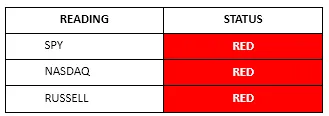

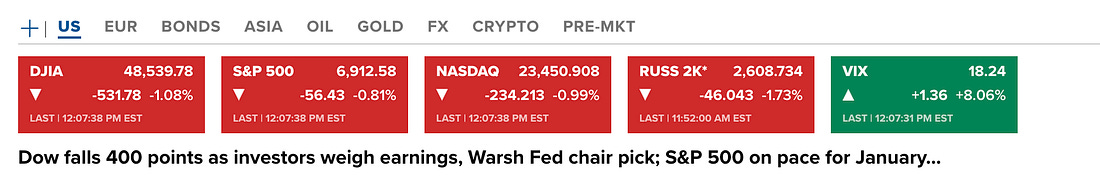

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Six Rules for Negative Momentum (Back To Our Roots)"When you french fry when you should pizza, you're gonna have a bad time..."Dear Fellow Traveler: We flew the yellow flag on Monday, and our signals turned Red on Wednesday. It had been an unusual period, turning red while we sat at all-time highs. We can blame the crowding into the big tech names on earnings. Or the systemic issues that I noted on Monday when ZeroHedge started talking about Downside Convexity. Drink! Let’s get to the breakdown of these markets… We Don’t Need a Narrative… We Need to Talk PlumbingIt’s an interesting day in the financial media because the mainstream outlets are talking about Kevin Warsh as the driver of selling in these markets. Warsh has been named as the potential replacement for Federal Reserve Chairman Jerome Powell. But that headline misses the structural issues that had been building in recent days (and really… for months and months)… And it’s another reflection of how we try to tell stories and blame “catalysts” when the real story of price is always found in math and probabilities. No doubt, earnings reports will weigh on sentiment, and profit-taking is ripe with markets at all-time highs… Initially, this growing selling pressure doesn’t look too bad on the surface. But the number of equities under pressure is rising. Momentum creates more momentum. Downside pressure creates more downside pressure. The unwinding of leverage gives us more leverage to unwind. And if people don’t put on the brakes… it quickly becomes a problem for retail. I think back to the South Park episode about skiing. Stan is trying to learn how to ski. His instructor teaches him to “Pizza” his skis to slow down and “French Fry” when he wants to accelerate. Thumper, the instructor, explains that “When you french fry when you should pizza, you’re gonna have a bad time...” This culminates in Ike failing to pizza and crashing through a restaurant. We are in French Fry territory. Nobody wants to pizza because pizza feels like missing upside. But that’s how walls get introduced to faces. It’s time to slow down (it was clear that way on Monday). And I remind you it’s okay to take some gains and reassess what’s happening. The Underlying IssuesI’ve called this the Viagra and Popsicle Stick stock market for a reason. The stimulus and policy support keep it standing, but the underlying structure is held together with whatever's lying around. Japan is doing carpet bomb stimulus. China is doing structural stimulus. The United States is buying $40 billion in Treasuries a month to support banking reserves ahead of tax season… something that isn’t Quantitative Easing, but aims for Quantitaitve Easing-like outcomes. Michael Howell has referred to this as “QE-not-QE.” But it’s very fickle… And those issues are exacerbating challenges that will not go away… BarChart highlighted Wednesday the things we’ve laid out for months… They note:

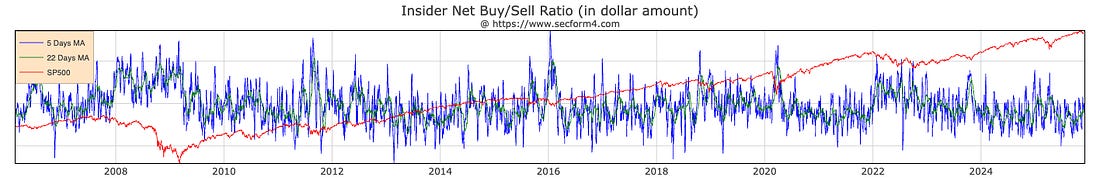

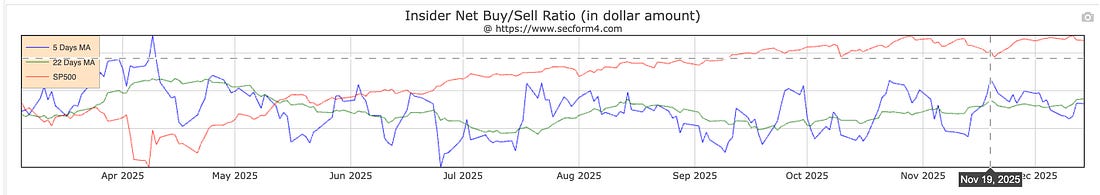

What we have, as a result, is a loss of confidence in currencies (the basis of our Hedge of Tomorrow Report in March 2024), continued stress in sovereign debt markets, and capital that wants to play defense rather than target growth. BarChart had warned about a coming “Global Margin Call” in December. The issue is that these warnings take time… effectively, if they're correct, we’re still in setup. That’s the frustrating thing about being early. You're technically right, but you sound like the guy at Thanksgiving dinner who's been predicting the housing crash since 2015. You’ll be eventually correct, but perpetually annoying. Michael Howell has noted that we have record levels of liquidity, but that momentum has stalled. That points to an asset reallocation… But there is something bigger happening… and we’ll continue to eye Japan where paper losses on bonds have built to eye-watering levels, according to Just Dario. So Now What?I can’t tell you if this is the start of a bigger downturn. We have significant quantitative support at the moment, but we know that we’re at the top of our liquidity cycle. Valuations are stretched, and the real threat remains the same: Capital leaving the U.S. again en masse. This remains my biggest risk from our 2026 outlook. What does that look like and lead to…? A cascading effect… Foreign capital - still a significant share of our markets - heads for the exits… Valuations can get hammered because leveraged funds may need to sell as outflows build… and passive flows that dominate the market have to readjust weights and possible sell too or at least aren’t bidding up. Sure, employees are buying into equity markets through their 401 (k) s, which is a long-term trend that aligns with continued macro expansion themes. But that buying persisted through 2022… a year dominated by tightening liquidity conditions. Passive flows are loyal…. but they’re not always smart. Right now… all I can do is the same thing that we always do… We prepare and react. When our signal goes negative, we want to pay very close attention to the MicroSectors FANG+ Index -3X Inverse Leveraged ETNs (FNGD). It has regularly been a signal around leveraged positions and questions about challenges in the equity markets. But more importantly, there are specific rules that we have for negative momentum conditions. I will remind you that policy accomodations have been quite significant in the last 18 months. Since August 2024, when these Japan worries really started to emerge (that’s the spike on the left in the FNGD), we’ve had 6 events where volatility spiked, only to turn back and drop 40% in 10 trading days. That’s incredible, because before late 2011 (in the wake of the European Financial Crisis), it had never happened. It speaks to the relationship of central bank responses and to the growing transmission impact between the U.S. and Japan, a subject covered by the Bank for International Settlements in July 2025. We did an extensive recap of that report. To put it in perspective, if Japan were the neighboring house to the United States on a cul-de-sac, Japan’s thermostat would affect the temperature inside the latter’s house. August 2024 was a huge warning to the world. But we chose to kick this problem down the road. And we are going to see a sizeable selloff as our liquidity cycle tightens. The job for Kevin Warsh is to decide how much he will tolerate as a hawk. So… what should investors do right now? I laid out a few things. In the past, I’ve written an article called “Six Rules for Negative Momentum.” Today, I want to alter those rules a little bit and expand… Yes… all of that commentary above was one big setup for… portfolio maintenance and management. The first rule was always to raise cash. But let’s move that to No. 2. Rule 1 needs to be exactly what I suggested on January 21. You need to complete an audit of your portfolio. Ask these questions - most important, why you own something. Again, if you can’t explain in a sentence why you’re holding on to something, it has to go. And you must ask about the opportunity costs. What does that position stop you from being able to do as an investor? Ask these five questions… Rule 2: Have a stash of cash to deploy. We covered this… Rule 3: Hold off right now on cash-secured puts and selling bullish put spreads. The reason is that if momentum continues to break down, even the best stocks in the world aren’t immune to bigger declines. I’ll remind you that when we hit negative momentum in July 2024… NVIDIA lost 33% of its value from peak to trough. What changed in the thesis of NVDA? Nothing. It was still the top stock on the board, poised for record growth, yet it got smashed because of the nature of equity markets. Today, names like NVIDIA are portions of large leveraged positions, benefit from the carry trade, and maintain massive position levels in ETFs (it’s in over 1,500 ETFs…) So, if there’s a bigger breakdown, you may find yourself getting assigned a stock at a price that you might not want (you’d be subject to larger paper losses). Let’s say you sold a put when our Apple signal turned negative in late July 2024. Apple cratered from $235 to $195 in about three weeks. Higher beta names like Palantir, NVIDIA, and Alphabet lost way more… If you are a person who likes to sell spreads… look to sell to the upside. Sell credit spreads to the upside on higher IVR names and look to benefit from weakening momentum. But be aware that if policy accommodation comes or the market finds a catalyst, you’ll need to be willing to cut these positions and take what the market is giving you. Rule 4: Put together your list of stocks that you want to buy when there are signals of a bottom (and we’ll discuss those in a moment). You might want to target the higher Beta names if policy accommodation comes. You might want to look at High F Score and Low Graham Ratio stocks for quality and value. Or you may have a laundry list of regional and community banking stocks you want to own, since M&A activity will continue. Rule 5: Learn the technicals. Both for the breaks to the downside… MACD, RSI, MFI, and ADX can help you build conviction. But we’re also focused on something much more profitable. We are looking for short squeezes in this market. Remember, there are “hated rallies” or rebounds in down markets (Summer 2022). We move into deeply oversold territory on the Relative Strength Index and the Money Flow Index. Both of these indicators can set us up for short squeezes. And we tend to see that these conditions are where retail leans heavily into shorting or panic-selling. Well, I’m here to tell you that these are the times ripe for short-term pops before we see another leg down or some sort of policy accommodation that provides support to the markets. I stress the March 12 short squeeze that we predicted and the November 21 squeeze (on the back of Japanese stimulus). In these periods, we tend to see ZERO breakout stocks in our readings, meaning there aren’t any buyers ready. Rule 6: Listen to the Insiders… and Changes in Policy (doesn’t matter if it’s trade policy, monetary policy, or fiscal policy). The whole system operates around liquid and illiquid conditions. There are no bull or bear markets, only liquid and illiquid ones in the post-2008 world. Although, Stanley Druckenmiller told the world this back in 1988 in a different fashion... Insiders have collectively called the bottom of every major panic or crash in the post 2008 world. We explicitly look for a spike in the five-day insider-buying-to-selling in aggregate dollars, and back that up with a dive into the number of filings (buying versus selling). If that buying aligns with a policy accommodation (could be here, China, the U.S., or Europe), pay attention. That is a signal of stress unwinding in the financial plumbing. As always, we trade this strategy until it breaks. The last time we saw it really pay off was November 19 (just two days before Japan announced stimulus). And of course, insider buying was at its extreme for 2025 on April 8, right when everyone was talking about the next Great Depression. Two days later… Trump called off Liberation Day when leveraged hedge funds started dumping U.S. Treasuries. I took the Australian Financial Review to task for not asking Janet Yellen an important follow-up question after she explained an unwind of the basis trade. And sure enough… we were off to the races with policy softening… If this doesn’t make sense… or you think I’m cherry picking… that’s okay. I did a one-hour presentation on this called The Wave Speech… It takes you through the combination of liquidity, momentum, insider buying, policy, and plumbing…  And… as promised, all sources are cited… All right… that’s enough for one day… Remember… Don’t french fry when you’re supposed to pizza… Or else, you’re gonna have a bad time… Oh, one last thing… now’s also the time to pay attention to sovereign-style investments… That’s the point of Postcards from the Edge of the World. Our next story arrives tomorrow… and it’s about the one commodity they’re really extracting from us all right now… Time. And stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Six Rules for Negative Momentum (Back To Our Roots)"

Post a Comment