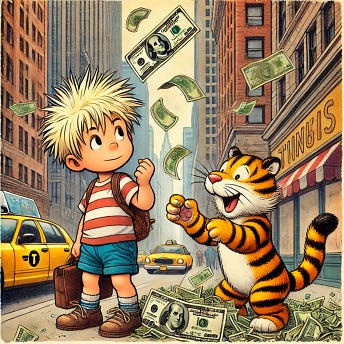

The Greatest (and Dirtiest) Lie in PoliticsWhen it comes to the money printer, the biggest lie isn't about interest rates... it's about who's really getting subsidized.Dear Fellow Traveler: You've heard this argument a thousand times. It’s commonly shouted across Thanksgiving dinner tables… Wealthy “blue states” carry the dead weight of lazy red states, sending their tax dollars to subsidize pickup trucks and sweet tea. It's a neat little narrative. It's also complete nonsense. Well, not complete nonsense. More like 73% nonsense with a dash of truth that's been marinated in partisan BS until it's unrecognizable. I’m calling this one down the middle because the whole thing is a distraction. The real concept isn't about red states mooching off blue states. It's about the wealthiest social class mooching off everyone else. One of the biggest secrets to getting and staying rich is to live where the money gets printed first. Location, Location, Monetary LocationIn finance, geography is destiny. New York City, San Francisco, Boston, Chicago… these aren't just blue cities. They're the beating heart of America's financial circulatory system. Wall Street isn't in Topeka, Kansas. Goldman Sachs didn't set up shop in Mobile, Alabama. When Jerome Powell fires up the money printer, new digital cash doesn’t appear in every American’s checking account. New capital flows through the Federal Reserve's primary dealers. Those are the big banks, hedge funds, and private equity firms. They’re all conveniently located in those blue financial hubs. It's like being first in line at a Black Friday sale, except the sale never ends, and the merchandise is free money. This isn't partisan policy. This is just monetary physics. Money flows where money lives. And money lives in Manhattan penthouses, not Mississippi trailer parks. The Cantillon Effect Wears a Blue TieRichard Cantillon figured this out back in the 1700s… The economist realized that whoever gets the new money first wins. The further you are from the money spigot, the more you get screwed by the inflation that follows. Every quantitative easing (QE) program, every "emergency" liquidity injection, every time the Fed cuts rates to "stimulate the economy"… That money hits asset prices before it hits grocery prices. Stocks go up. Real estate goes up. Art, wine collections, and vintage baseball cards tick up in value. Know what doesn't go up? Your salary. The people who own those assets, which have been artificially inflated by monetary policy, largely reside in blue cities. (Yes, a lot of wealthy people are moving to Florida, but notice that the financial hub is the very blue Miami.) Not because they're Democrats, but because that's where the money lives. Meanwhile, the poor bastards living paycheck to paycheck in red states AND blue states watch their rent climb. They see their groceries cost more. And somehow, they get blamed for not "participating in the recovery." It's like blaming someone for not enjoying a party they weren't invited to. The Middle Class Gets the Bill, Not the BenefitWhile Wall Street was celebrating the "wealth effect" of Fed policy, regular Americans received that wealth effect right in the face. Your 401(k) might have gone up (if you're lucky enough to have one), but so did the cost of literally everything else. Housing, healthcare, education… the things that matter… But hey, at least some hedge fund manager in Connecticut can afford a third house in the Hamptons, right? And since Connecticut is a blue state (and that’s the tax side), we can pretend this is somehow a victory for progressive values. The Fed created what we call "monetary socialism for the rich." We have privatized gains, socialized costs. Asset owners benefit from artificially inflated prices. Everyone else gets to pay for it through higher living costs. It's the most regressive tax system ever devised, and it doesn't appear on any ballot. Stop Playing the Red Team/Blue Team GamePoliticians and television hosts love that red state/blue state narrative because it keeps us fighting each other instead of looking up at where the real money is going. "Those welfare recipients in Mississippi are stealing from hardworking Californians!" Meanwhile, BlackRock just bought another 10,000 houses with freshly printed Fed dollars, driving up housing costs for everyone from Bakersfield to Birmingham. The real divide isn't geographical. It's vertical. The "up" people, those close to the money printer, get asset appreciation, capital gains, and early access to cheap credit. The "down" people, everyone else, get wage stagnation, inflation, and the privilege of watching their purchasing power evaporate in real time. What’s interesting is that there are plenty of "down" people in blue cities, too. Urban renters in blue states are being crushed. Which is why people are trying to make sense of how a socialist just won the Democratic primary in New York City. Ask any teacher, firefighter, or barista in San Francisco if they feel subsidized. They're too busy figuring out how to afford rent on their own on a five-figure salary. In New York, they’re blaming capitalism, citing inequality, and not realizing who is causing their outrage and economic disadvantages… It’s not the capitalist who owns a small business. It’s the monetary feudalists and the Federal Reserve. The Real Subsidy ProgramWant to know what an actual subsidy looks like? It's not food stamps or Medicaid. It's zero percent interest rates for banks, while your credit card charges 24%. It's bailouts for "too big to fail" institutions while small businesses go under. It's quantitative easing that inflates asset bubbles while calling it "economic stimulus." It's a system where money flows upward through monetary policy and downward through fiscal policy. So, the next time someone tries to sell you the story about blue states subsidizing red states, ask them this… Which states have the Federal Reserve banks? Which cities house the primary dealers? Where do the people who benefit most from monetary policy actually live? The answer isn't partisan. It's about proximity to wealth and power. The money printer doesn't discriminate based on voter registration. It discriminates based on net worth and zip code. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "The Greatest (and Dirtiest) Lie in Politics"

Post a Comment