The Best Time to Buy Tesla – or any Other Stock

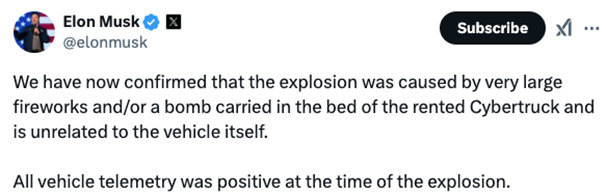

Dear Reader, Imagine for a minute being Elon Musk, the CEO of Tesla. I don’t mean imagine yourself as the richest person in the world with the ear of President-elect Trump. I mean imagine yourself as the CEO of Tesla when headlines everywhere were talking about your signature product exploding and burning outside the Trump International Hotel in Las Vegas. You’re dealing with headline after headline like this one from Reuters.  For an electric vehicle maker, few things are as damaging to your reputation as stories about your product catching fire. Elon Musk was out in front as usual on his social media platform, X. He was broadcasting facts about the explosion often revealing information even before law enforcement authorities had come to any other conclusions.  As you might imagine, any CEO in this scenario would be very concerned about the stock price. Tesla had seen a massive surge in its stock price since the election of Donald Trump and in the wake of Musk's close ties with the president-elect.  Regardless of what you think of Tesla or Musk, you should know that this is not the time to buy Tesla stock. That assessment doesn’t have anything to do with the recent explosion, or any headlines featuring Elon Musk. It also has nothing to do with Tesla missing annual delivery goals. A deep dive into the history of Tesla stock shows there are far better times to invest your money in Tesla stock. We know because we have the data to prove it. TradeSmith has run the numbers… and can tell you the exact dates over the last 15 years when Tesla enters a period of stock market bullishness, and when it exits that period as well. And we’re now making that data available to all our Trade Cycles subscribers. | Recommended Link | | | | It could double your portfolio by foreseeing the biggest stock jumps on 5,000 different stocks – to the DAY – with 83% backtested accuracy. Already, it would’ve pointed to 15 stocks that could’ve doubled your money in under 50 days in our study. Click here to learn more. |  | | Introducing Investing with Seasonality Regular readers have now heard about the revolutionary new system developed by TradeSmith that tracks the seasonality of stocks. This breakthrough technology identifies "green days" – the days when stocks enter a bullish period – for 5,000 different stocks. In a special event held Jan. 8, TradeSmith CEO Keith Kaplan explained why this system could redefine the way you handle your investments in 2025 and beyond. If you don’t know Keith, he leads a TradeSmith team that has empowered over 72,000 people across 86 countries to manage $30 billion in personal assets. TradeSmith algorithms are designed to optimize buy-and-sell decisions, delivering results that outpace even Wall Street’s top managers in backtests. Keith’s latest creation takes these principles of algorithmic investing to new heights. He believes this new tool could be the most significant money-making opportunity in the company's 20-year history. During this special event, Keith provided all the details about this system that boasts an 83% back tested accuracy rate and pinpoints the exact days when certain stocks are primed for explosive growth. At the heart of this breakthrough for TradeSmith subscribers is a simple online calendar that identifies the precise dates stocks are likely to experience their largest gains. It’s a culmination of decades of research, 50,000 tests a day across 33 years of market data, and insights gleaned from some of the most successful hedge fund strategies. The Power of "Green Days" Earlier, I asked you to imagine being Elon Musk, but here is something easier to imagine. Imagine you know, with near certainty, that Tesla stock will rise significantly if you buy it on May 19. Why May 19? Well, for the past 14 years, Tesla’s stock has surged an average of 24% over the subsequent 55 days starting on May 19.  That’s equivalent to a 161% annualized return—simply by targeting one specific day each year. It isn’t just Tesla, or mega-cap stocks either. TradeSmith’s system identifies thousands of such opportunities. Consider these: Advanced Micro Devices (AMD): November 16 marks its green zone, with an 86% success rate over 15 years. Lululemon (LULU): March 14 has seen an 87% success rate for over a decade. Broadcom (AVGO): May 23 boasts a flawless 100% historical success rate. Lithia Motors (LAD): June 19 consistently delivers gains with a 93% success rate. Using this strategy, investors can focus on a few high-probability trades. And when you can stack wins on a consistent basis, the results can crush the market’s average annual gains. | Recommended Link | | | | A new way to potentially double your portfolio in 2025 by predicting the biggest jumps on 5,000 stocks, BEFORE they occur. And how a “disconnect” in today’s market has opened the best opportunity in 20 years to apply this breakthrough new strategy today. Including 2 free recommendations in a historic event backed by 3 Wall Street legends. Watch now, before it goes offline. |  | | A Model Portfolio Designed to Dominate TradeSmith’s back tests show that a $10,000 investment in this new model portfolio – one built solely using the seasonality tool – could have grown into $85,700! That result would outperform the S&P 500 by 99% on average. On Jan. 8, Keith Kaplan shared a bold prediction about the market’s future and demonstrated why the “green day” strategy is perfectly suited for the current environment. You can still access the presentation for a limited time when Keith discussed: - Why traditional buy-and-hold investing could hurt your returns in 2025. - How to double your portfolio using this breakthrough strategy. - A free stock recommendation, complete with insights to supercharge your gains. TradeSmith’s new seasonality tool is your chance to embrace a revolutionary strategy that could redefine your financial future. Don’t miss out—you can still view a replay of the Jan. 8 event and take the first step toward doubling your portfolio in 2025. Regards, |

0 Response to "Must Read: The Best Time to Buy Tesla – or any Other Stock"

Post a Comment