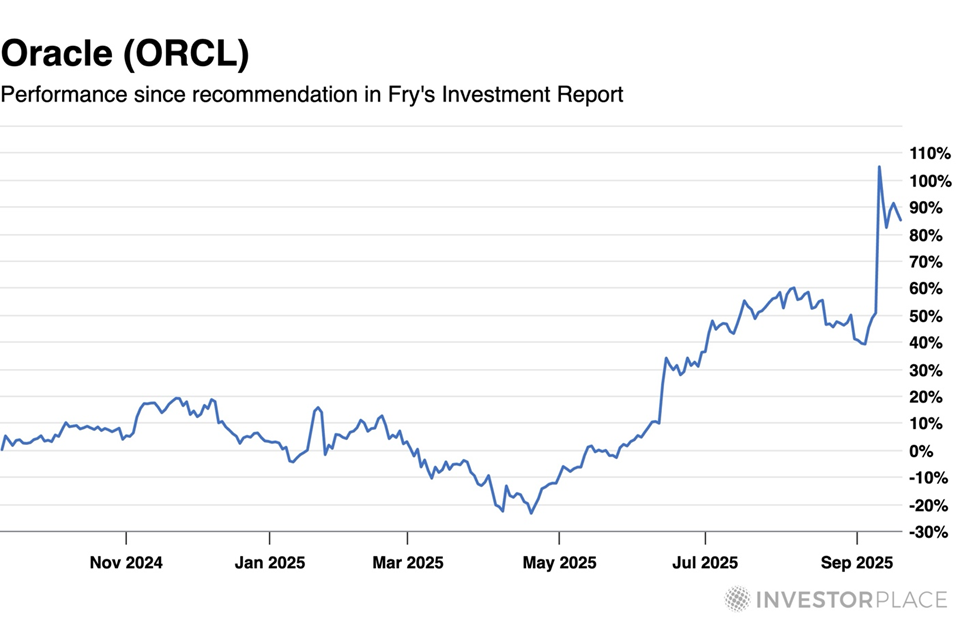

The next trillion-dollar company … autonomous vehicles are not on auto-pilot … quantum computing’s momentum VIEW IN BROWSER In 2004, a massive earthquake created a tsunami that roared across the Indian ocean, eventually hitting Thailand. Ten-year-old Tilly Smith was vacationing with her family on Mai Khao Beach when she noticed signs of the coming wave. Just two weeks earlier, Smith had studied tsunamis in school and recognized the warnings: a rapidly receding sea and frothy water. While others stared at the ocean, unsure what was happening, Smith alerted her family, and they helped evacuate the beach before the wall of water hit. She and her family were credited with saving at least 100 lives. Sometimes all it takes is seeing the signs. On September 13, 2024, just a little over a year ago, macro investing Expert Eric Fry saw the signs and recommended his readers take a position in Oracle (ORCL). Here is what he wrote in Fry’s Investment Report: This month’s recommendation is not a “hidden gem.” It is not an overlooked “turnaround play.” It is not an up-and-coming tech newbie. It is one of the bluest of blue-chip stocks in the technology sector. Its name is Oracle Corp. (ORCL). Typically, I do not recommend high-profile stocks like Oracle in this investment letter. But I am making an exception because I believe this company’s story, and its growth potential, is “Nvidia-like.” Given Nvidia’s growth since the beginning of the AI megatrend (+1,300% in the last five years), calling the potential gains “Nvidia-like” was a bold call. The stock had been grinding higher this year until 10 days ago, when the company announced four multi-billion-dollar contracts with companies such as OpenAI to obtain the massive computing capacity the AI megatrend requires. The stock immediately shot higher.

The capacity to deliver on much-needed computing power was part of the reason Eric recommended Oracle. From that same issue last year: Oracle provides industry-leading cloud infrastructure solutions. Additionally, Oracle’s small but fast-growing healthcare solutions business could deliver surprisingly strong long-term growth. Lastly, the company’s near-monopolistic data-base solutions can grow as rapidly as the cloud itself. Even Oracle’s direct competitors in the data center industry are integrating the company’s database solutions into their cloud offerings. Eric has specifically recommended selling Nvidia and other big names in Fry’s Investment Report and buying some of the key companies – trading at more reasonable valuations – that will power the next phase of the AI megatrend. You can find Eric’s presentation, “Sell This, Buy That” by clicking here. | Recommended Link | | | | Nvidia gave investors a chance to make more than 150 times their money with its AI chips known as graphic processing units. Legendary investor Louis Navellier believes this new invention could be even more revolutionary and mint a new wave of millionaires. Click here to get the details. |  | | Autonomous Vehicles Are Still Driving Higher Elon Musk made headlines recently when he bought $1 billion of Tesla (TSLA) stock, but is that because he still believes in the car company? Tesla (TSLA) made a name for itself as a maker of electric vehicles and has been working on rolling out autonomous robotaxis. But its focus seems to be elsewhere. Vehicle sales have slipped significantly. Sales dropped 13% in the first quarter compared to a year ago. And Musk seems more interested in Optimus, Tesla’s humanoid-robotics effort. Earlier this month, Musk posted on X that “~80% of Tesla’s value will be Optimus.” Last year, Musk predicted that Optimus robots would someday turn Tesla into a $25 trillion company. The eccentric billionaire makes headlines with everything he does, but if you think he and TSLA are the AV story, you’re missing out. Other AV companies, and their suppliers are having a big moment. One look at the Global X Autonomous and Electric Vehicle ETF (DRIV) (blue) shows it’s easily outpacing the S&P (green) this year.

Suppliers to AV makers have had even better years. At the beginning of 2025, tech investing expert Luke Lango flagged several leading AV stocks for his Innovation Investor subscribers, writing “the age of autonomous vehicles has arrived.” Here is what he told his Innovation Investor subscribers in February: We earnestly believe that 2025 could very well be the year that the self-driving car went mainstream. Of course, the arrival of the Age of Autonomous Vehicles also means the arrival of huge opportunities in AV stocks. The global transportation services market is estimated at over $7 trillion, and autonomous vehicles will turn that entire industry on its head, meaning it could impact how more than $7 trillion flows through the global economy. Luke highlighted the following as the possible big winners for AV plays, and you can see they’re outpacing the S&P (up 13% year to date as I write). - Broadcom (AVGO): +49% YTD

- Taiwan Semiconductor (TSM) +33% YTD

- Uber (UBER): +56% YTD

- Baidu: +59% YTD

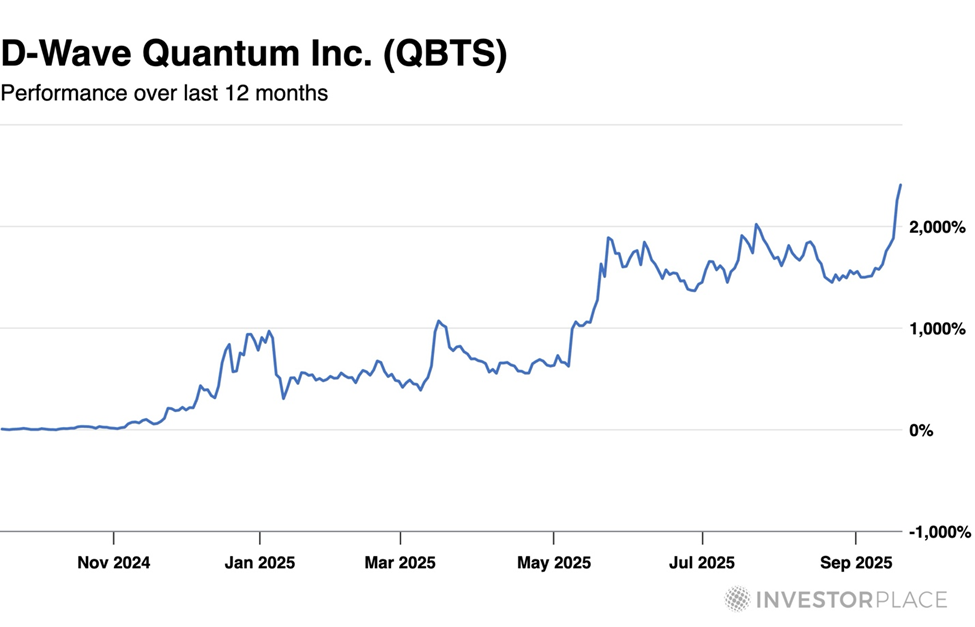

Luke nailed that call, but he also knows that Elon still has a part to play in developing the future. He has several recommendations associated with Musk’s Optimus project that could see the next big set of gains. Luke summarized the trend recently. Humanoid robots could eliminate labor costs across warehouses, restaurants, logistics, elder care, and domestic services. Just as the assembly line redefined work, AI robots could upend entire job sectors – and create new winners in the process. Morgan Stanley projects that the adoption of humanoid robots will accelerate throughout the 2030s and could surpass $5 trillion in market value by 2050. You can learn about the future of Optimus, “physical AI,” and the stocks to benefit in Luke’s Innovation Investor service. Two Quantum Stocks to Consider Today Another tech trend you should be riding is quantum computing. Many top quantum stocks accelerated this week after a contract announcement from IonQ, Inc. (IONQ). The company has formed a partnership with the U.S. Department of Energy and revealed a deal to acquire quantum sensing firm Vector Atomic. If you’re not familiar with quantum computers, they are the next evolution in computing speed and power. A classical computer (maybe like the one you’re using now to read this) processes information in bits, which can only be a 0 or a 1. A quantum computer uses qubits (quantum bits). Thanks to quantum physics, a qubit can be 0, 1, or both at the same time (this is called superposition). Here is how Louis Navellier explains the important difference in Growth Investor. To understand what I’m talking about, let’s think about a maze. A classic computer will run a simulation by choosing a path. When it hits a dead end in the maze, it will start all over again. It will repeat this process again and again until it finds the solution. But a quantum computer will test all paths of the maze simultaneously, giving you the correct answer in a fraction of the time. Aside from IONQ, Louis also likes D-Wave Quantum (QBTS) – the first to bring a commercial quantum computer to market and now positioning itself as “the Amazon Web Services for quantum computing.”

You can see above that the stock is up more than 2,000% in the last 12 months. That means a $10,000 gamble would be worth almost a quarter-million dollars today. Louis likes the recent developments he sees in the company. D-Wave recently reached a major milestone by selling its Advantage quantum computing system to Jülich Supercomputing Centre (JSC) in Germany – marking the first time a high-performance computing center has purchased a D-Wave system outright. This is a big step forward because it shows that companies and institutions are ready to integrate quantum computing into real-world applications. IONQ and QBTS are currently rated “B” in Louis’ Stock Grader system. You can read more about quantum in the report “The Quantum Moonshot with 100x Potential” in Growth Investor. Enjoy your weekend, Luis Hernandez

Editor in Chief, InvestorPlace |

0 Response to "Three Tech Investing Trends to Buy Now"

Post a Comment