Even some of the best traders are scratching their heads right now. Trying to lock down where the trend is today and get a head of it can seem exhausting. But a group of traders found a way to make it way easier a couple weeks ago and were able to simplify the process they use to grab the greatest potential gains from the market we are seeing right now.

Yet the folks working with one trader were able to pull in a 99% win in just three days. And it happened just a few days ago.

The noise of relentless headlines, seemingly brand new influences on the markets, and big changes around the globe may make it feel like this market is different than anything we have seen before, but the truth is the current that moves prices has been the same forever. It is just a matter of knowing how to spot it.

Lee Gettess has been helping pro traders for years refine their approaches and crank up the power of their returns. His understanding of the underlying forces that move the markets gives him a huge advantage when it comes to spotting gains early. He spotlighted a great trade in QQQ, the ETF that tracks the NASDAQ, and the people who took that trade were able to pull in a 99% winner in 3 days!

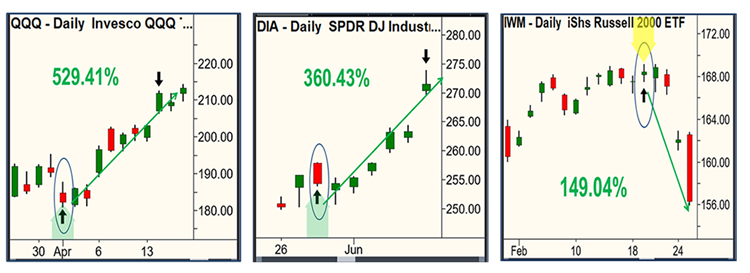

What makes this approach even better is that it is SIMPLE. Look at these winners:

When Lee sat down with us and a group of traders in a recent Investment Corner interview, he explained the simplicity of the approach that makes it realistic for hard working people to put to work for them.

- It uses just 4 commonly traded Index ETFs. This makes it easy to follow and easy to trade.

- The trades are made on specific days of the month, freeing up your time!

- The instructions are as easy as “buy on Green days, sell on Yellow days”

- It is literally as easy as 1, 2, 3!

The response to Lee’s interview where he laid it all out for everyone to see was huge. And since then, the performance has been astounding. We were able to bring Lee back and dive back into how this works and explain how traders like you can get in on it.

Don’t miss this opportunity. The market will only get crazier as we head toward the end of the year and you definitely want to put an approach that wins this consistently to work for you.

Lock in your spot at the interview and see for yourself.

Gettess “O-Force Trading”

Lee Walks Through How This Approach Is Ideal for Grabbing Winners In This Market

Webinar Date: Wednesday, September 29th

Webinar Time: 6pm Central

PS-This will be a live interview so you can ask your questions and get all of the inside scoop.

Register Now!

© 2021 Tradewins Publishing. All rights reserved. | Privacy Policy | Terms and Conditions | Contact Us

The information provided by the newsletters, trading, training and educational products related to various markets (collectively referred to as the “Services”) is not customized or personalized to any particular risk profile or tolerance. Nor is the information published by Lee Gettess a customized or personalized recommendation to buy, sell, hold, or invest in particular financial products. Past performance is not necessarily indicative of future results. Trading and investing involve substantial risk and is not appropriate for everyone. The actual profit results presented here may vary with the actual profit results presented in other Lee Gettess publications due to the different strategies and time frames presented in other publications. Trading on margin carries a high level of risk, and may not be suitable for all investors. Other than the refund policy detailed elsewhere, Lee Gettess does not make any guarantee or other promise as to any results that may be obtained from using the Services. Lee Gettess disclaims any and all liability for any investment or trading loss sustained by a subscriber. You should trade or invest only “risk capital” – money you can afford to lose. Trading stocks and stock options involves high risk and you can lose the entire principal amount invested or more. There is no guarantee that systems, indicators, or trading signals will result in profits or that they will not produce losses.

Some profit examples are based on hypothetical or simulated trading. This means the trades are not actual trades and instead are hypothetical trades based on real market prices at the time the recommendation is disseminated. No actual money is invested, nor are any trades executed. Hypothetical or simulated performance is not necessarily indicative of future results. Hypothetical performance results have many inherent limitations, some of which are described below. Also, the hypothetical results do not include the costs of subscriptions, commissions, or other fees. Because the trades underlying these examples have not actually been executed, the results may understate or overstate the impact of certain market factors, such as lack of liquidity. Lee Gettess makes no representations or warranties that any account will or is likely to achieve profits similar to those shown. No representation is being made that you will achieve profits or the same results as any person providing a testimonial. Testimonials relate to various other products offered by Lee Gettess and not the product offered here, but all of these products are based on Lee Gettess’ system. Performance results of other products described in such testimonials may be materially different from results for the product being offered and may have been achieved before the product being offered was developed.

Results described in testimonials from other products or the product being offered may not be typical or representative of results achieved by other users of such products. No representation is being made that any of the persons who provide testimonials have continued to experience the same level of profitable trading after the date on which the testimonial was provided. In fact, such persons may have experienced losses immediately thereafter or may have experienced losses preceding the period of time referenced in the testimonial. No representation is being made that you will achieve profits or the same results as any person providing a testimonial. Lee Gettess’ experiences are not typical. Lee Gettess is an experienced investor and your results will vary depending on risk tolerance, amount of risk capital utilized, size of trading position, willingness to follow the rules and other factors.

TradeWins Publishing, 528 North Country Rd., St. James, NY 11780

0 Response to "Get Inside The Force Crushing This Market"

Post a Comment