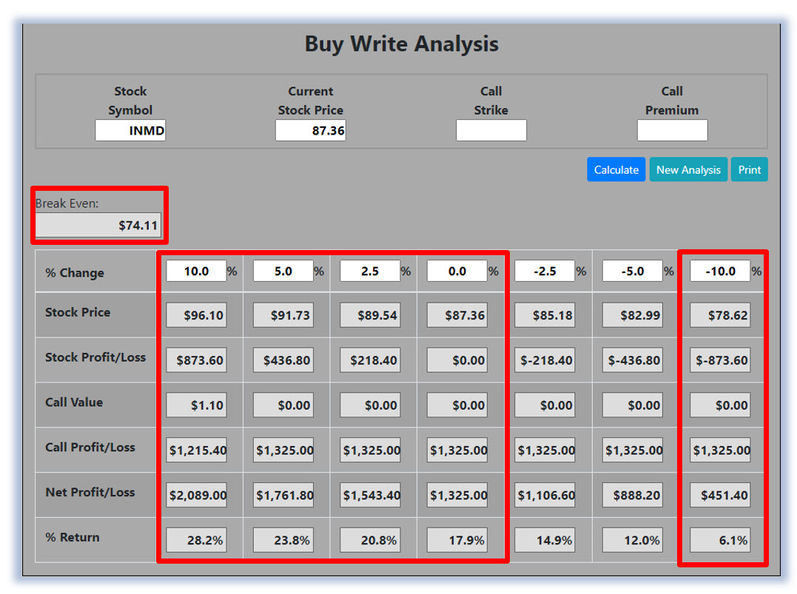

| Profit if INMD Is Down 10% Now, since INMD’s 12/26 Day MACD is currently above the 9-Day EMA and will likely rally from here, let’s use the Optioneering calculator to look at the potential returns for an INMD covered call trade. Covered calls are also known as buy writes. The Buy Write Calculator will calculate the profit/loss potential for a covered call trade based on the price change of the underlying stock/ETF at option expiration in this example from a 10% increase to a 10% decrease in INMD stock at option expiration. The goal of this example is to demonstrate the ‘built in’ profit potential for covered calls and the ability of covered calls to profit if the underlying stock is up, down or flat at option expiration. Out of fairness to our paid option service subscribers we don’t list the option strike price used in the profit/loss calculation. The prices and returns represented below were calculated based on the current stock and option pricing for INMD on 4/15/2021 before commissions. Built in Profit Potential For this covered call, the calculator analysis below reveals the cost or the breakeven price is $7,411 (circled). The maximum risk for a covered call is the cost of the covered call. The analysis reveals that if INMD is flat at 87.36 at expiration the covered call will realize a $1,325.00 profit and a 17.9% return (circled). If INMD increases 10.0% at option expiration, the covered call will realize a $2,089.00 profit and a 28.2% return. And if INMD decreases 10.0% at option expiration, the covered call will realize a $451.40 profit and a 6.1% return. Due to option pricing characteristics, this covered call has a ‘built in’ 17.9% profit potential when the trade was initiated. Covered call trades can result in a higher percentage of winning trades compared to a directional stock trade if you can profit when the underlying stock/ETF is up, down or flat. A higher percentage of winning trades can give you the discipline needed to become a successful trader. The Optioneering Team is here to help you identify winning trades just like this one.

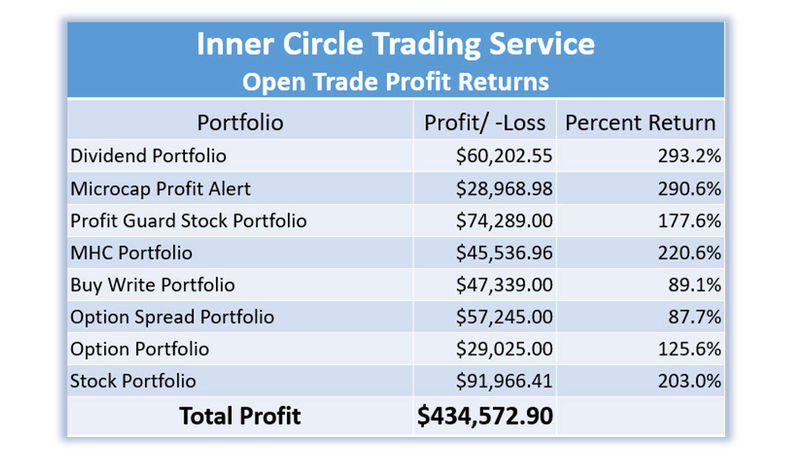

Interested in accessing the Optioneering Calculators? Join one of Chuck's Trading Services for unlimited access! The Optioneering Team has option calculators for six different option strategies that allow you to calculate the profit potential for an option trade before you take the trade. Average Portfolio Return of 185.9% Below is a screenshot of the current open trade profit results from Chuck’s Inner Circle Trading Service. There are currently $434,572.90 in open trade profits with an average portfolio return of 185.9% demonstrating the ability of the Optioneering Strategy to deliver substantial returns with no losing portfolios.

Get Chuck's Trades Sent to You! Do you want to start receiving hand-picked trades from 10-Time Trading Champion, Chuck Hughes? As a Trade of the Day subscriber, Chuck is offering you a special discount on his Inner Circle Trading Service. Just call Brad at 1-866-661-5664 or 1-310-647-5664 to join and use the code "Optioneering VIP" to receive special pricing! Wishing You the Best in Investing Success,

Chuck Hughes Editor, Trade of the Day Have any questions? Email us at dailytrade@chuckstod.com |

0 Response to "Medical Devices Co. Trending Up"

Post a Comment