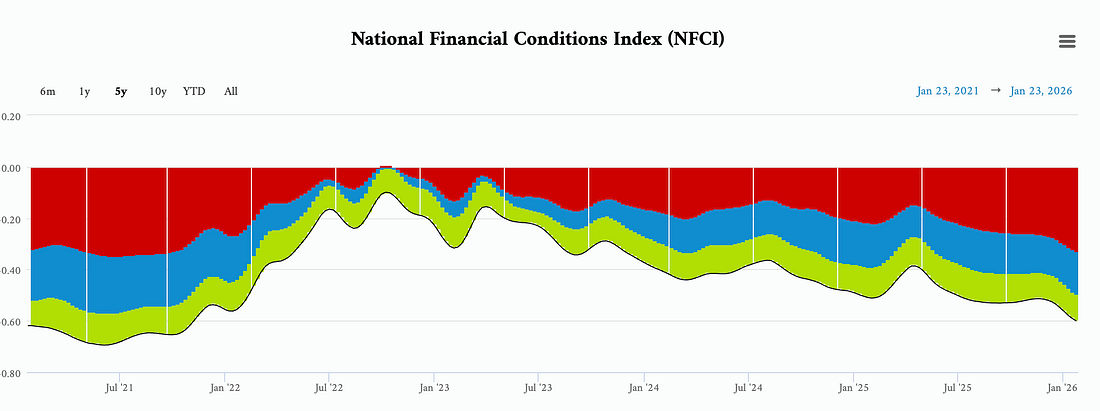

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: Well, I just woke up from a two-hour nap. I was on air to cover the Fed from 2 pm until about 4:15 pm. Let me recap what happened today… Super dry… No rate cut came today. And that was expected. As I said, this feels more and more like never-ending theater. Inflation clearly isn’t tamed. But “doing nothing” wasn’t neutral. It was in its own right a signal to markets. Powell used his time at 2:30 to let everyone know that the Fed’s not ready to cut. He’s not convinced that inflation is beaten, and they’re not really willing to move. Someone emailed me and told me that financial conditions are are tightening… No they aren’t… We’re in very, very loose economic conditions, according to the Chicago Federal Reserve. The Federal Reserve did exactly what markets expected today. It held interest rates steady. But in this environment, doing nothing was not neutral. It was a signal. The Fed’s statement upgraded growth from “moderate” to “solid,” removed language about rising downside risks to employment, and reinforced the idea that inflation remains the binding constraint. Two governors dissented in favor of a cut, but Powell controlled the narrative. In isolation, that sounds simple… But there’s a backdrop here. Japan is dealing with instability. Its bond market is under pressure. The yend is showing behavior consistent with intervention or coordination. Just the calls they made last week were significant enough actions to tell people shorting the yen to back off. The yen has funded risk assets for decades. It’s the financial equivalent of discovering your neighbor has been secretly paying your mortgage. You don’t want to ask too many questions until you absolutely have to. At the same time, the Fed has been active. They’re engaging in Repo operations, rate checks, and balance-sheet adjustments are doing more of the work than the rate policy itself. Liquidity is being managed even as rates stay high. That combination tells us why equities can sit at all-time highs while breadth faces pressure and volatility simmers underneath. This market feels like a dinner party where everyone is smiling, but three couples are clearly getting divorced. Powell understands that tension. Cutting rates now would add fuel to asset inflation at a moment when global liquidity is already unstable. It would create transmission issues in Japan. They’re not going to come out and tell you this… which is why you have to get the strongest whiskey you can find (try Mellow Corn) and sift through Bank for International Settlements reports. Holding steady preserves the Fed’s credibility for right now, especially with all of the chatter about independence. Yes, it can and will create short-term market discomfort and political noise. Earnings will also provide some cover for now… two out of three big names today weren’t bad (but holy hell is CAPEX becoming a problem for companies in AI buildout.) The key takeaway from all this today is that the Fed appears to be choosing restraint. We still have pressure in Japan, questions about FX markets, and questions around where funding channels will absorb stress. Bitcoin has held at 89,000… and that’s what we need to watch in case there are any deeper issues. That said, our signals are squarely red right now, and that’s an issue given that they turned red earlier today, BEFORE the Fed meeting, and have stayed that way. Keep an eye on the FNGD… It’s above its 50-day moving average still… and that’s an issue when more stocks are in breakdown mode than in breakout mode. Metals are surging, the dollar is weakening, and risk assets feel like they’re being propped up by viagra and popsicle sticks. Finally, I’d be silly if I didn’t mention gold. Just… whoosh… We explained why this was coming back in March 2024. I don’t have a price target… but the higher this goes, the more Mellow Corn we’re going to need. We’re experiencing history right now, and it’s okay to take some gains (which I did), even though this feels far more structural than it does a period of mania. I’ll explain why this all goes back to Howell’s Currency Wars thesis tomorrow. For now, I do have to run. Sorry to cut this short… My daughter wants to play a game before she goes to bed. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Super Dry Federal Reserve Analysis"

Post a Comment