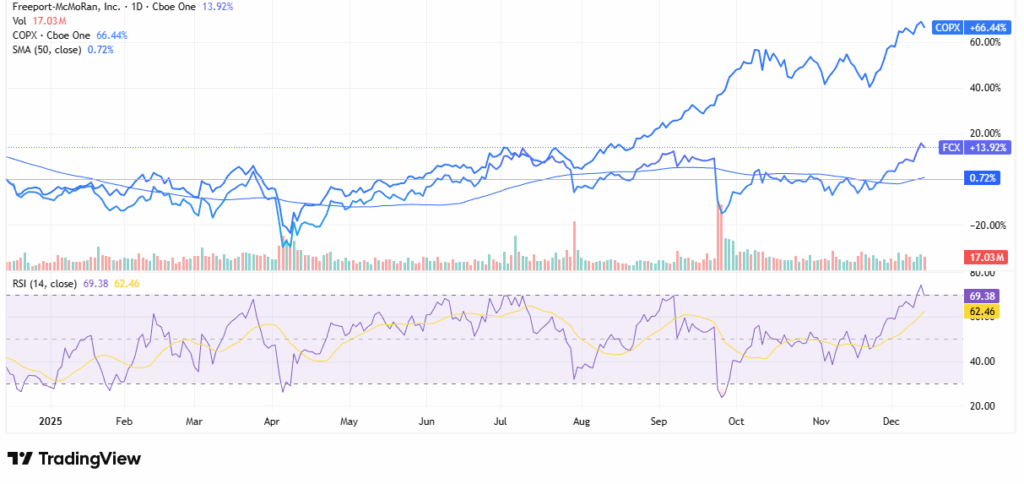

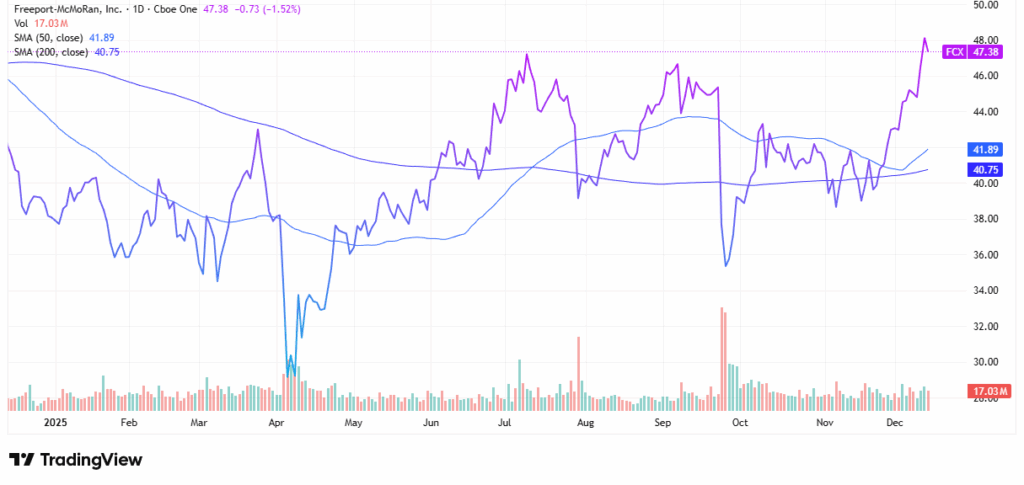

| Below is an important message from one of our highly valued sponsors. Please read it carefully as they have some special information to share with you. The #1 AI Investment Elon + Nvidia = Dear Reader, This single computer chip goes for $25,000 a pop. Regards, James Altucher Editor, Paradigm Press Today's editorial pick for you Freeport McMoRan (FCX) Stock: Attractive Catch-Up Story with Room to RunPosted On Dec 19, 2025 by Chris Markoch Shares of Freeport-McMoRan (NYSE: FCX) are up approximately 19% in the month ending December 12. That puts the year-to-date gain in FCX stock at around 25%. Still, for some investors that gain would be a letdown compared to the growth in the Global X Copper Miners ETF (NYSEARCA: COPX). The fund is up over 80% year-to-date. Table of ContentsHowever, there are reasons to believe that Freeport-McMoRan may outperform the industry in 2026. First, much of the company's laggard performance is due to the mudslide at its Grasberg mine that shut down a significant part of the company's operations. That situation is expected to improve. Second, demand for copper is moving from being cyclical to structural. The world will need copper for everything from data centers and the updating of our electrical grid. And it's still one of the most important metals for renewable energy applications and the broader digital economy, including the rise of artificial intelligence (AI) applications. That's why many investors believe copper prices may be one of the best ways to play the metals trade in 2026 and beyond. In that case, you'll want to consider FCX stock as a lagging leader with plenty of upside. Freeport-McMoRan May Be an Attractive Catch-Up TradeHere's a chart that illustrates what I mentioned in the lead to this article. Investors in the COPX ETF are smoking investors in FCX stock.  However, while what has happened in the past is instructive, investing is typically about where the market is going. In the case of Freeport-McMoRan, the story centers around its Grasberg mine. The mine was shut down in September after a mudslide halted production. FCX stock dropped approximately 22% in a single session after the news but has made up for that loss and even moved higher. That's because Freeport has performed the requisite safety assessments and has announced a phased restart for the second quarter of 2026. Better still, the company has said partial output is already resuming in unaffected parts of the mine. The company expects the Grasberg site to be back to full production – 1.6 billion pounds of copper and 1.3 million ounces of gold annually – in 2027 with that level of production running through 2029. Well-Protected Margins Add to the Bull CaseAnother reason to be bullish on FCX stock is the efficiency of its operations. The spot price of copper has gone back over $5 per pound. However, through its North American assets – such as the Morenci mine in Arizona, the company can mine for around $1.50 per pound. That kind of spread creates a low breakeven point, which can point to outsized profits if the price of copper continues to rise, as expected. And those gains will go directly to the company's bottom line, which is good news for future earnings growth. FCX Stock Valuation: How Concerned Should You Be?For all the positives surrounding Freeport-McMoRan, the valuation is an area of concern. As of December 15, FCX stock trades at 34x earnings. That's a premium of about 6.8% from its historic average. It also trades well above the average of the Metals & Mining industry, which is around 22x. However, with the surging copper trade, FCX has the opportunity to grow into its valuation. Analysts forecast earnings growth of over 28% in the next 12 months. Plus, FCX trades at a forward price-to-earnings (P/E) ratio of around 28.2x, which trims much of the premium out of FCX stock. The consensus price target for FCX stock is $50.32, which is about 5% above its closing price on December 12, 2025. However, since Freeport-McMoRan outlined restart plans for its Grasberg mine, several analysts have raised their price targets. And many of those targets are well above the consensus price. The Chart Shows Short-Term Froth but Bullish UpsideBut now for the most important question. Is FCX stock a buy right now? The chart has been in a steady uptrend that investors like to see. However, there appear to be signs of short-term froth that may mean it's time to wait for a better entry point. Price has broken above a year-long downtrend and now trades well above the rising 50-day moving average, confirming a bullish intermediate trend. Relative strength vs. the COPX copper-miners ETF has improved, but FCX is still lagging the group's powerful move, suggesting room for catch-up if copper's bull run continues.  RSI is knocking on the 70 level, indicating overbought conditions after a strong multi-month rally, so a pause or pullback to the moving average would be normal. For longer-term investors, that kind of dip toward prior consolidation zones could be an opportunity to accumulate, while short-term traders may want tighter stops in case momentum cools. FCX Stock is a Stock to Own, Not TradeLong-term demand for copper makes mining stocks like Freeport-McMoRan an integral part of an investor's portfolio for 2026 and beyond. The company's Grasberg mine won't be back to full production until 2027. However, investors who wait for that confirmation will miss the inflection point. If you're not in FCX stock, this is a time to start a position and use any dips to add to your position. And if you currently own the stock, it's a worthwhile hold. With a high potential for future earnings growth for 2026 and beyond, the company's dividend of 15 cents per share looks safe, which rewards you for holding the stock. This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above. Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc

|

Subscribe to:

Post Comments (Atom)

0 Response to "🤝 Elon + Nvidia Teaming Up?"

Post a Comment