Ticker Reports for August 29th

Does A&F's Q2 Earnings Win Point to a Strong Holiday Season?

Fashion retailer Abercrombie & Fitch (NYSE: ANF) posted better-than-expected earnings for its Q2 season, which ended August 3, 2024. While CEO Fran Horowitz-Bonadies expressed hesitancy about the company’s “uncertain” position, its success in realigning its offerings with consumer demands post-pandemic has left investors expecting more for the holiday season.

A&F: Earnings by Numbers

In its latest earnings release, Abercrombie & Fitch’s EPS of $2.50 per share beat analysts’ projections of $2.22 per share by about 12%. This represents a record second quarter for the fashion giant, with a total revenue of $1.1 billion and a year-over-year (YoY) increase of 21%. Earnings were split about evenly between Abercrombie and its subsidiary brand, Hollister.

Domestic consumers were the strongest supporters of A&F, with a net sales growth of 23% on top of 19% growth last year. The company also saw a 16% increase in sales in its Middle Eastern and European segments and a 3% increase in sales in Asian markets. A&F representatives reported that international markets would be a vector for continued future growth.

“Our team continued to execute at a very high level in the second quarter, resulting in better than expected sales growth and profitability,” CEO Horowitz-Bonadies said. “The strength of our brand portfolio and improvements we’ve made in global capabilities resulted in broad-based growth across regions, brands and channels.”

So Why Is A&F’s Share Price Dropping?

Despite this positive earnings report, investors were not impressed with A&F’s most recent growth rate, expecting more from the online resurgence of Y2K culture. Shares fell more than 14% upon the market open on August 28, with the drop starting in pre-market hours when the earnings report was officially released.

Part of this dip in share price may be coming from the company’s updated margin guidance. Abercrombie raised its full-year operating margin from 14% last quarter to 14% to 15% this quarter, indicating that a higher percentage of net income will need to be reinvested into the company to maintain growth. This comes off another increase in margin from 12% to 14% in the last quarter, leaving some investors questioning whether A&F’s growth plan is sustainable in the current consumer cyclical environment.

Despite this, Abercrombie has raised its sales target to 12% to 13%, which is above analyst estimates of 12%. This increase comes as the company enters an “uncertain” holiday season, but leaders remain confident that this positive earnings report was more than just a fluke.

“Although we continue to operate in an increasingly uncertain environment, we remain steadfast in executing our global playbook and maintaining discipline over inventory and expenses," said Horowitz-Bonadies.

What Is Driving Market Interest in A&F?

During the height of COVID-19, global shutdowns shuttered Abercrombie’s retail outlets, and the rise in e-commerce fast fashion brought devastation to consumer retailer share prices as domestic companies struggled to compete with the volume of options produced by companies like Shein.

Since then, Abercrombie has experienced a stunning rebound, with shares recently valued at more than $140 — an increase of almost 1,500% since the height of the pandemic when they hit a low of about $9 per share. This dive that was shared by other major fashion retailers like Gap Inc (NYSE: GAP) and American Eagle Outfitters (NYSE: AEO).

But Abercrombie’s drastic increase in share price has not been seen among competitors, which have rebounded more modestly. So what about A&F’s strategy is driving such substantial growth?

For starters, A&F has changed its strategy from trendy teen fashion to more sustainable, mature pieces designed to appeal more to its professional customers. It has also put an increased focus on natural fibers, offering a series of 100% cotton and linen lines — something virtually unheard of among fast fashion retailers, which favor a large volume of low-cost design choices over more detailed construction. This and easing material costs have contributed to its 64.9% gross profit increase, representing a YoY increase of 240 basis points.

Holiday Season Impact: Will A&F’s Strategy Appeal to Shoppers?

As you analyze A&F’s earnings report, it’s important to remember that these reports can result in sudden, non-standard volatility. While analyst consensus is that Abercrombie is a Hold, many of its competitors have enjoyed more positive ratings and growth estimates, indicating positive sentiment for the sector in general. A&F’s ability to connect with both younger demographics and nostalgic shoppers could certainly boost holiday sales, but time will tell if the company will be able to increase its profit margins and turn investor sentiment around.

Alex's "Next Magnificent Seven" Stocks

Today Alex Green is releasing his new breakdown of AI's "Next Magnificent Seven."

So please make some time to watch it.

Best Buy Stock Flashes Bullish Signal, Challenges Remain

Best Buy (NYSE: BBY) has been attempting to navigate a difficult retail sector environment marked by declining sales and increased competition from e-commerce giants. Best Buy’s earnings report for the second quarter of fiscal year 2025 (Q2 FY2025) was recently released, offering some promising signals for investors.

Best Buy’s financial report release unveiled an earnings beat on revenue and earnings per share, providing insights into the company's financial health and prospects. However, the report also highlighted Best Buy's ongoing challenges and its strategic initiatives to address them.

Best Buy’s Q2 FY2025 Numbers

In the Q2 FY2025 earnings report, Best Buy reported revenue of $9.29 billion, exceeding analyst expectations of $9.24 billion. This represents a slight decline from last year, when the company generated $9.58 billion in revenue. However, despite a year-over-year decline of 3.1%, the revenue figure indicates the company's efforts to drive sales growth are showing some traction.

Earnings per share (EPS) in the quarter reached $1.34, surpassing Best Buy’s analyst community estimates of $1.16, an improvement from the $1.25 EPS recorded in the same quarter a year earlier. The company's profitability performance demonstrates the effectiveness of its efforts to drive efficiency and focus on higher-margin products and services.

Same-store sales, a critical metric for retail businesses, decreased by 2.3% during the quarter compared to a 6.2% decline in the same period last year. While this marks an improvement, it still reflects Best Buy's ongoing challenges in driving customer traffic and maintaining sales at existing stores. The decline in same-store sales is likely influenced by a combination of factors, including the impact of inflation, a shift in consumer discretionary spending habits, and increased competition from online retailers. However, the report highlighted that the company saw strong comparable sales growth in the domestic tablet and computing categories, demonstrating the potential for future growth.

Best Buy's Strategic Response

To address these challenges and drive future growth, Best Buy is implementing a multi-pronged strategic approach to enhance its customer experience, improve its market positioning, and expand its profitability.

The company is focused on "sharpening" its customer experiences, a key component of its turnaround strategy. This involves enhancing its stores, investing in its mobile app, and expanding its services business. Best Buy aims to create a more engaging and convenient customer shopping experience by offering personalized services and tailored product recommendations.

Best Buy is also expanding its non-GAAP operating income rate, a key indicator of profitability. This strategy aims to maximize efficiency and minimize expenses while maintaining revenue growth. By streamlining operations, optimizing inventory management, and reducing overhead costs, Best Buy is targeting higher profit margins without sacrificing its commitment to growth.

Another strategic focus is enhancing its services business, including product installation, technical support, and home theater design. This strategic initiative aims to generate recurring revenue streams and differentiate Best Buy from its online competitors, which often lack the same level of personalized services.

Additionally, Best Buy is investing in artificial intelligence (AI) driven product offerings. The company believes that AI-powered devices and applications will drive future growth in the consumer electronics market. Best Buy is strategically positioning itself as a leader in this emerging segment, offering customers a wide range of AI-enabled products and providing expert guidance on their usage and benefits.

Beyond the Numbers: What Are Investors Saying About Best Buy?

Following the release of the Q2 FY2025 earnings report, shares of Best Buy jumped more than 15% in premarket trading, signaling investor optimism about the company's prospects. This bullish reaction reflects the company's ability to exceed analyst expectations and focus on strategic initiatives to drive growth and profitability.

Analysts have also been increasingly optimistic about Best Buy's future. Loop Capital boosted its price target on Best Buy from $93.00 to $100.00, giving the stock a buy rating. Wedbush, however, reaffirmed a neutral rating and set a $85.00 price target on shares of Best Buy in a recent research note. This divergence of opinion among analysts highlights the ongoing debate about Best Buy's future.

Insider trading activity also offers insights into the company's prospects. In another Best Buy news article, Chairman Richard M. Schulze sold 1,000,000 shares of the stock in a transaction recently. The shares were sold at an average price of $88.25 for a total transaction of $85,850,000.00. Following the transaction, the chairman now directly owns 15,890,103 shares in the company, valued at approximately $1,364,165,342.55. While insider sales can sometimes be a cause for concern, it's essential to consider the context and motivations behind these transactions. In this case, the insider sales might reflect the chairman's financial needs or a belief that the stock is currently overvalued. However, the fact that he still holds a significant stake in the company suggests long-term confidence in its prospects.

The Verdict: Is Best Buy a Buy?

Best Buy's Q2 FY2025 earnings report offered mixed results, providing evidence of both progress and challenges. The company's ability to beat analyst expectations on revenue and EPS is a positive signal, but the decline in same-store sales underscores its ongoing challenges. The company's strategic initiatives, including its focus on enhancing the customer experience, expanding its services business, and investing in AI-driven products, offer potential for growth. Still, the impact of these initiatives on the company's financial performance will need to be closely monitored.

For investors, the decision of whether or not to invest in Best Buy is a complex one. The company's financial performance is solid, and its strategic initiatives offer potential for growth, but the macroeconomic environment remains challenging, and the competitive landscape is increasingly complex. Investors should carefully consider all of these factors before making any investment decisions. Conducting thorough due diligence and analyzing the company's financial statements, industry trends, and competitor landscape is crucial before making any investment decisions.

Exposed: 3 CENT Crypto to Explode September 23rd?

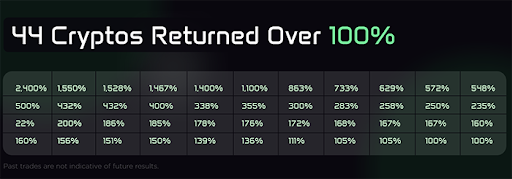

Chris Rowe – the man who recommended Amazon in 1998… Bitcoin and Ethereum in 2017…

And has spotted 44 different coins that have returned over 100%...

Today, he is now making the biggest crypto call of his ENTIRE career…

Affirm Shows Buy-Now-Pay-Later Is Here to Stay in Latest Results

Affirm (NASDAQ: AFRM) has seen wild fluctuations in its stock price over the past three years. Shares peaked at nearly $169 in November 2021 but are down 80% from that level today. However, shares are up 82% in the past 52 weeks.

Investors might recognize the fintech company as a payment option allowed when making online purchases. Affirm often pops up when checking out online to pay off a purchase in installments, subject to a credit check.

Let’s dive into the company’s annual financial statement to understand better what it does. We'll then examine recent news and the firm's financial results and close by providing some outlook on the company.

Breaking Down Affirms Operations and New Relationship with Major Mag-7 Firm

Affirm operates as one reportable segment. However, it has two main customer types: merchants and consumers. The company brings in revenue from merchants by charging them a fee when a transaction is made using Affirm’s buy now pay later (BNPL) payment option. The fee is usually higher if the interest charges on the payment plan are lower.

When customers make purchases using Affirm's payment option, it cuts into a company’s margins on that sale. However, merchants still have a big incentive to use Affirm as it helps increase overall sales. Customers who may be afraid to make big purchases at one time are more likely to do so if Affirm is an option.

The company generates revenue from consumers based on interest charges for its payment plan. It does not charge late payment fees. It also has a marketplace app where customers can buy directly from merchants. In the fiscal year 2023, 20% of Affirm's transactions occurred in the app. Lastly, the Affirm Card allows customers to convert debit purchases into installment loans.

A big source for potential growth is Affirm's partnership with Apple (NASDAQ:AAPL). Its BNPL plan will be available as an option in Apple Pay in late 2024. However, investors will have to wait to see the effect. Affirm says it doesn’t see a material impact on revenues until 2026.

This is because the firm will be rolling out the feature to Apple users slowly to manage risk. It wants to fix issues that might occur while the use of the feature is relatively small. This is so that those issues don’t become the massive problems that they might if everyone had access initially.

However, this isn’t an exclusive agreement. Customers will also be able to use BNPL options through Citigroup (NYSE:C), Synchrony Financial (NYSE:SYF), and Fiserv (NYSE:FI).

Revenues are Strong and Profitably May Be Turning the Corner

The company has grown revenues solidly since going public in 2021. Revenues grew 51% from a year ago in fiscal Q3 2024. Operating margin recovered from -80% in March 2023 to -37% in March 2024.

Although revenue growth is strong, net income is still deeply negative. The company's losses neared half a billion dollars in the 12-month period ending in fiscal Q3. However, in its last earnings release, the firm articulated a timeline for when it hopes to achieve operating profitability on a non-adjusted basis.

Affirm posted fiscal Q4 2024 earnings that blew estimates out of the water on Aug. 28. Its loss of $0.14 per share was a massive decrease from the fiscal Q3 loss of $0.43. Revenue grew 14% from Q3 and 38% from the previous year’s quarter. Revenue came in 9% above expectations.

The company expects revenues to decrease slightly from fiscal Q4 next quarter to $655 million, but that number is still $30 million above expectations. Shares rose close to 17% in after-hours trading. The company expects to achieve positive non-adjusted operating profit by the end of fiscal 2025.

Affirm Is Silencing the Doubters

Affirm's strong revenue growth is impressive. This is especially true amid current macroeconomic weakness and high interest rates, which are headwinds to the lending company. The company's results in the last two quarters have cast doubt on claims of a flawed business model, which arose from its absurdly negative margins in 2023.

Its continually rising Transactions per Active User are a good sign. Payments from these customers are higher margin and show that existing customers like the product and are using it more. The Fed potentially entering an interest rate cut regime would provide a tailwind, and the company could really take off during a period of lower rates.

0 Response to "🌟 Affirm Shows Buy-Now-Pay-Later Is Here to Stay in Latest Results"

Post a Comment