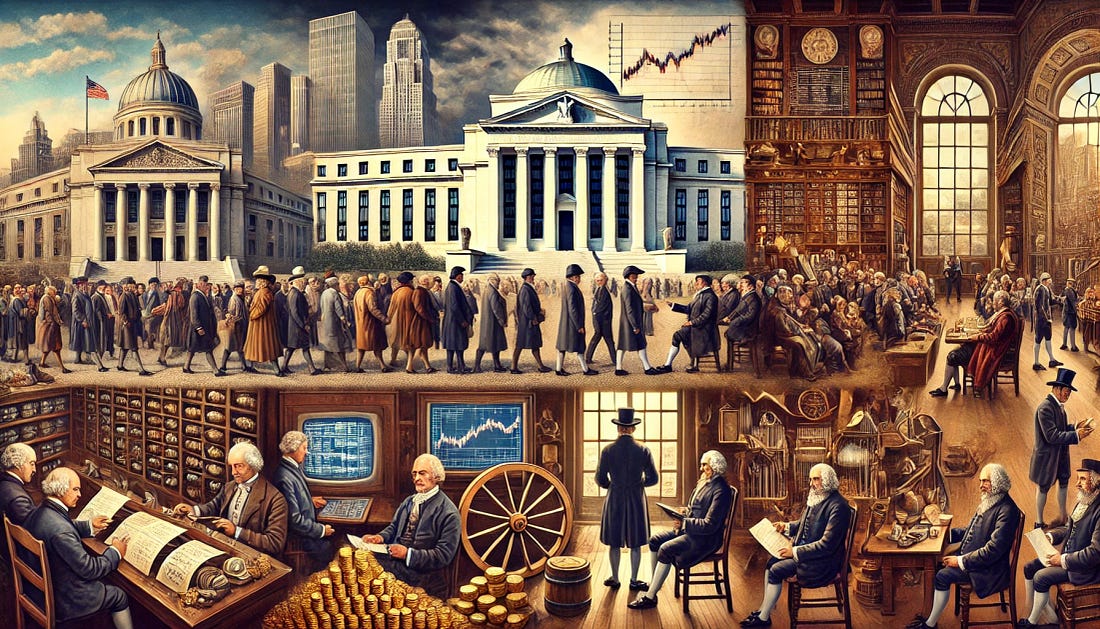

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. The Story I've Waited Months to Tell...Today I present a well-known history through a purely economic lens... one that reveals striking parallels to modern monetary systems… Please keep an open mind…Dear Fellow Traveler, Many in the financial publishing world are critical of the Federal Reserve. We study and debate the policies that fuel K-shaped economic recoveries, which drive up the prices of the things that matter… housing, energy, education, and healthcare… but leave the middle and working classes further underwater. These problems (fueled by loose monetary policy and misdirection) jolted in 1971, escalated in the 1990s, and have further accelerated since 2008. Naturally, more and more people worry about the future and the sustainability of U.S. debt, as well as the central bank’s role in financial engineering and inequality. Yet, we treat the Federal Reserve as if its failures are somehow unique to the history of central banking and related policies. We don’t give enough credit to history for the warning it offers about what we’re seeing today… Consider another system that had many similar functions to modern central banking… but this institution was infinitely more important than the Fed in human history. This institution is one that rarely receives mention in an economic context (despite being a character in one of the most widely told stories in the world today). Nor do we fully interpret how one man fought directly against its extractive policies… I’m about to present a familiar historical story - one you know - through a purely economic lens… one that reveals striking parallels to modern monetary systems… I ask you to keep an open mind… It’s All Very FamiliarTo start… You have to imagine a region under foreign occupation. You might not need to look far in this modern world, but this is in the era of field armies sweeping across continents... There are similarities between the economic system of that time and today’s wealth concentration. Imperial taxation squeezed everyone... But the real financial stranglehold came from the centralized institution that controlled the regional economy. This wasn’t just a place of gathering. It functioned like a monetary chokepoint similar to modern central banking… The “Banking” SystemIn this region, men over 20 years old were required to pay an annual tax. And it could only be paid in a specific currency. Those were high-grade silver coins, not the standard bronze or mixed-metal currency of daily commerce. Financial intermediaries created exchange rates and swapped currencies. And they did so at fees that would make modern banks blush - historical estimates suggest charges of 4% to 8% on every required transaction. But here’s where it gets worse. If someone wanted to participate in mandatory economic activities, they weren’t allowed to bring their own goods to the capital. They had to purchase institution-approved products at monopoly prices. A pair of doves that cost a few bronze coins in the outer markets? Inside the institution, they commanded premium silver, with major markups… A lamb might cost a day’s wages outside? Inside, it might cost a month’s earnings. The system created a captive market where every transaction enriched the same financial gatekeepers. This impacted everyone outside the city walls… Many farmers teetered on the edge of losing everything. It wasn’t because they were unproductive, but because participation in the system itself came with perpetual tolls. Fishermen worked all night to haul in catches, only to watch most of their profits disappear into fees and exchange rates. The economy was built on wealth transfer from the bottom up. The Week Everything ChangedSoon came the annual taxation period when local economic activity reached its peak… One day, a tradesman from the outer provinces walked into the institution that controlled the regional economy. What he witnessed was exactly what feels familiar to many… It was a system designed to extract wealth from working people while enriching the gatekeepers who controlled access to what people needed most. This man didn’t write a strongly-worded letter to the authorities. He didn’t file a regulatory complaint. He didn’t start a protest movement. He didn’t issue a white paper or argue on CNBC. He crashed the tables where the “bankers” exchanged the currencies... He scattered the coins across the floor. He drove out the people charging these massive exchange rates… It didn’t go over well… The institutional authorities, the ultimate insiders of their day, couldn’t let this disruption to their revenue model stand. This tradesman had threatened the entire foundation of their wealth extraction system. They didn’t debate him. They didn’t negotiate with him. They arrested him - in what I consider one of the biggest wrongful convictions in history. And then, they nailed him to a cross. This Isn’t the Story You KnowNow, I know what you’re thinking. This isn’t the Sunday school version you heard growing up about Jesus of Nazareth when he “cleansed the temple.” This isn’t to strip the story of its spiritual dimension. It’s to reveal the economic one that’s been hiding in plain sight. The Roman tax was painful. The Temple’s financial system was suffocating. To be clear, I’m not claiming the Temple was a central bank in the modern sense. But it demonstrated core features of what I call monetary chokepoints: currency gatekeeping, forced exchange, and monopoly access to essential economic activity. And I’m not alone in this framing. Some economic historians have increasingly described the Jerusalem Temple as not merely a religious center, but as a central fiscal authority (see: Jerry Bowyer) My argument isn’t about institutional structure. It’s about recurring outcomes, no matter the theology, laws, or stated mission. I’m not debating the Temple’s stated purpose. I’m isolating its economic outcome (something I do with all financial systems). And the outcomes here are strikingly familiar. The Temple centralized tax collection, dictated currency use, and imposed monopoly pricing on sacrifices. It was the chokepoint of Judea’s economy - in ways that echo modern monetary chokepoints. Think about the structure… It required currency that only it could provide. It offered monopoly pricing on mandatory purchases. It had a captive market where every participant had to pay tribute to the same financial gatekeepers. This was wealth extraction that flowed from the poorest farmers and fishermen up to the institutional authorities. There were theological and political dimensions to this moment, of course… But if you temporarily strip those away and isolate the economic function of the Temple, you’ll see how monetary control becomes a tool of power. Every core function of a monetary chokepoint was active there. It had currency control, exchange rate manipulation, and systematic wealth transfer from the productive economy to financial intermediaries. “You’ve turned this place into a den of thieves,” Jesus said. And he was right. Not because of the religious significance… though that mattered deeply… but because of the economic reality and the associated corruption. The system extracted wealth from working people through controlled exchange rates, monopoly pricing, and mandatory participation. This wasn’t just about restoring proper worship… It was about confronting an economic system that drained labor into tribute from those who could least afford it. The Pattern ContinuesStrip away the robes, the coin, the paperwork, the Bloomberg terminal… You’ll find similar outcomes. From Jerusalem to the Medici banks of Florence. To Amsterdam’s Bank. To the Bank of England. To Rothschild’s London. To today’s Federal Reserve’s Eccles Building. I’m not listing these to claim they’re structurally identical… I’m listing them because they all served the same social purpose: to control access to economic life. They stood between the people and the resources they needed to live. No… they’re not identical structures. A Temple treasury extracting coin fees in 30 A.D. is not the same as a Renaissance lending syndicate or a modern central bank adjusting interest rates. Their tools, mandates, and legal structures were wildly different. But when you carve away the mechanism and look only at the outcome… concentrated monetary control that forces the population to pass through a single gatekeeper to participate in economic life… you see the same pattern repeating across eras. That’s what I mean by a “monetary chokepoint.” Look at what we have now… The Federal Reserve controls currency and interest rates, and it does so in ways that benefit banks and brokers through the modern version of the Cantillon Effect. We have healthcare, housing, education - all controlled by institutional gatekeepers who are extracting wealth through artificially inflated costs. Even property taxes are paid only in government currency. These taxes force every laborer to convert their time and productivity into state-approved money to remain in their own homes. If you control the money, you enable every other form of institutional extraction. That’s why monetary chokepoints sit above all the others on the social scale. For most Americans, there’s no real option to opt out. Insurance prices keep rising… housing costs are at all-time highs (driving rents higher). Electricity costs continue to surge… all because of monetary policy. The Temple required expensive sacrifices that only they could sell. Today’s system creates similar dependencies through essential services like mortgages, student loans, and healthcare financing, often with limited alternatives. If history continues to warn us about monetary chokepoints, why do we keep rebuilding them? The ChoiceJesus of Nazareth wasn’t the only one… Whether one views his actions spiritually, politically, or economically, the pattern is undeniable. Throughout history, individual voices have stood against this same wealth extraction system… and paid the price. Some won. Some lost. Some changed the course of history. From Jerusalem to Florence to Amsterdam to London to Washington D.C. - if history teaches you something about power, and you don’t adjust your behavior accordingly… You’re not thinking… you’re spectating. I don’t write so you can nod and scroll. I write to help you consider a strategy. So, let’s continue this analysis. In the coming weeks, I’ll be putting together a series called “Man Versus Central Bank.” These columns, like this one, do not ignore or downplay the theological and religious elements of the Gospels or other historical texts. They only aim to highlight the impact of economic chokepoints. I’ll tell the history of these events through the lives of individuals who opposed central banking and similar chokepoints throughout history. Those who won, those who lost, and those who altered our perspectives… As we proceed, I’ll also explain how and why it’s time to reposition your money, mindset, and dependence. Unless reform comes to fix this mess… but that doesn’t seem likely in these times. Whether that’s alternative investments, decentralized assets, or simply understanding the rules better than the gatekeepers, that’s how we defend against the current system… It’s not financial advice; it’s historical observation and educational analysis. We can’t stray from our plan, as the system proves that history repeats and rhymes… And we don’t stay positive because things are easy. We stay positive because history proves the dam always breaks… and those who are prepared get carried forward, not washed away. So… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "The Story I've Waited Months to Tell..."

Post a Comment