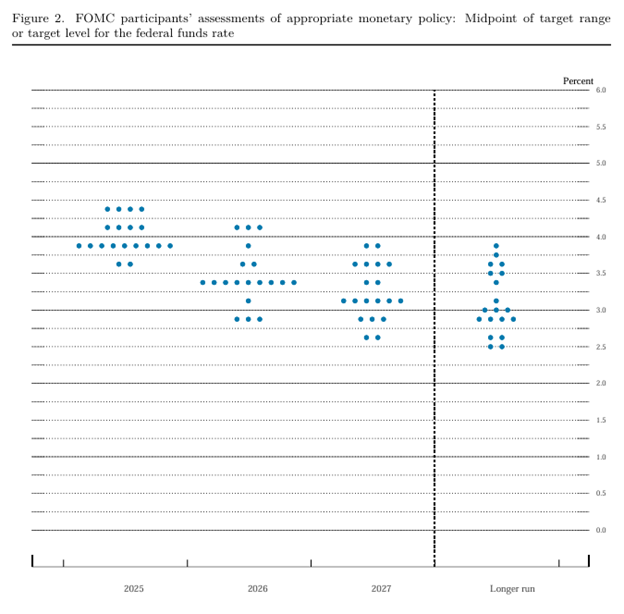

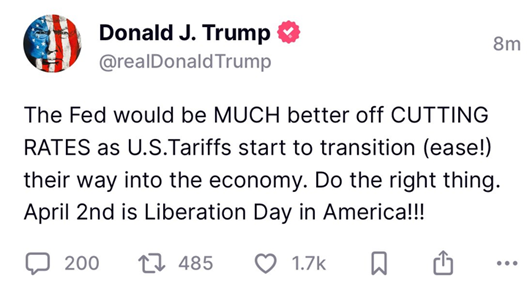

The Fed Holds Rates Steady – So, When Is the Next Cut? Dear Reader, In my 40-plus years in the markets, it's one of the most regrettable things I've seen... Somewhere along the way, there was an elevation of whoever is leading the Federal Reserve to a kind of "rockstar" status. I think it happened during the 1990s. Alan Greenspan was the Fed Chair back then, and it was during the dot-com boom. Remember those days? The market was on fire. Everything was going up. The tech-heavy NASDAQ soared 800% from 1995 to March 2000. But in 1996, Greenspan famously warned of "irrational exuberance" in the market. Wall Street took it as some sort of prophecy. But the reality is that the boom would go on for another three years. This isn’t the first time the folks at the Fed have been wrong, either. By early 2001, the federal funds rate sat at around 6.5% and the Fed predicted the economy would be “sluggish in the near term” but would regain strength later in the year. But as the “dot-com bubble” burst and the tragic events of 9/11 took shape, interest rates were cut 11 times down to a record low of 1.75% due to a weakening economy. In December 2018, the Fed projected that interest rates would be hiked two times and no additional moves would be made in 2019. Fast forward to mid-2019, and the Fed had cut interest rates three times. At the time, the U.S. and China were in a trade war that made the Fed concerned about the stability of the economy. I bring this up because the Fed held its latest meeting this week. And while no major changes were expected with key interest rates, investors were on pins and needles to find any indication of how many cuts to expect in the coming months. And to do that, they were primarily looking for movement in the latest “dot plot” survey as well as in Fed Chair Jerome Powell’s comments after the meeting. Now, I have been on record saying that I think the Fed will be cutting rates four times this year, and in today’s Market 360 I’ll explain why. But first, we’ll review its latest interest rate decision as well as the dot plot and Powell’s comments. Then, I’ll explain where you can find stocks that can move up no matter how volatile the market is. To Cut or Not Cut On Wednesday afternoon, the Fed decided to hold interest rates steady at the 4.25% to 4.5% range. And as expected, the Fed forecasted two rate cuts this year in its dot plot, which is the same as last year. Interestingly, eight of the Federal Open Market Committee (FOMC) members only forecasted one key interest rate cut.  What’s different, though, is the outlook on inflation and economic growth. They’re expecting unemployment to be up 4.4% and for the economy to grow at an annualized pace of 1.7% instead of the previously anticipated 2.1%. But the biggest question on everyone’s mind was how President Donald Trump’s tariffs have impacted inflation and what it says about the latest consumer sentiment. Thankfully, Fed Chair Jerome Powell addressed this during his press conference. Powell stuck to the script and was largely dovish. One interesting comment was that he said that the University of Michigan showing a sharp increase in long-term inflation expectations was an “outlier.” Consistent with the FOMC statement, Powell said, “Inflation has started to move up… We think partly in response to tariffs. And there may be a delay in further progress over the course of this year.” However, he believes that any tariff inflation would likely be “transitory.” While Powell said he thought the tariffs are probably a hurdle to keeping a lid on inflation, he reiterated that the Fed is prepared to respond if necessary. "We think our policy is in a good place to react to what comes," he said. | Recommended Link | | | | Louis Navellier has spent four decades building a billion-dollar empire on the back of big data and technology… Now he’s stepping forward with a shocking warning about how AI will soon impact the wealth of everyday Americans. Click here to watch his new video ASAP. |  | | Why I Expect Four Key Interest Rate Cuts The Fed may only be forecasting two key rate cuts this year, but I am anticipating four. The reality is we are in the beginning of a global interest rate collapse. The European Central Bank (ECB) has already cut rates twice and the Bank of England (BOE) has cut once this year. Additionally, bond yields in China are below Japan’s 30-year bond. This is due to China having deflation, because of its large population decrease and overproducing on batteries, EVs and televisions. You can’t have rates collapsing and have our yields not go down, and the Fed doesn’t like to fight market rates. The truth is that the folks at the Fed aren’t looking more than a few months ahead. Now, President Trump had a few choice words in response to the latest Fed decision.  But the fact is I think the President will get his way in the end. Because as global interest rates continue to collapse, this should force the Fed to cut more than what’s shown on the dot plot. A Way to Profit No Matter What Happens... I know that all of the recent chaos and volatility has a lot of investors feeling uncertain. But I have been on record as saying that these tariffs are simply a tool for the Trump 2.0 administration. It’s the classic carrot and stick approach... The ultimate goal is to create more onshoring – in other words, more jobs in America. In fact, I predict that the Trump 2.0 administration is going to spark a growth explosion without precedent. That’s because Trump is all about business. He knows what the artificial intelligence industry needs to help it reach its true potential, and he’s going to make sure it gets it. Trump 2.0 will slash regulations and dismantle roadblocks to AI development on an unprecedented scale. This intersection of Trump 2.0’s pro-growth policies and the rapid advancement of AI is what I call the Trump/AI Convergence – and it’s creating an investment opportunity of a lifetime. Now, I have the perfect strategy we can use to our advantage during this situation... It’s a strategy that allows you to pull regular “income” from the market. But it has nothing to do with waiting around for dividends or learning a complicated options strategy. Instead, this trading strategy leverages my proven Stock Grader system (subscription required) to make repeatable realized gains… Actual money coming in every month that you can spend or save. That’s what has led us to “income” opportunities (based on an initial $7,500 investment) from partial sells on positions, like: - $2,710 from Sitio Royalties Corp. (STR)

- $3,375 from CECO Environmental Corp. (CECO)

- $2,783 from Catalyst Pharmaceuticals, Inc. (CPRX)

- $7,135 from Builders FirstSource (BLDR)

- And more…

You can learn all about how I plan to use this strategy to profit from the Trump/AI Convergence in my brand-new presentation. As an added bonus, you’ll learn how to gain access to an exclusive podcast where I give my outlook on how the Trump AI Convergence is unfolding, as well as my outlook for 2025. Click here to learn more now. Sincerely, |

0 Response to "Must Read: The Fed Holds Rates Steady – So, When Is the Next Cut?"

Post a Comment