Ticker Reports for July 29th

Kimberly-Clark Stock Dips and a Buying Opportunity Emerges

Global personal care products giant Kimberly-Clark Co. (NYSE: KMB) stock formed a resilient and rapid rebound after initially falling on its Q2 2024 earnings results. The company’s portfolio of brands are household names in 175 countries, as nearly 25% of the world's consumer population uses its product daily. Shares peaked after $160.19 in August 2020 during the pandemic and sank to a low of $108.72 before staging a rebound to a 52-week high of $145.62. Investors can watch for the daily symmetrical triangle pattern to resolve.

Kimberly-Clark operates in the consumer staples sector, competing with consumer goods manufacturers like Proctor & Gamble Co. (NYSE: PG), Colgate-Palmolive Co. (NYSE: CL) and Clorox Co. (NYSE: CLX).

Kimberly-Clark has a Popular Portfolio of Brands

While the name Kimberly-Clark may not be familiar to consumers, its brands are well known. Huggies, Poise, Kotex, and Depends lead the company's Personal Care brands. This segment saw the most promising growth in Q2 2024, with 8% YoY organic growth and 14% YoY operating profit growth. China and North America led volume growth. Focus markets experiencing volume growth include Australia, Brazil, and Indonesia.

Its Consumer Tissue brands are led by Scott, Kleenex, Cottonelle, Viva, and Andrex. Organic growth fell by 2%, but operating profit grew by 23% YoY in Q2 2024. Flat volumes reflected mid-single digit pricing in North America offset by retailer inventory reductions in North America. Low single-digit pricing in North America was more than offset by the lapping of energy surcharges in Western Europe. Volume-led share gains with Kleenex in the U.S., U.K., Australia, and Andrex in the U.K.

Its K-C Professional brands include Scott, Kleenex, and WypAll, which experienced flat organic growth and a 1% drop YoY in operating profit. Lower volumes in North America were driven by ongoing business rightsizing and recent foot traffic weakness in Retail, Foodservice and Lodging channels.

KMB Forms a Symmetrical Triangle Pattern

The daily candlestick chart for KMB illustrates a symmetrical triangle pattern. This pattern is comprised of a descending upper trendline and a rising lower ascending trendline converging at the apex point. KMB shares initially sank 5.7% to $138.74 on its Q2 2024 earnings release, falling to a low of $134.67 before rallying back to a $142.79 gap fill in the following days. The daily relative strength index (RSI) has flattened around the 54-band. Pullback support levels are at $

Kimberly-Clark Has Mixed Q2 2024 Results

The company reported Q2 2024 EPS of $1.96, handily beating consensus analyst estimates by 25 cents. However, revenues fell 2% YoY to $5.03 billion, falling short of consensus estimates of $5.1 billion. FX translation impacted sales by 5%. The divestment of its Tissue and K-C Professional business in Brazil in June also impacted sales by 1%. Organic sales rose 4%, driven by a 2% increase in price and a 2% increase in volume and mix. Volume and mix were positives across North America, developing and emerging (D&E) markets, and developed markets like Australia, South Korea, and Western and Central Europe.

Net interest expense was $63 million, down from $67 million in the year-ago period. The year-to-date (YTD) operating profit was $1.5 billion, which included $235 million in costs related to the transformation initiative. YTD adjusted operating profit was $1.7 billion, up 15% from $1.5 billion in 2023. YTD cash provided by operations was $1.5 billion, up from $1.4 billion a year ago. Fundamentals continue to shape up as the company took the opportunity to raise its 2024 outlook.

Full Year 2024 Raised Guidance Outlook

Kimberly-Clark expects organic net sales to grow at a mid-single-digit rate, while reported net sales are expected to be impacted negatively by 400 bps of currency translation and 120 bps from divestitures. Adjusted operating profit guidance was raised and is now expected to grow at a mid-to-high teens percentage rate on a constant currency (CC) basis, up from previous forecasts of low-teens growth. Reported operating profit and reported EPS are still going to be negatively impacted by 700 bps in FX translation.

Kimberly-Clark CEO Mike Hsu commented, “We have made strong progress while navigating dynamic consumer and retail environments. We have a strong foundation that we can leverage to accelerate investments across the enterprise. Our focus is to deliver high-quality consumer solutions at every price point, increase our operational scale, and enhance our long-term potential. We're excited about our opportunities to capitalize on our momentum to deliver our enduring goal of enhancing value for all our stakeholders."

Kimberly-Clark analyst ratings and price targets are at MarketBeat. There are 15 analyst ratings on KMB stock, comprised of six Buys, seven Holds, and two Sells, with a 2.72% upside to the consensus price target of $145.67.

Rare signal predicts 50% market drop - before election

The market is near all-time highs, we're told that unemployment is low, AI's a gift to humanity, and the FED will cut rates any day now.

But there's one indicator that's flashing a BIG warning sign to investors.

Leading Gold Stock Shines With Q2 2024 Earnings Release

Leading gold mining company Barrick Gold Co. (NYSE: GOLD) stock is trading down 1.66% despite gold prices rising 15.4% year-to-date (YTD). While it's easy to assume gold mining stocks should move in lockstep with gold prices, that's not usually the case. While it's true that higher gold prices would result in higher revenues for gold miners since they would be collecting more for their gold, there are other factors like operational efficiency, interest rates, hedging, and diversification that can dampen the impact of rising gold prices. However, Barrick Gold is widely considered to be a best-of-breed as one of the world’s largest gold producers.

Barrick Gold operates in the basic materials sector, competing with other miners, including Newmont Co. (NYSE: NEM), Kinross Gold Co. (NYSE: KGC), and Rio Tinto Group (NYSE: RIO).

Barrick Gold Mines More than Just Gold

While Barrick Gold is known as a gold miner and producer, it also mines and sells other materials, including silver and copper. The company has ownership stakes in gold mines in Canada, Argentina, the Dominican Republic, Mali, Tanzania, the Ivory Coast, the Democratic Republic of Congo, and the United States. Barrick Gold operates 13 gold mines and three copper mines with projects throughout 18 countries, including copper mine interests in Saudi Arabia, Zambia, and Chile. The company expects to increase gold production by 40% as it grows from 5 million gold equivalent ounces (GEOs) to 7 million by 2030.

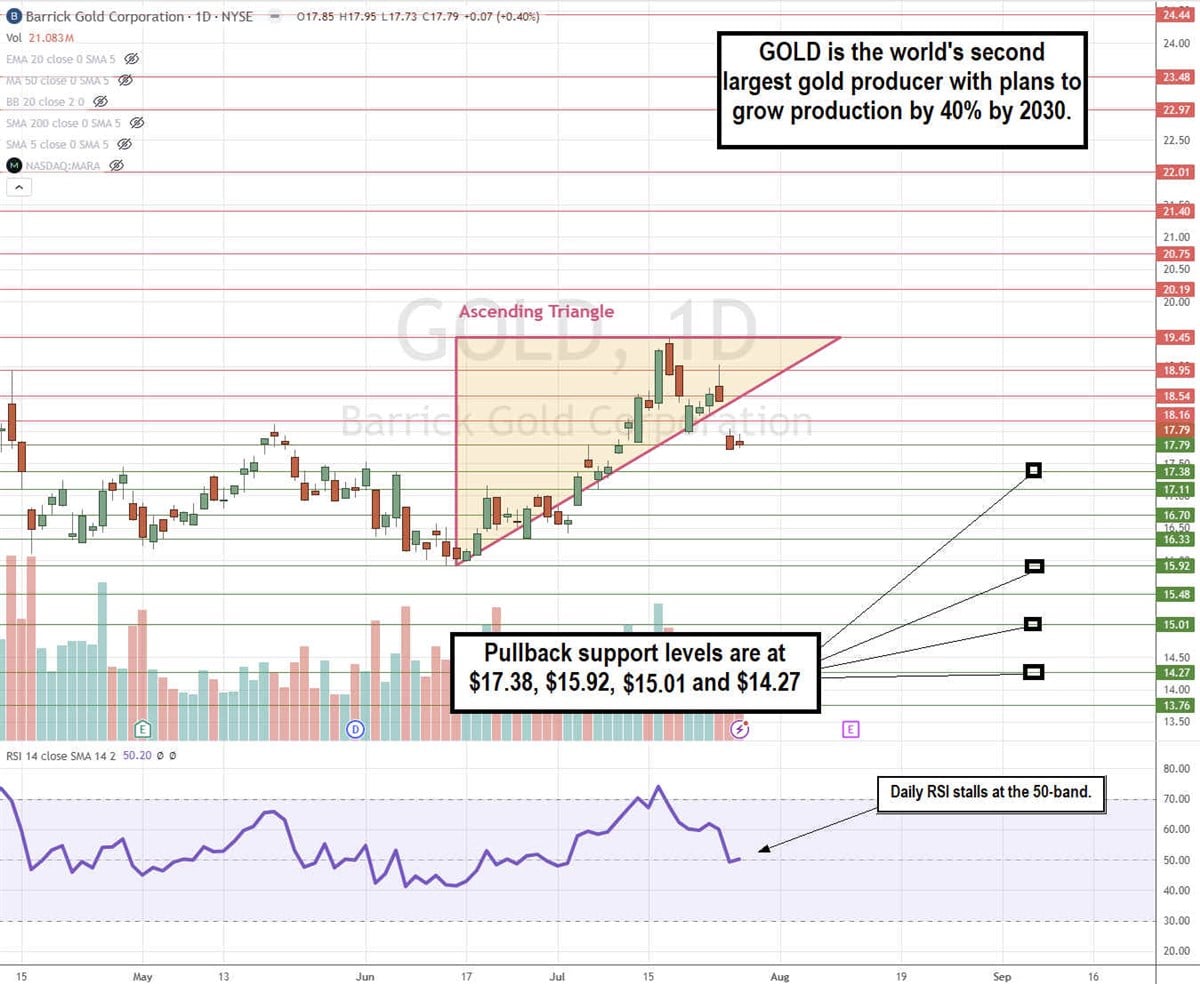

GOLD May Be Breaking Down From an Ascending Triangle Pattern

The daily candlestick chart for GOLD illustrates an ascending triangle breakdown pattern. The pattern was formed by the flat-top upper trendline resistance at $19.45, converging with the rising lower trendline off the $15.92 low. The breakdown is forming under the lower trendline at $18.54. The daily relative strength index (RSI) has fallen to the 50-band. Pullback support levels are at $17.38, $15.92, $15.01, and $14.27.

Solid First-Quarter Results Bodes Well for 2024

Barrick Gold reported Q1 2024 EPS of 19 cents, beating the consensus estimates by 4 cents. Revenues grew 3.9% YoY to $2.75 billion, beating $2.74 billion consensus estimates. Net earnings were $295 million. Barrick sold gold for an average realized price of $2,075 per ounce in the quarter, which was up from $1,902 per ounce in the year-ago period. Gold prices have steadily risen since then.

Gold Production Fell YoY Due to Maintenance Delays

Barrick produced 940,000 ounces of gold in Q2, which was less than the 952,000 ounces produced in the year-ago period. Higher costs and lower production levels reflected the delayed ramp-up at Pueblo Viejo, where the reconstruction of the conveyor was completed. Planned maintenance in the Nevada gold mines and mine sequencing at other sites contributed to the lower production. However, the company expects costs to come in lower while production ramps back up for the rest of 2024.

Kibali Gold Mine Update

On July 2, 2024, Barrick Gold confirmed that Kibali continues to be Africa's largest and most automated gold mine due to its three hydropower stations. Its backup solar power plant and battery storage system are expected to go online in 2025, taking the renewable component of its energy mix up to 85%. Kibali continues to deliver growth, and further investment in technology and capacity positions it to sustain its 750,000-ounce annual production schedule beyond its current 10-year horizon to 15 years and beyond.

Barrick Gold Continues to Invest in Mali

On July 9, 2024, Barrick stated that the long-term viability of the Loulo-Gounkoto gold mining complex was a top priority to ensure the Malian mining industry’s sustainability. Barrick has been a substantial contributor to the country’s economy. Barrick has invested over $10 billion in the past 29 years and over $1 billion in the past year alone.

Barrick Provides Q2 Gold and Copper Production Update

On July 16, 2024, Barrick Gold reported preliminary Q2 production results. Barrick produced 948,000 ounces of gold and 43,000 metric tons of copper. This improved over Q1 2024’s production of 940,000 ounces of gold and 40,000 metric tons of copper.

The company stated that it remains on track to achieve its full-year 2024 guidance for gold and copper output of 3.9 million to 4.3 million ounces of gold and 180,000 to 210,000 metric tons of copper. Production will progressively increase per quarter with a higher weight in the second half of the year. Barrick forecasted Q2 sustaining costs of gold would rise 1% to 3% from $1,474 per ounce in the previous quarter, but that will drop in the second half as production increases.

Barrick Gold analyst ratings and price targets are at MarketBeat. There are 14 Wall Street analyst ratings on GOLD stock, comprised of 10 Buys, three Holds, and one Sell, with a 24.7% upside to the consensus average price target of $22.20.

BITCOIN

Did you miss out on the 1000%+ gains of Bitcoin over the past 5 years?

If so, you don't want to miss this...

Pharma Giant's Shares Up After Impressive Q2 Earnings Release

Bristol-Myers Squibb (NYSE: BMY) is in the healthcare sector and is the 10th largest pharmaceutical firm in the world by market capitalization. The company released Q2 2024 financial results on July 26, 2024. Let's begin by reviewing the firm's annual filing to understand its operations. Then, we'll review the quarterly financial results. To wrap up, we'll explore the stock's outlook and discuss Wall Street's price targets.

Bristol-Myers Squibb: Biopharmaceuticals Leader

The company operates as one reportable segment, engaged in the entire value chain of biopharmaceutical products from discovery and research to global distribution. Living organisms produce biopharmaceuticals, whereas traditional drugs are synthesized from chemical compounds. Examples are monoclonal antibodies, vaccines, insulin, gene therapies, and stem cells.

The company received 70% of its revenue from the United States and 28% internationally.

The company’s highest revenue-producing drugs in 2023 were Eliquis and Opdivo. Eliquis is a blood thinner used to prevent clotting and strokes in people with atrial fibrillation (AFib), and Opdivo treats various types of cancer. They accounted for 27% and 20% of total revenue, respectively.

The company also received 14% of its revenue from Revlimid. However, its sales fell 39% from 2022 because the drug lost its patent protection, and generics entered the market.

BMY Shares Up Big After Earnings

Bristol-Myers Squibb impressed markets with its earnings release; shares were up by 11.5% on the day of the release. Adjusted earnings-per-share (EPS) came in at $2.07, resulting in a 27% earnings surprise. The company beat revenue estimates by $680 million, reaching $12.20 billion.

Adjusted EPS is up 18%, and revenue is up 9% from a year ago. The company also increased gross margin by 60 basis points. Furthermore, it massively increased its full-year adjusted EPS guidance. The guidance midpoint now sits at $0.75 per share, up from $0.55 per share in April.

Significant pressure is on Bristol-Myers' new drugs to perform well, and its biggest money-making drugs will lose their patent protection over the coming years. This will cause large revenue declines for the drugs as generics become available.

This will occur in 2026 for Eliquis and in 2028 for Opdivo. Eliquis’s revenue drop might be particularly fast as Medicare is negotiating a lower price through the Inflation Reduction Act, which will go into effect in 2026.

The financial results show that the new drugs are holding up their end of the bargain right now. Opdualag, Camzyos, and Sotyktu are three drugs that could grow their revenues up to $4 billion a year by 2030. Opdualag increased revenues by 53%, and Camzyos posted sales of $139 million. Sotyktu grew revenue in the United States by 71%. Additionally, Reblozyl increased revenue by 82%, Breyanzi by 55%, and Zeposia by 53%.

Keep an Eye on KarXT, a Potential Blockbuster

Investors should watch for developments around KarXT, the company’s schizophrenia medication. Analysts project the size of the schizophrenia market could reach over $7 billion by 2028. Bristol-Myers needs the drug to pay off, as it acquired the firm Karuna at the end of last year for $14 billion to add the drug to its portfolio.

The drug is currently undergoing Phase 3 FDA trials, and a decision on its approval is expected in late September. Results have shown that KarXT effectively improves schizophrenia symptoms and is not associated with any serious side effects. If approved, the drug would be “the first truly new treatment for schizophrenia in decades." This would provide Bristol-Myers with a large market on which to capitalize.

Investors should also watch sales of AbbVie’s drug VRAYLAR, an already-approved schizophrenia treatment. Its revenue grew at a compound annual rate of 70% in 2022 and 2023. However, KarXT does not have many of the negative side effects, including movement disorders and weight gain, associated with VRAYLAR.

If VRAYLAR can grow this quickly, there’s no telling how fast KarXT, a seemingly superior medication, could grow. Researchers are also testing KarXT for potential use in Alzheimer's disease patients, a market that could exceed $13 billion by 2030.

The average Wall Street analyst price target sees the stock as fairly valued right now. Yet, Bristol-Myers Squibb has a bottom-barrel forward price-to-earnings ratio of 7.1. This, combined with its fast-growing drugs and a potential blockbuster in KarXT, gives credence to the argument that the shares have a significant upside.

0 Response to "🌟 Kimberly-Clark Stock Dips and a Buying Opportunity Emerges"

Post a Comment