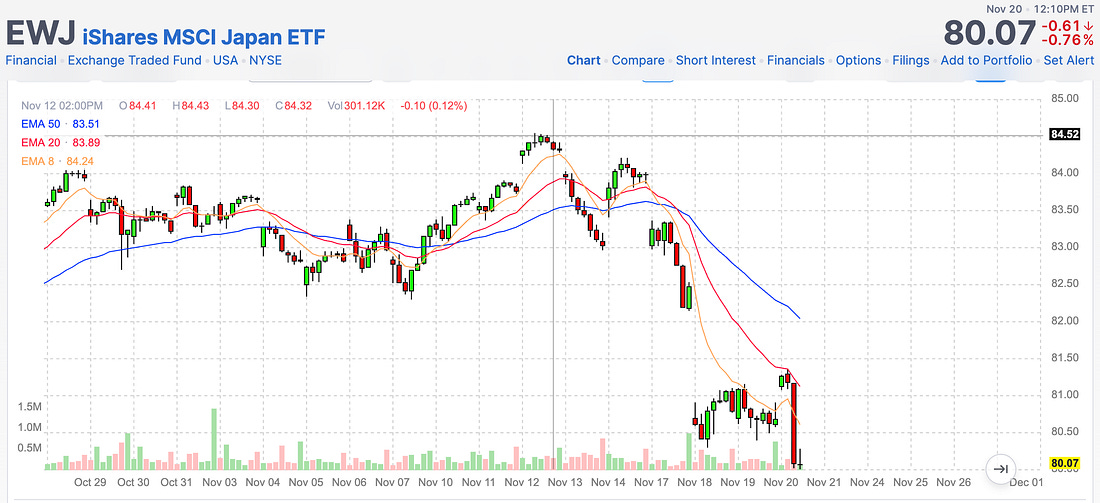

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. We are still VERY Red… and it’s getting worse. The reason… likely Japan… We never changed, and now we’re moving deeper into the red than we were yesterday. We’re back down to two breakout names. This is a plumbing issue. We’re back above the 50-day EMA on the FNGD. Dear Fellow Traveler, NVIDIA popped 5% in pre-market trading this morning on earnings that had analysts reaching for superlatives they’d already exhausted six quarters ago. By noon, the S&P 500 and Russell actually turned red. And while everyone else was scratching their heads about how the world’s most important AI company could beat estimates and still roll over… I went back and looked at a chart… Oh… yeah… Japan… Everyone’s been watching the AI show and not the money. The Story is STILL JapanI’ve spent the better part of a year explaining why Japan’s debt situation is unsustainable. How can they keep financing American consumption when their own borrowing costs are spiking? How their role as the world’s most reliable creditor is coming to an end. But this morning, when NVIDIA reported, I got pulled into analyzing their inventory levels and working capital instead of checking what was happening in the country that’s been moving global markets. While I was dissecting NVIDIA’s ninth consecutive quarter of beating estimates by exactly $2 billion… their accounts receivable skyrocketing, inventory piling up, revenue concentrated among just two major clients… The real headline today is Japan. Look East, EveryoneAre we going through another Liz Truss situation… but this time Japan instead of the United Kingdom? It’s starting to feel similar… Japan’s new Prime Minister Sanae Takaichi is promising massive fiscal stimulus at exactly the moment when Japan’s borrowing costs hit all-time highs. Their 30-year bond yields touched 3.40% this week. The USD/JPN exchange rate just spiked to 157… Bond prices have fallen for three weeks. This is a similar challenge that destroyed Liz Truss in the U.K. Promise fiscal stimulus when bond markets are already nervous, watch yields spike, then watch everything unravel. The difference? The Bank of Japan had to step in before Takaichi even officially took office. The BOJ stepped in and absorbed a massive share of auction supply. What the Hell is the Carry Trade?Here’s where everything connects, and why Japan matters infinitely more than NVIDIA’s quarterly performance. The carry trade is stupidly simple, which is why it’s so dangerous. You borrow money where interest rates are really low. You take that cheap money and buy something that pays higher returns somewhere else. You pocket the difference. For 15 years, Japan has been the world’s favorite place to borrow money. Their rates have been stuck near zero since the Clinton administration. Sometimes they’ve actually been negative… the Japanese government was paying people to borrow from them. Here’s how it worked… borrow 100 million yen at 0.1% interest. Convert it to dollars. Buy U.S. stocks that go up 15% a year. Pay back the 0.1% in Japan. Keep the other 14.9%. It’s like getting a free loan to gamble in the stock market. When everyone’s doing the same trade, it works beautifully. Japanese money flows into U.S. stocks, real estate, bonds, crypto… well anything that yields more than zero. But when things unwind… it gets ugly… Bitcoin just cracked under $87,000 as we talk… Yeah. This is bigger than NVIDIA… When the Trade BreaksBut when Japanese interest rates go up, or the yen gets stronger, or people just get nervous and want their money back, everyone tries to exit at once. That means selling your U.S. stocks, converting dollars back to yen, and paying back your Japanese loans. When millions of people do this at the same time… it doesn’t matter what NVIDIA’s earnings look like. Everything goes... That’s “carry trade unwind.” And when it happens, it’s fast, violent, and indiscriminate. The trade has been so profitable for so long that it’s everywhere. Your pension fund probably has exposure. That emerging market ETF in your 401(k)? Definitely carry trade adjacent. The Fed Pivot That Isn’t ComingThe market also spent months pricing in Fed rate cuts that probably aren’t coming. Just a few weeks ago, traders were betting on aggressive Fed easing in 2025. Lower U.S. rates would have been great for the carry trade… wider spreads between Japan and the U.S., a weaker dollar, and more liquidity flowing into risk assets. But inflation is proving stickier than anyone wants to admit. The labor market isn’t cooperating with the Fed’s soft landing narrative. And now there’s growing pessimism about a December rate cut by the Federal Reserve. When the market realizes the Fed isn’t going to make borrowing cheaper, and Japan can’t keep rates at zero without destroying its currency, the carry trade gets squeezed from both sides. You borrowed yen expecting U.S. rates to fall (making your trade more profitable). Instead, U.S. rates might stay higher for longer while Japanese rates are forced higher by bond market vigilantes. That’s not a gentle unwind. That’s a margin call waiting to happen. This morning’s NVIDIA reaction might have been carry traders taking profits on anything liquid while they still could. When you’re leveraged 20-to-1 and the trade is moving against you, you don’t wait for fundamentals to matter. You sell everything. First. If the Fed DOES cut rates in December… The carry trade is why… But they’ll just tell us that their outlook on the job markets is weaker (they need something…) The Foundation is CrackingHere’s the thing that’s more important than NVIDIA… Japan’s debt-to-GDP ratio is 235%. Their new Prime Minister is promising helicopter money when their borrowing costs are at all-time highs. The Bank of Japan is printing yen out of thin air to prevent its bond market from collapsing. When the world’s most reliable source of cheap money becomes unreliable, the entire global financial system has to reprice everything at once. That’s what it feels like has happened this morning. Not because NVIDIA had bad earnings… They actually reported another quarter of impressive growth… It’s when the foundation of global finance began to wobble. Why This Actually Matters I can spend all day explaining how NVIDIA finances its customers’ purchases or guarantees $860 million in facility leases for partners who can’t secure their own financing. IT MAKES PERFECT SENSE if you ignore it… But when Japan can no longer provide cheap money without destroying its own currency and bond market, the whole structure collapses. NVIDIA could cure cancer, and the stock would still fall if carry trades are unwinding. Even when you understand which story matters most, it’s easy to get distracted by the noise. NVIDIA’s earnings were noise. Japan’s bond market crisis was the signal. The lesson isn’t complex: Follow the money, not the marketing. If anyone is confused about Japan and the markets, do them a favor… forward them this… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "SIGNAL STILL RED: Why'd the Market Give Back Gains Today? Look East..."

Post a Comment