Dear Reader,

50-year Wall Street legend Marc Chaikin, has come to be known for one thing in recent years...

Predicting the big moves in the stock market, using what he calls, "the most powerful stock cycle indicator I've ever seen, based on more than 100 years of data."

And just days ago, Chaikin went public with details on: The exact month the next big stock market crash is most likely to begin.

Will Marc Chaikin be right yet again, in predicting the next big market move?

I would NOT bet against him. He used this same cycle indicator in 2018 when he said stocks would fall on live TV...

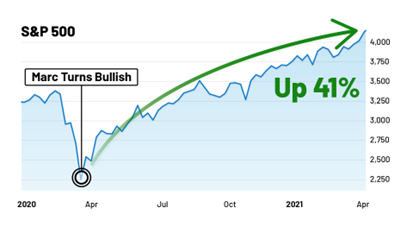

He used it in 2020 to help folks get back INTO stocks...

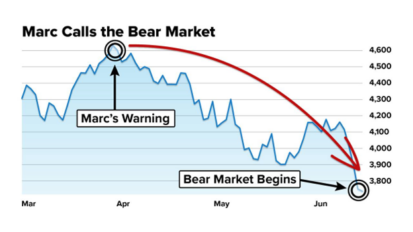

And in March of 2022 to predict a crash, when he wrote: "Millions of investors are about to be blindsided by a wave of stock crashes..."

And then again to predict huge bull markets in both 2023 and 2024...

And now, Marc Chaikin is using the exact same cycle indicator again to detail when he believes the next market crash will begin.

He says it's going to catch millions off-guard.

Which is why he recently produced a brand-new presentation detailing everything you need to know, including where to be invested now, and exactly when to the next crash is most likely to start.

Chaikin even reveals the name and symbol of one of his favorite investments to buy right now. To get the full story and access Chaikin's presentation for free on his website, click here...

Regards,

Vic Lederman

Editorial Director, Chaikin Analytics

Alphabet Reclaims $200 Threshold—Bull Run Reignited?

Written by Ryan Hasson. Published 8/12/2025.

Key Points

- Alphabet has turned a weak first half of 2025 into a strong comeback, reclaiming the $200 level and rising 32% this quarter.

- Q2 2025 delivered beats across revenue, EPS, and all major business segments, easing AI disruption fears and prompting multiple analyst upgrades.

- With a forward P/E of 18.9, Alphabet remains attractively priced relative to its historical average.

Alphabet (NASDAQ: GOOGL) has quietly transformed what began as a shaky start to 2025 into a full-blown comeback.

The stock lagged its Magnificent Seven peers early in the year, weighed down by regulatory fears and concerns that its dominance in search and advertising was wavering.

Those worries are fading, and with them, the bears. As Alphabet leaned into its AI prowess, cloud strength, and ad resilience, its shares surged, and momentum is now firmly back.

Bullish Momentum Returns to GOOGL

The stock is officially in the green year-to-date, up 6.18% as of Monday’s close, and has rocketed 32% in the past quarter alone, including an 11.5% jump this month alone.

Most importantly, Alphabet has reclaimed the $200 level, a psychological and technical resistance point that had held it back for six months. Now sitting just under 3% from its 52-week high, Alphabet is setting itself up for a fresh breakout into uncharted territory.

Technically, this is not an overbought sprint. Alphabet is still building its base, not blowing past resistance like many red-hot tech peers. The clean push through $200 after building weeks of momentum below it suggests more upside could be ahead, as long as the rally remains contained and measured.

Earnings Spark Most Recent Rally

Alphabet’s compelling Q2 2025 earnings, released on July 23, are at the heart of the rebound. Total revenue of $96.43 billion beat expectations and reflected a substantial 14% year-over-year gain. Earnings per share came in at $2.31, well above consensus and up 22% YOY.

Key growth came from advertising, cloud, and search. Google Cloud soared 32% to $13.62 billion, crossing the $50 billion annual run rate landmark.

YouTube ad revenue climbed 13%, and, perhaps most importantly, Google Search & Other grew 11.7%, well above the 8% expected, helping to quiet concerns about AI disrupting Alphabet’s core business.

These results weren’t ignored. Following the blowout quarter, a wave of analysts raised their price targets. Barclays lifted its target to $235 from $220, and JPMorgan increased it to $232 from $200. Multiple other firms followed suit.

Institutional money also started flowing back in. Cathie Wood’s ARKW recently added $35 million in Alphabet shares. Zooming out, over the previous twelve months, institutions have been busy buying shares of the tech giant. In total, $96 billion worth of GOOGL has been purchased versus $52 billion in outflows over the previous year.

Valuation and Entry Perspective

Despite the surge in momentum, GOOGL still looks reasonably priced. Its current P/E is around 21.4, and its forward P/E of 18.9 remains well below its historical standards. So even after a 32% quarterly move, Alphabet isn’t trading at a tech bubble multiple, making the risk-reward picture more compelling for disciplined investors.

For those anticipating more upside, a logical entry could be on a pullback toward key support zones near $190 or even $180, where resistance was overturned earlier in the year.

If Alphabet can reclaim a clean stair-step pattern above $200, reinforced by analyst upgrades and institutional faith, it could quietly morph into one of this year’s strongest major-cap tech stories.

This message is a paid sponsorship sent on behalf of Chaikin Analytics, a third-party advertiser of InsiderTrades.com and MarketBeat.

This ad is sent on behalf of Chaikin Analytics, 201 King Of Prussia Rd., Suite 650, Radnor, PA 19087. If you would like to optout from receiving offers from Chaikin Analytics please click here.

If you need help with your account, don't hesitate to contact MarketBeat's South Dakota based support team at contact@marketbeat.com.

If you no longer wish to receive email from InsiderTrades.com, you can unsubscribe.

© 2006-2025 MarketBeat Media, LLC. All rights protected.

345 N Reid Place, Sixth Floor, Sioux Falls, South Dakota 57103-7078. United States of America..

0 Response to "The day and month stocks are most likely to crash next"

Post a Comment