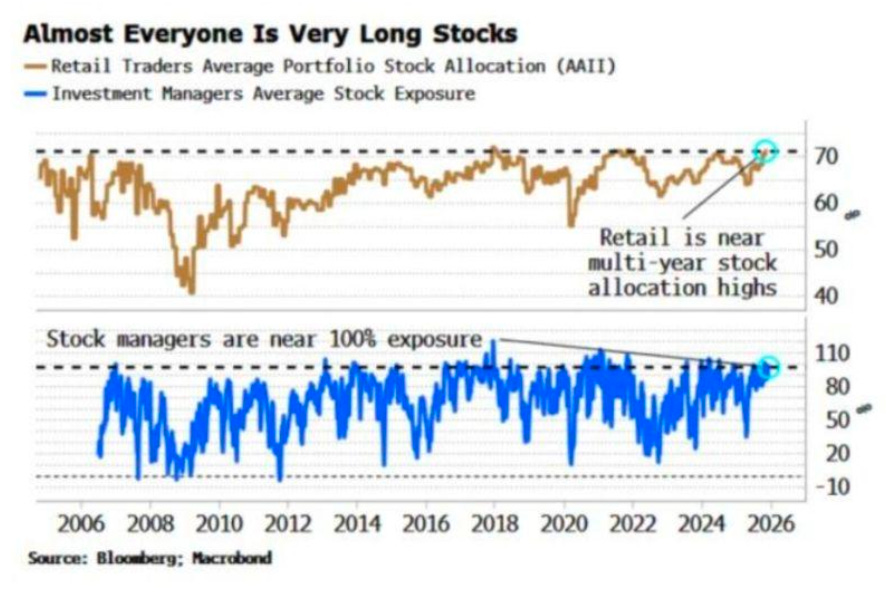

One Last Note Before The Week Begins...I just want to remind you what we're trying to do here in 2026...Dear Fellow Traveler: Everyone’s all in… Right now, retail traders have allocated nearly 70% of their portfolios to stocks. That’s the highest level in over 20 years. The last time we saw allocations this stretched? The 2021 meme stock frenzy. Before that? Right before the dot-com collapse. Meanwhile, professional investment managers are running at nearly 100% stock exposure. One of the most extreme readings in two decades. That’s a 65 percentage point surge since the April lows. To put this in perspective… stock allocations sat at just 55% during COVID in 2020. They fell to 40% at the 2008 bottom. Risk appetite is through the roof. Everyone’s betting in the same direction. And when everyone is positioned the same way... That’s when the surprises hit hardest. Here’s What Most People Don’t UnderstandThe financial media won’t tell you this. Most newsletters won’t either. It doesn’t sell subscriptions. The truth is that this market isn’t driven by earnings, valuations, or fundamentals the way past markets were. It’s driven by liquidity. By the creation of capital, where it flows, and who gets access to it first. The Federal Reserve, Treasury, and shadow banking system pump trillions into the financial system. That capital doesn’t flow evenly. It finds its way into equities, distorts valuations, blows up traditional metrics, and creates perverse incentives. Right now, we have 4,233 tradeable U.S. stocks and over 4,800 ETFs. READ THAT SENTENCE AGAIN… That’s not capital formation. That’s financialization. An economy designed to extract wealth rather than build it. Once you understand this, you can’t unsee it. And once you see it, you can finally position yourself on the right side of it. What I Built. And Why It Works.I emerged from the 2008 financial crisis with a confession… Despite having a job on Wall Street, I was as dumb as a stump about how the Federal Reserve actually worked. So I spent the next 17 years figuring it out. I studied monetary policy at Johns Hopkins. Trade policy at Purdue. Insider buying patterns as part of my MBA at Indiana. Cross-border capital flows at Harvard Business School. I worked in competitive intelligence, political advocacy, financial research, and as a journalist at the Chicago Mercantile Exchange covering hedge funds and commodities. All of it fed into a single equation. A signal that tracks when money is leaving the market before the headlines hit. On February 22, 2020, that signal went negative for the first time. I moved heavily to cash on February 24th. The COVID crash that followed enabled me to buy a house while others were drowning. Since then, we’ve successfully avoided:

And I helped readers navigate the most recent selloff into November 21… and the rebound that followed… (On Nov. 23, I said this rebound would come.) I’ve been out in front of every major drawdown since 2020. Not predictions. Not guesses. A systematic approach to reading when institutional money is heading for the exits. What The Capital Wave Report DeliversThis isn’t a newsletter about stock picks. It’s about understanding the forces that actually move markets. And using that knowledge to protect what’s yours. Each day, subscribers receive:

What We’re Really Doing Here Psychologists Kahneman and Tversky proved that humans feel the pain of loss roughly twice as much as the pleasure of an equivalent gain. Losing $10 hurts more than gaining $20 feels good. That’s why most investors make their worst decisions at the worst possible times. Selling at the bottom. Buying at tops. Paralyzed by fear when they should act. My mission is your financial self-defense. I’m not promising 100%, 300%, or 1,000% gains. I’m not selling dreams of overnight riches. I’m making sure you can protect what’s yours. And know when to get back in when the storm passes. When everyone is freaking out, we have a systematic process to identify when the crisis has ended. When everyone is complacent (like they are right now) we have signals that flash before the surprises hit. Here’s what one subscriber wrote me in February… before the big selloff… Another sent me a three-pound Tomahawk steak for my birthday after taking gains on Apple and Microsoft before the selloff. That’s the real product: peace of mind, backed by a systematic approach that has worked through every major market dislocation of the past five years. My North Star Tell the truth about money and our deeply misunderstood financial system, regardless of who it pisses off. Not to make friends with Wall Street executives. Not to get invited to Federal Reserve cocktail parties. Not to build some guru following. Just to cut through the bullshit and explain how things actually work. So you can take action. Because once you understand how the money printer impacts markets, you won’t unsee it. And you’ll sleep a hell of a lot better at night. Right Now, The Warning Signs Are Flashing Retail allocation at 20-year highs. Professional managers at near-100% exposure. Everyone was positioned in the same direction. I’ve seen this setup before. I know how it ends. If you want to know when institutional money starts heading for the exits, before the headlines hit, The Capital Wave Report is built for exactly this moment. I’m offering it to you at an incredible price for 2026. I will be increasing this letter to $200 a year in 10 days… Largely because of the track record and the sheer amount of content and benefits that our readers receive. Join us. Let me show you that I’m here to help protect your money… and that your money is WORTH protecting... Stay positive, Garrett Baldwin The Capital Wave Report Me and the Money Printer About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "One Last Note Before The Week Begins..."

Post a Comment