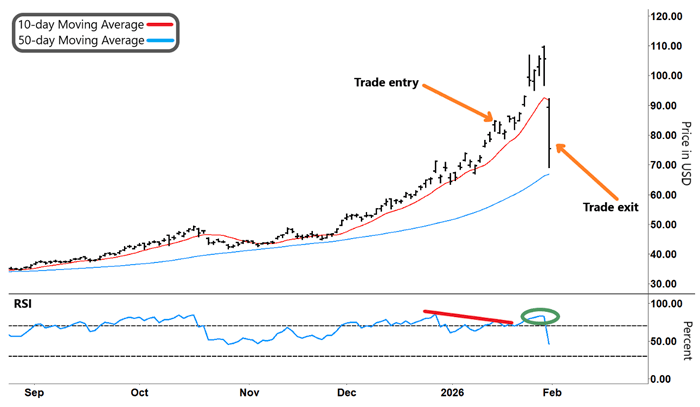

This Is Why We Trade Options By Larry Benedict, editor, Trading With Larry Benedict Since we launched Trading with Larry Benedict, I’ve shared countless examples of how I go about my trades. The reason I do that is simple… I want to show how we put my mean reversion strategy into action using options. I believe options are one of the greatest tools ever for retail traders. Of course, we don’t always get our trades right. But over time, our winners outnumber the losers, and we end up with solid profits. Today, I want to share another trade that reinforces how useful options can be. And no beating around the bush, this trade was right up against it for a time. So let’s see how things panned out… (If you enjoy this e-letter, I’d be very grateful if you recommended it to a friend. You can click here to forward it . Thank you!) A Bigger Bubble Than Tech Much of the market’s focus over the last year was on Big Tech. Many (including me) have remarked on the bubble forming amid the excitement about AI. Yet this year, all that hype was soon overtaken by another asset class… Gold and silver both made serious moves in 2025. Then things accelerated in 2026. By last week’s peak, gold and silver were up 30% and 70%, respectively, year-to-date (YTD). (And we were still only in January!) But throughout my four-decade career, I’ve seen plenty of bubbles and frenzies. They all finish the same way. There were no fundamental reasons for gold and silver to be trading at such crazy highs. It would only take the right catalyst for them to topple over. One thing I look for is diverging patterns. When a stock or commodity is rapidly rising alongside signs of slowing buying momentum, that can often precede a tumble. Eventually, falling momentum pulls a stock or commodity lower. That pattern was developing with silver. So on January 14, we opened a put option trade on iShares Silver Trust (SLV). (A put option typically increases when the underlying stock falls.) Leading up to our trade, you can see silver’s rapid acceleration. Meanwhile, the Relative Strength Index RSI was making a lower high (red line), pointing to buying momentum waning. Check out the chart… iShares Silver Trust (SLV)

Source: eSignal (Click here to expand image) After first opening the trade, things went against us. Silver resumed its climb as buying momentum returned, pushing SLV much higher. Had we been short the trade via stock or futures, we would have been stopped out for losses. That’s why options are my favorite way to profit from a downside move. When buying options, the most I can lose is the premium. In this trade, we paid $3.83 per option contract. (That means we were risking $383 per contract, since a contract is for 100 shares.) For that clearly defined risk, we gained access to what turned out to be a highly lucrative trade. Tune in to Trading With Larry Live

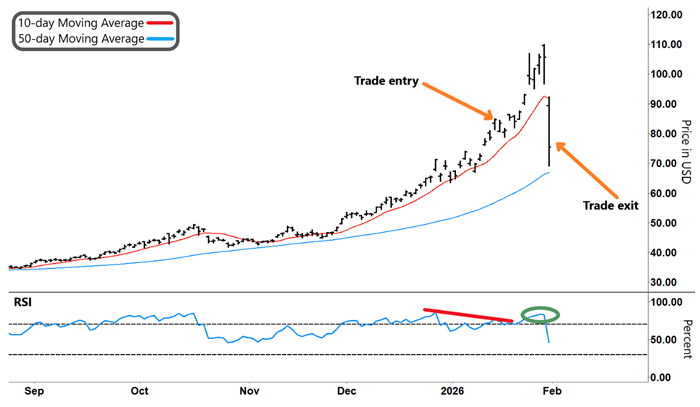

Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. | Taking Profits Silver’s reversal finally hit last Friday (green circle). The RSI reversed sharply from overbought territory, causing SLV to tank. That propelled our trade into good profits. Take another look: iShares Silver Trust (SLV)

Source: eSignal (Click here to expand image) We exited our option at $6.10 (or $610 per contract). That represented a 59.5% gain in 16 days. (Did you take part in this trade? Share your experience with feedback@opportunistictrader.com.) As always, we need to remember that options use leverage, so they amplify both profits and losses. Options also expire, so we have to get the move we’re expecting within a certain window. If the move doesn’t play out soon enough, we run the risk of our option expiring worthless. That’s why careful position sizing is vital for these trades. Options’ defined risk (which I mentioned above) enables us to trade only what we’re comfortable with. As you can see, using options enabled us to stay in a trade that didn’t immediately go our way. But in the end, our patience paid off handsomely. If you’d like to learn more about the important market signals I’m watching now so you can get in on our next trade… then be sure to go right here to watch my latest briefing. Happy Trading, Larry Benedict

Editor, Trading With Larry Benedict P.S. I hope you’re enjoying all of your Opportunistic Trader content. That’s why I have a favor to ask… Would you please add services@exct.opportunistictrader.com to your contacts list? That will “whitelist” us with your email provider and help ensure these emails reach your inbox. If you’d like to learn more about whitelisting, you can check out our detailed instructions here. Thanks for your help! Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. | |

0 Response to "This Is Why We Trade Options"

Post a Comment