at the upper chain of the financial publishing world said, “No one wants to buy a newsletter around insider buying?” Well… why not? Insider buying is a very clear signal. If a CEO and CFO is buying a stock, that’s significant. If a CEO and CFO aren’t buying their stock… that matters. If the CEO and CFO aren’t buying their stock… or at least getting paid in their stock… then why are you buying it? This is basic behavioral finance… Well, I dusted off the letter on the mantle and started putting in a little more time to deliver updates and insights on insider purchases. If you want to see today’s letter, it’s right here. I opened it up for everyone for free… We’re making moves… Two additional points on this… If you’re interested in the Insider Buying report… We have a Black Friday discount. This is a higher premium on this… and we’re working on automating Edgar with… a scoring system. That will take a little time… Second, Shanaka is a new writer that I don’t know that well, but he had an incredible piece on Japan the other day that I recommend. No. 5: This Doesn’t Prove Anything…My last thing, I think… There’s a guy on LinkedIn right now banging on pots and pans, saying that Harvard just bought $320 million in Bitcoin… and then started mocking people for thinking BTC is just for libertarians and tech nerds… Okay… hold on. If we’ve seen anything in the last month, Bitcoin tracks global liquidity, it’s an incredible leveraged asset, and it experiences rather significant volatility. I own Bitcoin. But I’m not owning it because Harvard does. Here’s what this guy Jean-Michael said…

Ron Howard Voice: “It was speculation…” Harvard also famously lost $1.8 billion under Larry Summers's guidance (that guy’s having a week). Bitcoin is the extreme Beta bet that liquidity conditions will expand… When the liquidity cycle peaks and we have another “winter” - this will go down for a while. Then we’ll all go back and wonder how so many smart people at Harvard temporarily got it wrong. The simple answer: People don’t understand how the financial system works… Final Question…Garrett, when do you sleep? Sunday.  Enjoy your weekend… And stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Josh is Not an Idiot... and Other Things I Think..."

Post a Comment