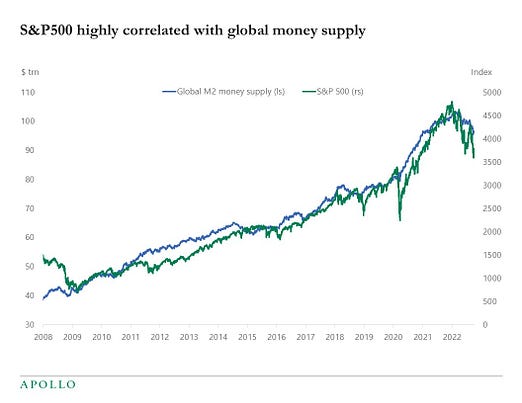

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Things I Think... I ThinkBig gains... big losers... and one of the top strategies of 2025 and beyond.Good morning, Have a look at this chart… Would you describe this as a Bull Market? How could you not? I mean… LOOK AT THAT RALLY… It’s at an over 817% return in just two years. What crypto is this? What technology stock haven’t you heard of… It’s neither… Let me show you… It’s the Venezuelan stock market. (Home of 337% inflation in 2023) It turns out that printing money and creating massive amounts of debasement and inflation can make anyone “Rich” in terms of how much money they have. Turn on that money printer, baby. Then everyone can be a millionaire. Are you getting it yet? Are you seeing it? The average American doesn’t see themselves as the frog in the pot yet. Nonstop money printing and the ever-increasing easing and liquidity drive stocks higher. Stop pretending otherwise… No. 2: This is Why Active Managers FailIn the last decade, 80% to 90% of “Active Managers” underperformed the S&P 500. That means everyone would have been better off just buying the S&P 500 SPDR ETF (SPY), which tracks the index's performance. I can answer why this has happened... They don’t understand how liquidity works. They don’t understand that the Money Printer “outperforms” them. Apollo Academy offers this chart of the S&P 500 against the Global Money Supply. Are we getting it yet? When you look at everything beyond the M2, as defined by Cross Border Capital, and assess it against the MSCI Global Index, things make sense… These markets are an illusion. Print money… and risk assets go higher. It wasn’t hard to beat the SPY if you knew where to look. What could they have done to outperform the S&P 500 during that period? Bought the S&P 500 SPDR ETF (SPY) when it was above its 20-day EMA, hedged or moved to cash when it was below its 20-day EMA. Then, they could have loaded BACK up when there was a policy shift and a big uptick in insider buying. The best way to do things is usually the simplest. No. 3: Banks and Baseball MatterSpeaking of strategies that can beat the market… My father-in-law, Tim Melvin, is visiting us in Baltimore. We’re going to the Orioles game today so that my daughter can run the bases afterward. Last night, we talked about the markets a little bit. I remind you that Tim’s an expert on community banks, value investing, and alternatives like closed-end funds (CEFs) and special situations. Later today, I’ll send another email about one of the top trends of 2025 and 2026… Banking M&A. Mergers… Acquisitions… where the banks he recommends could be bought for much more money than their stock price suggests they’re worth today. The smaller American banks have been under pressure. Regulations, the cost of technology, challenges at the board level, and more. But Treasury Secretary Scott Bessent wants to lighten the rules, fueling a surge in pent-up demand for banking mergers. With Tim’s huge list of banks trading under their tangible book value (the sum of their parts), this could be one of the best asset classes to own in a sea of uncertainty. Tim’s community bank strategy has beaten the S&P 500 by 2,325% over the past 22 years. So, if you had invested $25,000 following this approach, you could be sitting on more than $4 million today. The future will hold similar returns given the need for these banks and the ongoing destiny of deals in the future. Look out for an email from me later today. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Things I Think... I Think"

Post a Comment