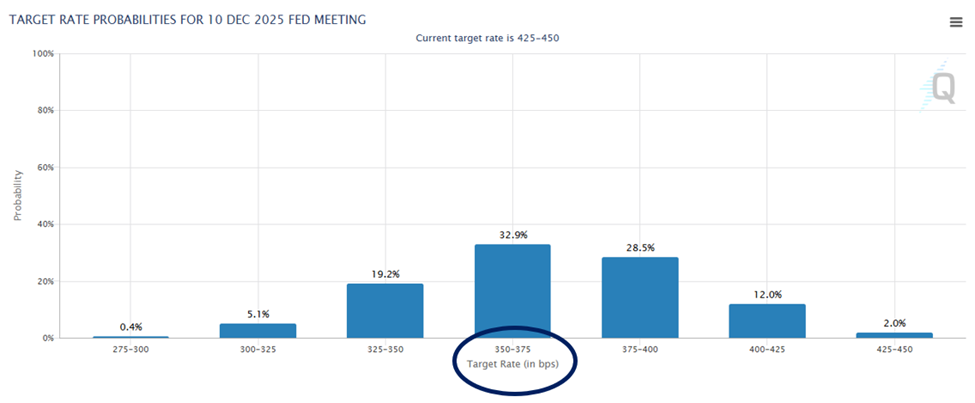

Core PCE inflation runs hot … Big Oil execs aren’t happy … is gold in for a breather? … where crypto goes next … a “rare chance” to get into leading AI stocks This morning, the Federal Reserve’s favorite inflation gauge came in hotter than expected, and the market isn’t taking it well. As I write Friday early afternoon, all three major indexes are sharply lower, led by the Nasdaq’s 2.7% decline. The February Personal Consumption Expenditures (PCE) Price Index showed prices remaining above the Fed’s target rate. Though the all-items PCE data were in line with forecasts, core PCE, which strips out volatile food and energy prices, increased 0.4% on the month and 2.8% on the year. Dow Jones Economists had forecasted respective numbers of 0.3% and 2.7%. The monthly increase was the largest gain since January 2024. Meanwhile, the Bureau of Economic Analysis report released this morning found that consumer spending rose just 0.4% for the month. This was below the 0.5% forecast. At least there was good news with personal income. It climbed 0.8% for the month, much better than the estimate for 0.4%. As always, the question is, “how will this impact the Federal Reserve’s interest rate policy?” The market’s answer appears to be “not much.” As you can see below, the CME Group’s FedWatch Tool shows that traders are still putting heaviest odds on the Fed enacting three quarter-point cuts in 2025.

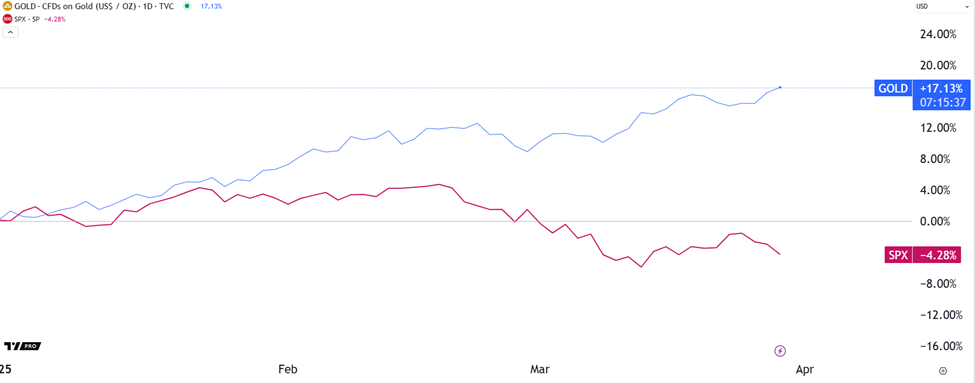

As I write, the probability clocks in at 32.9%. For context, one week ago it was 34%. Regular Digest readers know that legendary investor Louis Navellier believes this undershoots how many cuts the Fed will ultimately deliver. Here’s Louis from last week: I still expect four key interest rate cuts this year. The reality is that global interest rates will collapse given weak economic growth in Asia, as well as economic contractions in the U.K., Canada, France, Germany and Mexico. Global central banks like the Bank of England and the European Central Bank will need to continue cutting key interest rates to shore up their respective economies. And Treasury yields will continue to decline as global central banks slash key interest rates. Since the Fed does not fight market rates, I expect our central bank will follow suit and cut rates four times this year. As we’ve highlighted in the Digest, if Louis is right, we’ll face a new question: Will Wall Street interpret four rate cuts as a bullish, proactive measure from the Fed that’s promoting steady growth by aligning interest rates with the neutral rate… Or will four cuts be seen as a bearish, reactionary move from a Fed that’s playing defense against a looming recession? The market’s answer will drive your portfolio value. We’ll keep you updated. Welcome to our new running segment: “Uncertainty Watch” In recent weeks, we’ve been highlighting the widespread uncertainty facing investors and corporate planners today. Much of it stems from President Trump’s tariff plans. The fogginess is so pervasive that, today, we’re launching a new running segment: “Uncertainty Watch.” (Hopefully, it’s a very brief running segment.) The longer that corporate planners and U.S. consumers remain uncertain about upcoming economic conditions, the greater the likelihood that they hold off on capital expenditures and big-ticket purchases. Enough of that and corporate profits fall… sentiment multiples contract… and our portfolios suffer the consequences. So, we’re going to track this uncertainty. For today’s take, let’s zero in on Big Oil. Yesterday, the Federal Reserve Bank of Dallas released the results of its quarterly survey of anonymous oil executives. I’ve read all the comments and they’re overwhelmingly negative. The response below is, in my opinion, the best summation of the various issues, also tying in the investment impact: As a public company, our investors hate uncertainty. This has led to a marked increase in the implied cost of capital of our business, with public energy stocks down significantly more than oil prices over the last two months. This uncertainty is being caused by the conflicting messages coming from the new administration. There cannot be 'U.S. energy dominance' and $50 per barrel oil; those two statements are contradictory. At $50-per-barrel oil, we will see U.S. oil production start to decline immediately and likely significantly (1 million barrels per day plus within a couple quarters). This is not “energy dominance.” This contradiction has been on our radar since I first read about “Drill, baby, Drill.” Why would Big Oil drill more when the outcome would be lower oil prices? Sure, there’s a hypothetical point at which lower prices might goose demand, resulting in higher overall consumption that increases Big Oil’s bottom line. But one step over that perfect supply/demand balance would eat into profits. It appears that for many Big Oil executives, the risks associated with lower and lower prices outweighs the potential benefit of higher volumes. We’ll keep tracking both oil and uncertainty and will report back. Is gold due for a breather? Gold continues to have a banner year. As I write, it’s notching the latest in a series of all-time highs here in 2025. As you can see below, gold is up 17% on the year while the S&P has fallen more than 4%.

But if master trader Jeff Clark is right, the yellow metal is due for a pullback. For newer Digest readers, Jeff is a market veteran with more than four decades of experience. In his service, Jeff Clark Trader, he uses a suite of indicators and charting techniques to profitably trade the markets regardless of direction – up, down, or sideways. And one of them is signaling a potential reversal in gold. From Jeff: The gold sector is overbought. The Gold Bugs Index (HUI) is trading historically far above its 50-day moving average line. It recently rallied 10% in just one week. There’s negative divergence on the technical momentum indicators. And it looks vulnerable to a swift pullback. Take a look…

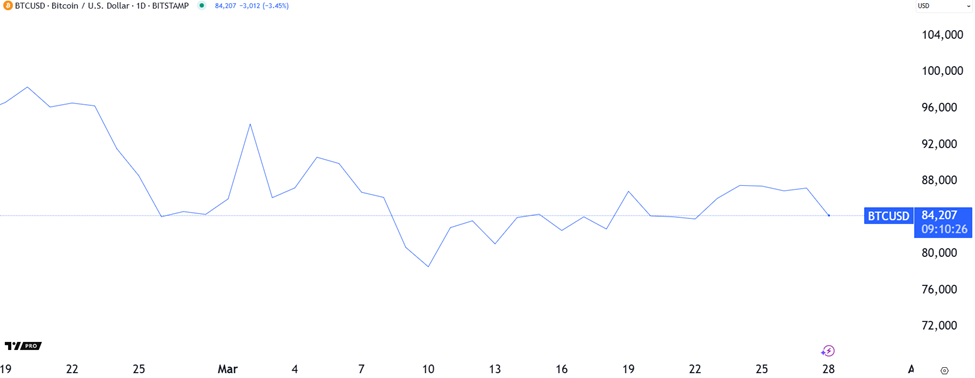

HUI rarely strays more than 8% away from its 50-day moving average (the squiggly blue line on the chart) before reversing and heading back towards the line. The red arrows on the chart point to the multiple times last year HUI traded 8% or more away from its 50-day MA. Each time, the stock move reversed back towards the line almost immediately. Now, if you’re in gold already, we recommend you snooze your way through any upcoming pullback. Given our federal government’s financial position, as well as soaring debt from global central banks, we anticipate far higher gold prices to come. But if you’ve missed gold’s bull run this year, keep an eye on this over the coming days/weeks. Any substantial pullback could be a good entry point for a longer-term investor. What’s the latest on “digital gold”? As you can see below, after sinking to roughly $78,000 earlier this month, bitcoin has been edging higher. As I write, it trades just north of $84,000.

For where it’s headed next, let’s go to our crypto expert, Luke Lango. From his latest issue of Crypto Investor Network: We think cryptos put in a durable bottom last week. We think the worst of the 2025 sell-off is over. And, most importantly, we think cryptos – Bitcoin and altcoins – are due to a big rally over the next few months. Luke lays out a handful of reasons. Two of them you’d expect: coming relief from Trump’s tariff-related uncertainty and a shift back to risk-on sentiment. But the third is a little different – a “Fed Bump.” Here’s Luke: Cryptos are a risk-on asset, and as such, they have developed a strong correlation with money supply. When money supply is robust and growing, investors have more money to pour into risky assets and they pile into cryptos, pushing crypto prices up. When money supply is constrained and shrinking, investors have less money to pour into risky assets and they rush out of cryptos, pulling crypto prices lower… Money supply growth is very closely tied to the Federal Reserve’s interest rate actions. When the Fed is cutting rates, money supply growth expands as more money enters the economy through more lending and more spending. Luke explains that the Fed has moved to the sidelines and held rates steady since December. This has slowed money supply growth, which, uncoincidentally, has happened alongside a big drop in crypto prices. Luke doesn’t expect this to last: Money supply growth should pick-up over the next few months because the Fed will get back into rate-cutting mode. The market is calling for about three rate cuts over the next 12 months. If we do get three rate cuts over the next 12 months, then money supply growth should expand over the next 12 months. History says that should boost crypto prices. And that brings full circle to today’s PCE report and its potential impact on the Fed’s interest rate policy. Finally, don’t miss this “rare chance” to get into leading AI stocks Yesterday, Louis Navellier, Eric Fry, and Luke Lango sat down to discuss the emerging divide between the “haves” and “have nots” in the market – and in our society. One of the most influential factors behind this growing divide is wealth generated from cutting-edge technology and artificial intelligence. Our three experts delivered the step-by-step playbook you need to follow to make the most of the opportunity (If you missed it, I encourage you to check out the replay here). A quick note on why this presentation was especially timely… AI is not a trend. It’s not going away. As we pointed out yesterday using an example from Microsoft founder Bill Gates, AI’s capabilities will render most human labor unnecessary far sooner than many people realize. Having your wealth aligned with AI is a critical defense against such economic creative destruction. Today, fear is weighing on the prices of leading AI stocks. For example, AIQ, The Global X Artificial Intelligence & Technology ETF, is down almost 15% since mid-February.

But with a longer-term perspective – and the awareness of the enormous changes AI will bring – such a pullback is just a more attractive entry price. Could AI stocks go lower? Absolutely – and investors should be prepared for that. But the more important question is whether today’s prices are ones that are likely to reward investors, say, five or 10 years from now. Here’s Louis’ overall take (not on AIQ, but on top-tier AI stocks in general): If you missed out on the big gains from AI stocks since 2023, this is a rare “second chance” to get in on some of the most innovative companies in the world. In fact, our latest batch of picks easily has triple-digit upside in just a handful of months. That’s why I teamed up with Eric and Luke to deliver a rare special broadcast yesterday. In it, we revealed why nearly a trillion dollars of new investments could soon flood two little-known corners of the AI Revolution… how it could accelerate the lucrative AND destructive force behind the phenomenon known as the Technochasm… and what you need to do to prepare (and profit). We’ll keep you updated on all these stories here in the Digest. Have a good evening, Jeff Remsburg |

0 Response to "Hot Inflation Tanks Stocks"

Post a Comment