Trump's treachery (From Porter & Company)

3 Tightly-Held Growth Stocks Set Up for Short Squeezes

Suppose you are looking for growth stocks with insiders buying, good luck. While it is not impossible to find such stocks, growth companies tend to utilize share-based compensation, and that means insiders are more likely to sell than buy. The critical detail is how much skin insiders have in the game and whether other sell-side factors, including the institutions, analysts, and short-sellers, are involved. If insider ownership is high, institutional support is robust, analysts are bullish, and short-selling data is favorable, the share price of the underlying stock will likely move higher. If not sooner, then later, it’s only a matter of time. This is a brief overview of three growth stocks that meet the specified criteria. The End of Elon Musk? Don't make him laugh.

Jeff Brown has been hearing this same tired story for years, and he's been proven right time and time again.

And now, while the media focuses on Tesla's "demise," he's uncovered an AI breakthrough that's about to make Elon's doubters eat their words yet again.

According to his research, if you listen to the media and miss out on Elon's newest breakthrough, it's going to cost you the fortune of a lifetime. Click here to see why the "End of Elon" crowd is about to be wrong again. RH, The Stock Formerly Known as Restoration Hardware, Is Tightly Held RH (NYSE: RH), formerly Restoration Hardware, has had its share of hurdles and headwinds. However, the company remains on track to achieve double-digit growth in 2025, albeit slightly below analysts' expectations. Insiders have been selling in 2025, but no red flags have been raised. Insider ownership remains high at 28%, with executives and individuals holding approximately half of the total. Institutional ownership, including major shareholders such as FMR LLC, accounts for approximately 90% of the stock and has been net positive so far this year. Analysts’ price target reductions assisted the stock price collapse in 2025, but the group is otherwise in favor of this name. They rate it as a consensus Hold with a price target roughly 50% above the early June price points. Short interest is also a factor in this stock's price decline, rising to a two-month high in May, above 20%, sufficient to keep the market under pressure until the dynamic changes. That could occur later in the year or with tariff relief and include a short squeeze or short-covering rally.

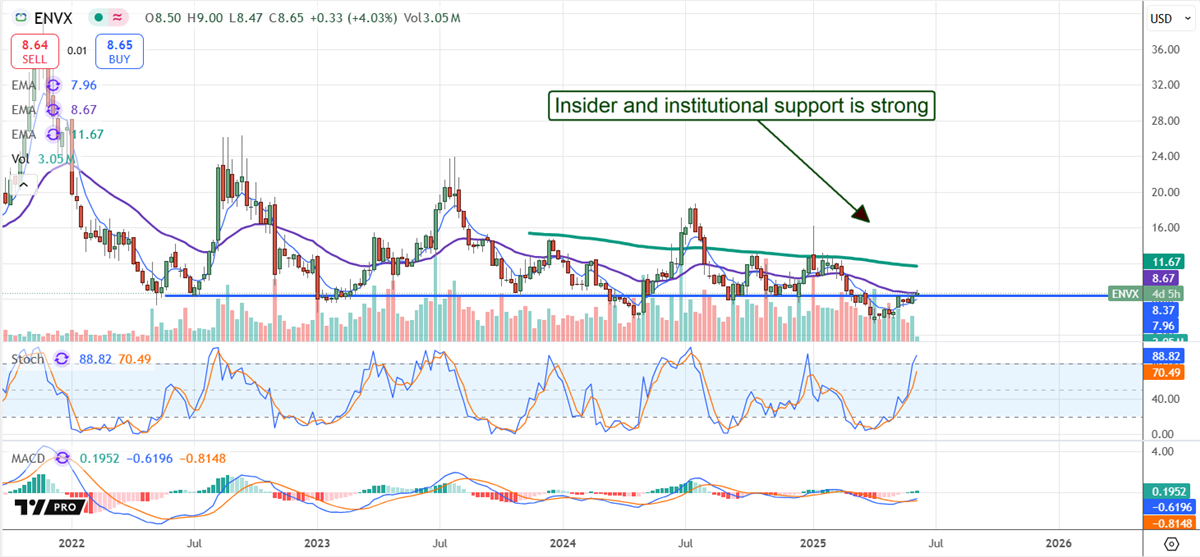

Enovix, Next-Gen Battery Maker on Verge of Hyper Growth Enovix (NASDAQ: ENVX) researches, designs, and develops advanced lithium-ion batteries with a focus on silicon anode architecture. The batteries provide higher discharge, faster charging, and greater energy density than traditional designs and are gaining traction this year. The company’s manufacturing capacity is expanding, along with orders, leading analysts to forecast a surge in revenue that will reach the high triple digits over the next two to three years. Its insiders are selling in 2025, but again, no red flags are raised, and their holdings remain robust at roughly 15%. Institutional ownership is currently at only 50%, but the group is buying in 2025, and analysts are bullish. The 11 tracked by InsiderTrades rate the stock as a Moderate Buy with a bullish bias and expect it to advance 100% at the consensus. Recent revisions have placed this stock in the low end of the range, but the trends still forecast a solid double-digit upside. Again, short-sellers are in the mix and pressuring the stock in 2025. The short interest remains high at 27% of the float, but is trending lower with catalysts on the horizon. Revenue is expected to begin surging by the end of the year and will likely result in a short-covering rally or squeeze.

The robotics revolution is here.

And it's set to impact everything from how we manufacture goods to how we drive, deliver packages, and even perform surgeries.

According to Forbes, this could unlock a massive $24 trillion opportunity for investors.

And I've zeroed in on 6 robotics stocks at the center of it all. Here's how to get access to all 4 reports now Super Micro Computer Set Up for Super Mega Rally Super Micro Computer (NASDAQ: SMCI) emerged from its year of turmoil in solid shape with a new auditor, finalized reports, and robust business tied to NVIDIA and the rise of AI. The critical details are that this profitable company is outperforming estimates and is expected to sustain a strong double-digit growth pace for the foreseeable future. Insiders are selling the stock, as expected, but they own approximately 17%, including a 10% stake held by Vanguard, while the institutional group is buying. They own more than 85% of the stock and provide a solid support base, as is evident in the charts. Analysts are bullish on this stock. Although the consensus is a Hold and the price target forecasts a mere 7% upside in early June, the coverage is rising, sentiment is firming, and the high-end range of targets puts this market at a one-year high. The catalyst to continue analyst trends and drive short-sellers out of the market will be an upcoming earnings report, possibly the FQ4 report and guidance for F2026. It will likely be robust due to the persistent strength shown by NVIDIA and spending trends among hyperscalers and AI infrastructure operators.

Written by Thomas Hughes Read this article online › Read More: Did you like this article?

|

0 Response to "Insider-Owned Stocks Ready to Surge"

Post a Comment