You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: The market is now back within reach of all-time highs… Not because companies are making more money or the economy is booming. It’s all about the Money Printer… The U.S. government owes a metric ton of money and needs to refinance it at higher rates (think: refinancing your mortgage when rates just doubled). Treasury Secretary Scott Bessent saw this coming months ago. His solution? Do what his predecessor, Janet Yellen, did… Flood the market with short-term IOUs instead of long-term ones. Instead of taking out a 30-year mortgage, the government uses its credit card. Over and over. Why? These short-term Treasury bills (T-bills) are like rocket fuel for the financial system. Hedge funds gobble them up, not just for the interest, but to use as collateral… It's like using your house to get a loan, except they’re using government IOUs to borrow even more money and buy more stocks. Rinse. Repeat. Lever up. That’s where we’re heading… The Fed Is Playing Games With Your MoneyThe Federal Reserve is supposed to be "tightening" in this environment. That would make the credit in the system leaner. It would make it harder to borrow. The Fed says it’s reducing its balance sheet through QT (quantitative tightening). Sounds serious, right? Well, it turns out they’re secretly pumping money back in through the back door. Smart guys like Joseph Wang (ex-Fed trader who knows where the bodies are buried), Michael Howell, and Andreas Steno Larsen have caught them red-handed:

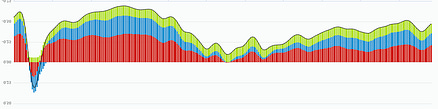

The Fed is tightening with one hand, but expanding on the other side… It's like your spouse saying they’re on a diet… while secretly hitting the Taco Bell drive-thru at midnight. Look at the ChartsBelow is the S&P 500 (aka "the market") since January 2020: Now here’s what the real economy’s been doing — measured by the Chicago Fed National Activity Index (CFNAI). It tracks things like jobs, production, and spending. Now flip the economic chart upside down… See something strange? It starts looking a lot like the stock market. The market is supposed to predict growth over the next six to 12 months. But it doesn’t seem to be predicting the economy anymore. It’s reacting to liquidity flows in real time. Since 2020, stock prices have stopped caring about silly things like "profits" or "growth." Here’s what moves markets now:

I spent years reading CFA books, studying Greek-letter models, and chasing “fundamentals.” But I’m sensing that markets don’t trade on fundamentals anymore. They trade on liquidity flows. Since the Fed started printing like a drunk sailor in 2010, stocks have become a gauge of how much cash is sloshing around the system. Not earnings. Not GDP. Not “fundamentals.” Markets used to predict where the economy was heading. Now? They follow the money… wherever it flows, whenever it flows. And guess what’s coming next? The Treasury will continue to issue lots of short-term debt to keep the music playing... This isn’t technically called “money printing.” It’s just debt management. But functionally, it’s collateral creation, which becomes leverage and risk asset fuel. This rebound rally isn’t happening because American companies suddenly got smarter, leaner, or more productive. It’s happening because Washington found a way to juice the system and turn on that money printer without calling it QE. Stay positive, Garrett Baldwin The Receipts (Sources)

About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "The Rally Is Real — But... What's Behind It?"

Post a Comment