You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: So, last night, I reviewed our Girls Under 8 soccer roster. One of the interesting things that this girls’ rec league does is that it takes all the ratings of players and then balances the teams. It’s a trust model. The team we played last week rigged it all… Let me explain… Imagine a situation where we have 100 kids, and the average rating is 3. Then, every team would have 30 points if there are 10 teams. The team we played last week had two girls who were easily the best two kids in the league (these girls were on the team that won the league last year)… But… Here’s the thing. The parents set the ranking preseason from 1 to 5 when they register their children… The parents estimate and guess the rankings… with no real measuring stick… So if you think your kid is a 5, that counts against the random assignment… (The two girls who dominated last week were ranked a “4” preseason… no freaking way…) How good were these two girls? Imagine that Nomar Garciaparra and Mia Hamm just decided to move to Maryland, had twins, and changed the kids’ names. That’s who we just played… (and we still only lost 2-0)… But that said, two kids with “five” rankings consume 33% of the team budget. All the rosters are blind. There’s no draft. It’s just a measurement of what the parents think their kids are compared to the rest of the league. This other coach ran this team last week with militant efficiency… While we were playing and trying to pass the ball without sobbing, I could only think of Rocky IV, where Drago’s corner was just screaming to finish the job… Yes… Under-8 girls’ soccer is intense. Huh? But… let’s back track… when it comes to self-evaluation… Most parents wrote “3” when guessing their kid’s skill set… That makes sense. They believe their child is average at 7 years old in soccer… What is the measuring stick, right? Well, one of our parents wrote a very high number for their daughter. But she’s not at all interested in playing soccer. Last week, she asked to sit out an entire half. Then, during warm-ups, she told me about her cat. Later, she told me the names of the first 15 elements on the Periodic Table during the first quarter. And every time she told me the next one, she started over… So I heard “Hydrogen” 15 times… This was while I was trying to coach the game. But then she stopped… and she goes over and starts pouting… “What’s wrong?” I asked. “I can’t remember Number 16…” she said. And now, I’m sitting in a chair… and she’s freaking out… like this is some national stage of knowing what the Periodic Table numbers are… So, I sit down (while my best player is trying to take a penalty shot) and say, “Well, what’s 16?” She just looks at me blindly… She doesn’t know. And I’m trying to be nice and encouraging… But there’s also some insane impulse in my lizard brain (trying to coach eight other kids) that screams… SULFUR!!! It’s Sulfur… Why are you doing this to me!!! But That’s Not AllThis is a totally rational email… It gets wilder… One parent rates my best defensive player almost the lowest number possible… She was the kid who was upset about the team's name. This girl is a solid “4” as a defensive player… She’s an absolute brick wall… zero emotion… probably a Marine in the future… The type of girl who will one day tell her significant other, “Hold my earrings” while she steps at some guy and tells him that she refers to her left hand as “her punching hand” and her right hand as “Jack Johnson…” I’m putting her on my company’s Board of Directors. It’s Game 3… we still have not scored a goal this year. But if we win, I’m going full Steve Martin in Parenthood…  Count on it… Now… “CHARTS!!!” Chart No. 1: The Stock Market is Not the Economy… and the Economy is Not…We start this week with the most obvious observation in the financial system. Anyone who still thinks that the S&P 500 properly reflects the underlying U.S. economy (on a forward-looking basis), it’s time to put that theory to bed. This is the disconnect between the S&P 500 and the number of job openings in the United States. Now… this might not tell you “TOO MUCH”… But it’s a reminder of what the stock market has actually been doing since at least COVID. It’s reacting to liquidity flows in real time. The first chart (below) is the S&P 500 SPDR ETF (SPY), and the second is an upside-down varation of the National Financial Conditions Index (measuring risk, credit, and leverage) It’s front-running liquidity expectations… and liquidity is what drives equity prices. Since 2020, stock prices have stopped caring about silly things like "profits" or "growth" or employment… Here’s what moves markets now:

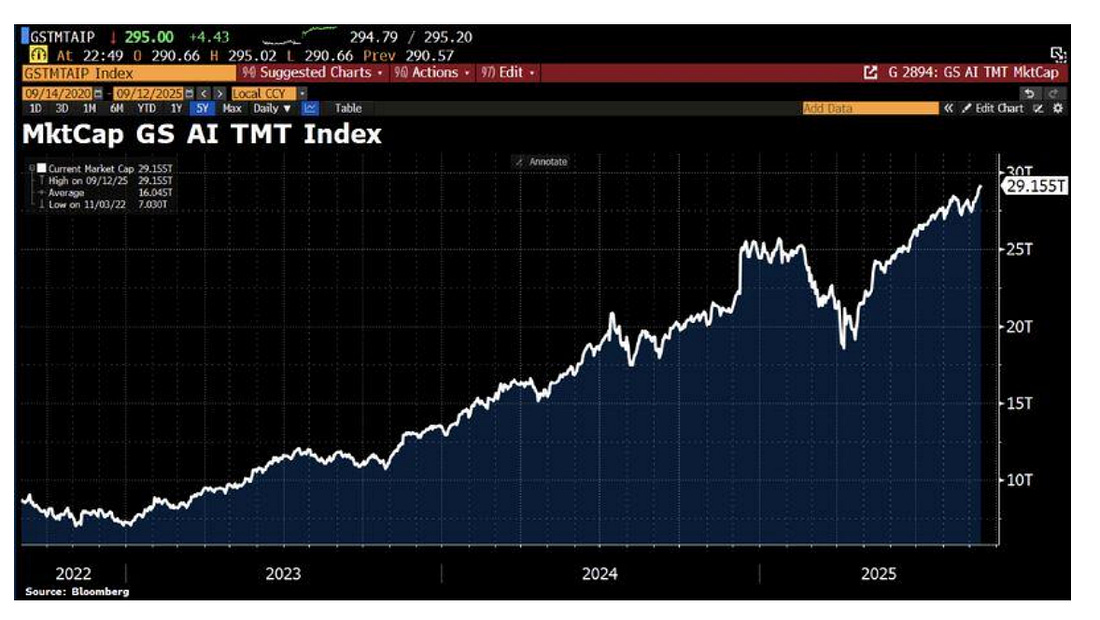

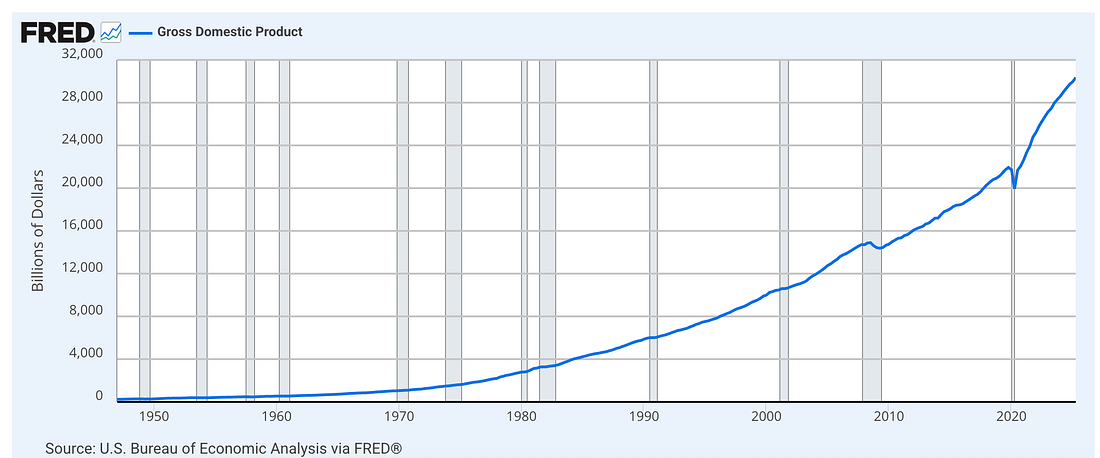

Chart No. 2: The Most Powerful Chart in AmericaYesterday, I noted that Alexandria Ocasio-Cortez may explore a presidential run in 2028… (and if she loses the nomination to Gavin Newsom, she is a LOCK for 2032). People have asked how all of these socialist mayors are winning in places like New York City, Chicago, and Los Angeles… I ask them, 'Have they paid attention to how significant the movement has been across the country since 2022?' The Democratic Socialists of America (DSA) have put county executives in Montgomery County, Maryland; Allegheny County, Pennsylvania; Fulton County, Georgia… (That’s surrounding Washington D.C., Pittsburgh, and Atlanta). And they’ve put mayors in six California cities… How is this happening? Here’s another hypothesis for us to test… This chart is the 109 AI stocks on the Goldman Sachs TMT AI Basket… It’s worth $29.2 trillion… That nearly the size of the entire U.S. economy… Given that financial institutions and the ultra-wealthy that control the stock market own the first chart, the nearly $30 trillion in AI value… All while that AI replaces jobs and leads to more automation… While the Fed continues to pump money into the system and drive up the prices of essentials like food, housing, energy, and education… The K-shaped recoveries have been brutal since 2008… It’s not shocking that younger Americans are looking around… thinking that this is capitalism post-2008 (it’s not!!!!!), and now turning to the economic illiteracy of socialism… I know that’s not what people want to hear. But if they want to keep burying their heads in the sand and telling Gen Z and Millennials to pull up their bootstraps… they’re gonna be mighty surprised when we end up with more Mamdamis and more AOCs running things in the future… Chart No. 3: Nothing, Anywere, Ever, Matters More Than What?That chart title is intentionally insane on purpose… Because so is this chart… The S&P 500 just hit another record… It’s trading at 3.3 times sales. That’s an all-time record. This means that equities are trading at 3.3 years of revenue… REVENUE. Not profits. Revenue is the top-line figure. That means no taxes, no R&D, no payroll… Every dollar coming in the door… This is insane. However, it’s completely logical when the U.S. government is running a deficit of 6.5% of GDP (which helps drive inflation), global liquidity levels hit all-time highs, and we continue to inflate assets - because the money has to go somewhere. Be sure to read Alfonso Peccatiello’s piece on LinkedIn from this week titled: All They Told You About Money Printing Is Really, Really Wrong… It’s a really solid piece that tells the story of liquidity in a different way than I typically discuss… Okay… Go Dolphins… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Girls' Soccer... And Three Must-See Charts..."

Post a Comment