Ticker Reports for June 4th

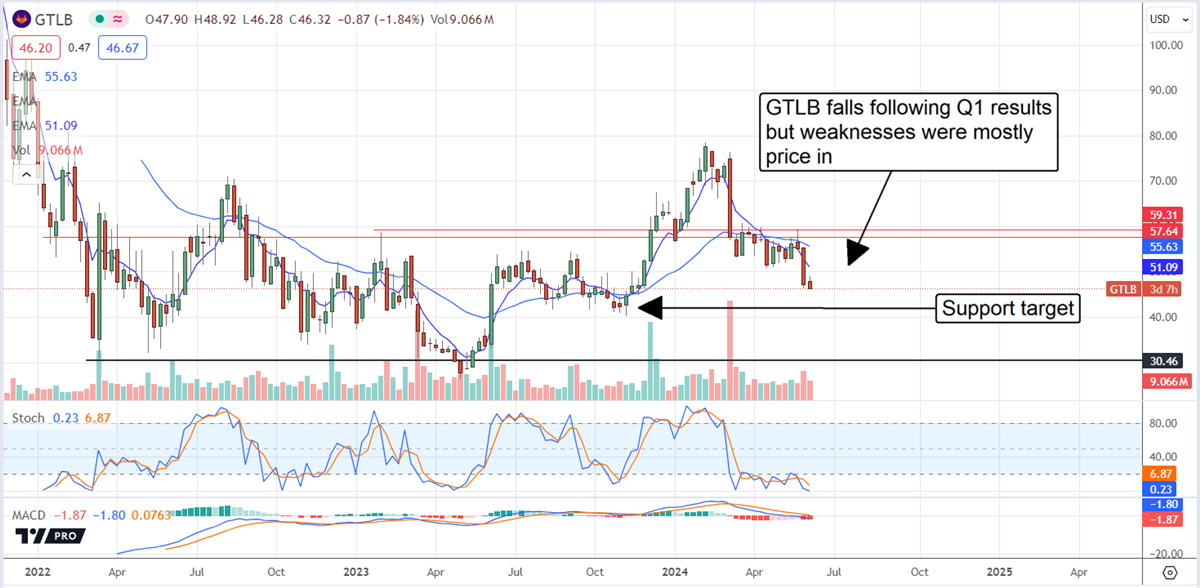

GitLab's Weak Results Were Priced In; Time to Buy the Dip?

GitLab’s (NASDAQ: GTLB) post-release plunge was not as large as it could have been, but the weaknesses were already priced in. The stock price fell 15% the week before after results from MongoDB (NASDAQ: MDB) and UiPath (NYSE: PATH) undercut the outlook for AI and IT spending this year. The takeaways, however, are that the tech sector is growing, albeit at a less robust pace than prior forecasts, and AI is leading the technology industry, setting these businesses up for long-term success.

GitLab Had a Solid Quarter, Guides for Growth

GitLab had a solid quarter with revenue of $169.2 million, growing more than 33% YoY and outpacing the consensus by 180 basis points. The strength is driven by increasing customer count and penetration, with clients contributing more than $5,000 in ARR up 21% and clients contributing more than $100K in ARR up 35%. Net retention rate, a measure of revenue growth from existing clients, came in at 129%, indicating nearly 30% comp-client growth compared to last year. RPO, a leading indicator of future business, is strong and up 48%.

The margin news is good. The company continues to post GAAP losses but has significantly improved its operating and adjusted operating margin over the last year. The takeaway is that cash flow and adjusted free cash flow are positive in Q1 for the first time, and the adjusted earnings came in well above forecasts. The $0.03 is $0.07 better than forecast and suggests the guidance may be weak.

Guidance is good but fell short of the consensus, leading to some weakness in the stock price in premarket trading. The company expects Q2 revenue from $176 to $177 million for roughly 5% sequential growth and 26% compared to last year. As good as 26% growth is, it is shy of the consensus and slowing compared to last year and the first quarter, which is a problem for highly-valued tech growth stocks. This stock trades over 100X earnings for this year and next, providing a substantial headwind for the market.

Analysts Reset the Outlook for GitLab

The analysts are resetting the outlook for GitLab stock following the release. MarketBeat.com tracked nearly a dozen revisions within the first 12 hours, including a price target reduction. The new targets include a fresh low target of $50, and most are below the consensus, but all assume some value remains for investors. The $50 low price target is still $3 or about 6% above the current action, suggesting a floor for the market. Assuming the market follows through on the indication, this stock should move sideways soon and may even begin to rebound over the summer.

Despite the price target revisions, GitLab remains one of the top-rated stocks tracked by MarketBeat. The top-rated stocks are the 150 stocks with the highest average analyst rating over the past 12 months, with a minimum of five reports. GitLab has a strong following, with 25 analysts rating it as a Moderate Buy and about 35% upside at the new consensus, which is near $65.

GitLab Heading for Lower Prices

GitLab’s weak guidance was expected by the market and priced into the stock, but that doesn’t mean it can’t move lower now. The high valuation alone is enough to keep the stock price capped, and the analysts aren’t helping with downward revisions to the price target. Investors might expect this stock to move down to critical support near $40, if not the bottom of the trading range, before finding solid support.

A move to $40 may trigger a strong market response because of institutional interest. For over a year, the institutions have bought this stock at a 2:1 pace compared to sellers and own more than 90% of the shares. That is a robust vote of confidence in the company, and the largest shareholder is Google (NASDAQ: GOOGL).

Bigger than Nvidia

In my new investigation, I detail why this is the single most important factor in the future of AI.

I explain what this Keystone technology is… why it's so critical to the future of not just AI but mankind…

Birkenstock Looks Like a Fit in Any Growth-Oriented Portfolio

Birkenstock Holding plc (NYSE: BIRK) delivered a stellar earnings report, and BIRK stock continues to soar as the broader market reprices equities in anticipation of higher-for-longer interest rates amidst persistent inflation.

Neither seems to be an issue for the luxury footwear maker known for its iconic sandals. The company reported earnings per share of 44 cents on revenue of $522.51 million. Both numbers exceeded analysts' estimates, which were already lofty heading into earnings.

Gross margin was down slightly. However, the company attributed that to its focus on expansion. If that's the case, then, as the company indicated, it should only be a minor blip for investors to consider.

The company also increased its guidance for the remainder of 2024 based on expectations of solid growth in all three regions: the Americas, Europe, and Asia, as well as in both its business-to-business (B2B) and direct-to-consumer (DTC) channels.

The Next Crocs?

It's always tricky to say one company is "the next" something else. So, let's get the issue of valuation out of the way right now. Birkenstock trades at a forward P/E of around 44x. That's comparable with a company like Lululemon Athletica Inc. (NASDAQ: LULU), which is well above the average of retail stocks. Crocs Inc. (NASDAQ: CROX), on the other hand, trades at a far more attractive 12x forward earnings.

Nevertheless, Birkenstock and Crocs have more in common than iconic footwear. For example, Birkenstock is a digitally native company that makes it attractive to millennials and Gen Z consumers. While not digitally native, per se, Crocs has leaned into digital and now does a significant business through its DTC channel.

Both companies have posted stellar stock price growth in 2024. CROX outpaces BIRK, but it also has a longer history of earnings growth. Plus, while over 93% of Crocs shares are owned by institutions, only about 19% own Birkenstock shares. That's likely to change in coming years as analysts become more comfortable with price discovery for BIRK stock.

At the present moment, analysts have a Moderate Buy rating on both stocks, and both are perceived as due for a pullback in their respective share prices. Both stocks also have a high amount of short interest. Crocs checks in at about 8.3%, while Birkenstock has over 15%. Once again, some of that can be attributable to the higher percentage of institutional ownership in CROX stock.

How High Can BIRK Stock Go?

Strictly from a technical standpoint, BIRK stock looks fairly value now that it's up about 36% from its low on April 18, 2024. That's comparable to the 40% gain in the stock after its IPO compared to its initial sell-off in February.

However, since the company's earnings report on May 30, the Birkenstock analyst ratings on MarketBeat show a number of analysts with price targets of 5% or higher than the current price. That list includes JPMorgan Chase & Co. (NYSE: JPM), which confirmed its Overweight rating on the stock and increased its price target from $56 to $64.

Birkenstock now carries the privilege of expectations. However, at a time when many retailers are looking to lower the bar, Birkenstock is raising it. It's not irrational to expect a pullback in BIRK stock, but that will be a buyable dip.

Major Elon Musk Crypto Leak Revealed

Reports of a leaked meeting between Elon Musk and staff at X.com could send shockwaves through the crypto market.

Musk revealed a "mind-blowing" plan to take over the global payment system. In his own words, the world's richest man said "you won't need a bank account."

Prominent voices in crypto believe what comes next will mirror a crypto mass adoption similar to the one that triggered bitcoin's last bull run.

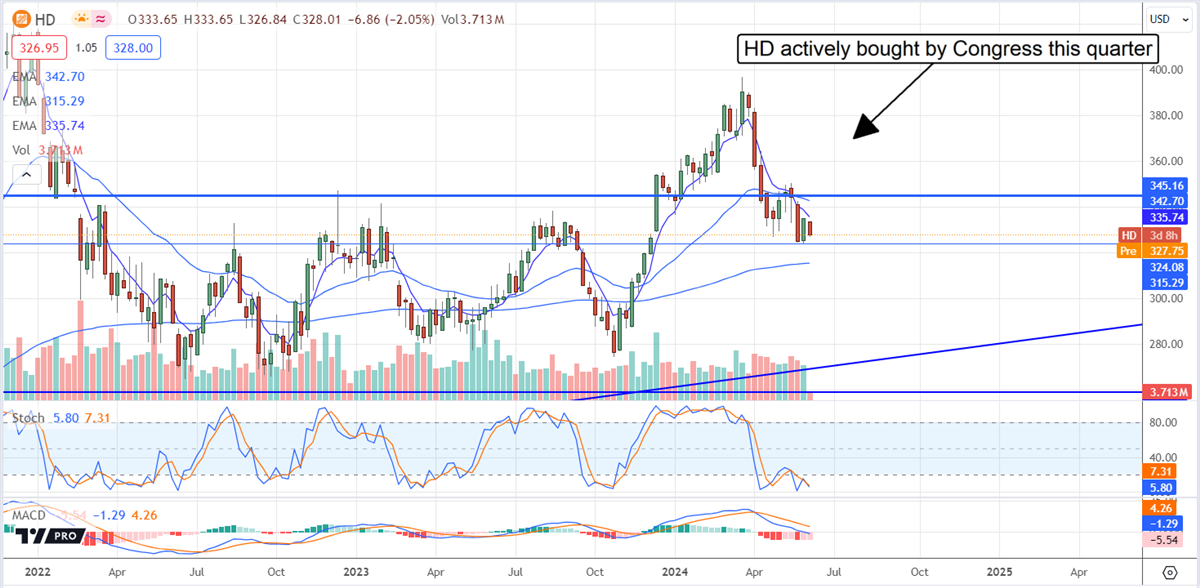

These Are the Most Active Congressional Trades This Quarter

Congressional trading activity is important because Congress regularly outperforms the broad market. Rules and regulations aside, these people have a deeper knowledge and understanding of how legislation and international relations impact a business, as shown in their results. That’s why so many investors like to follow along with Congress. This is a look at the most actively bought and sold stocks by Congress this quarter. The results are interesting.

Applied Materials is the Most Bought Stock By Congress

Applied Materials (NASDAQ: AMAT) is the most bought Stock by Congress, and this is saying something because it leads the #2 position Home Depot (NYSE: HD) by a wide margin. Three Congresspeople are in the mix, including John Boozman (R-AR) and Tommy Tuberville (R-AL). Both sides of the aisle made purchases totaling $123,500, a small amount but nearly 6X the amount spent on Home Depot.

Among the drivers for this trade are the results, which have outperformed expectations for the last year. The company is well-positioned as a manufacturer and purveyor of semiconductor manufacturing equipment, which is in demand because of the accelerating advancement of AI chips and billions in government spending focused on re-shoring the US semiconductor industry.

The Q1 results were solid, but the strength relative to consensus was expected due to the revision trend. This led the market to sell off but left the uptrend in stock prices intact. The move lower aligned the market with the consensus estimate, which rose nearly 8% since the release. The revisions lead the market to the high end of the analysts' range and imply another 10% upside for this Moderate Buy-rated stock.

Home Depot is Actively Bought This Year

Home Depot is the 2nd most actively bought by Congress, with three Congresspeople making a single trade each. Buyers include Kevin Hearn (R-OK), Marjorie Taylor Greene (R-GA), and Lloyd Doggett, with trades estimated at $24,000. Drivers for this trade include the company’s market-leading position, professional home improvement market exposure, capital returns, and an upcoming economic pivot driven by the FOMC. The FOMC is expected to slash interest rates later this year and unstick a virtually frozen housing market.

MarketBeat tracks 28 analysts with ratings on HD stock. They rate the stock at Moderate Buy and are leading the market to a rebound, if not a new high. The post-release activity includes numerous price target reductions that range around and align with the current consensus of $377, a 15% upside from recent price action.

The Most Sold Stock by Congress is The Baldwin Group

The Baldwin Group (NASDAQ: BWIN) is the most sold stock by Congress, and its details are telling. The three sales are made by a single member, C.Scott Franklin (R-FL), and amount to nearly $3.8 million, making it the most actively traded stock by buyers or sellers. Coincidentally, the sales come from a Florida representative ahead of what is forecast to be a busy hurricane season, but there is probably no connection there. The analysts tracked by MarketBeat rate The Baldwin Group at Strong Buy with the potential for a 30% upside.

Apple Gets The Stink-Eye From Congress

Trading in Apple (NASDAQ: AAPL) was active, with six members making eight trades totaling $137,500. Trades were made by members of both parties, including Josh Gottheim (D-NJ) and Tommy Tuberville (R-AL). The drivers for this trade could be the company’s lagging position in AI and weakness/headwinds in China. Their activity coincides with a top for the market set earlier this year, but it looks like it is about to get blown off. Analysts have been lifting this stock's sentiment rating and price targets ahead of this month’s upcoming developer conference and product announcements. They see Apple moving up to and above $205 to set another new high before the end of the year.

0 Response to "🌟 These Are the Most Active Congressional Trades This Quarter"

Post a Comment