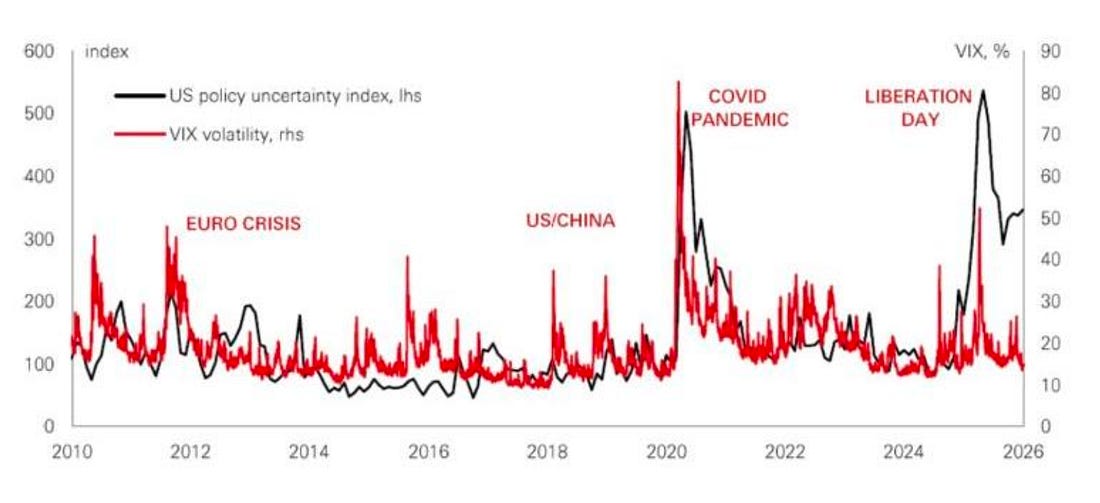

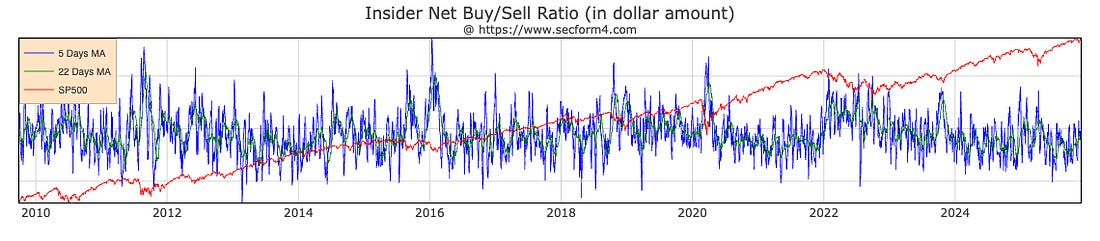

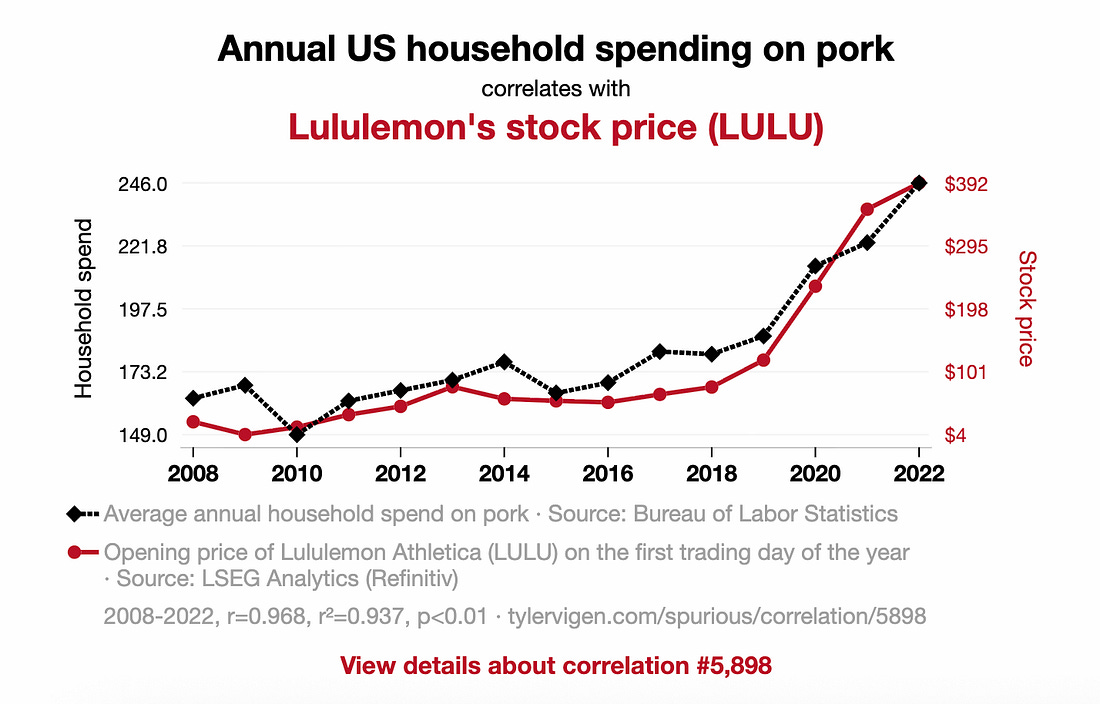

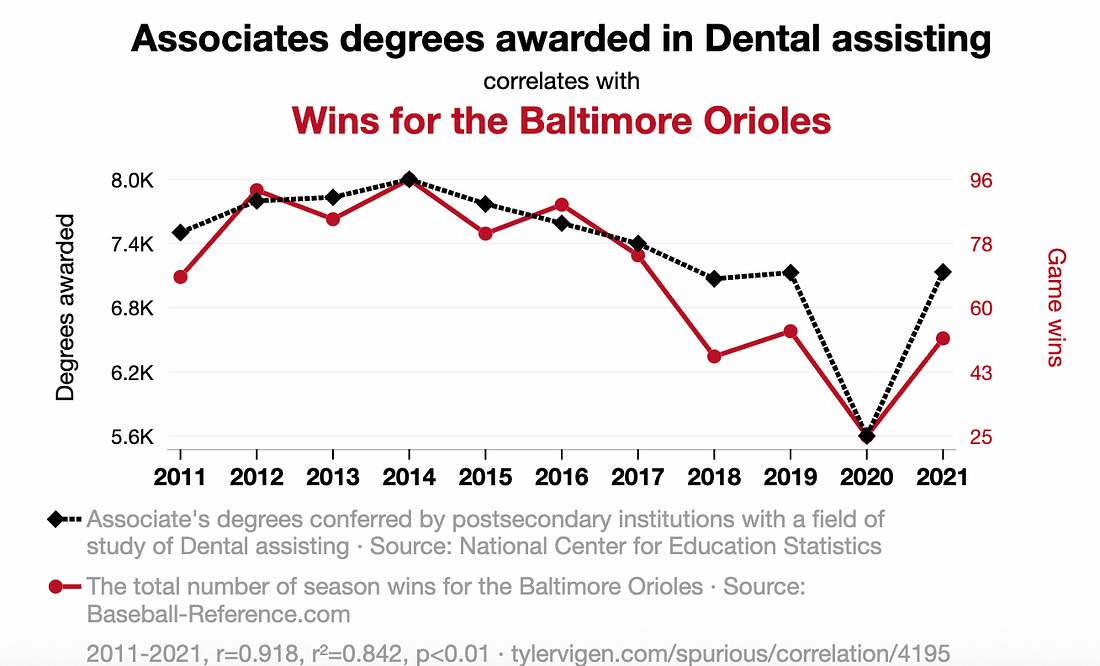

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: My friends are now trying to get me to go to Las Vegas to see Phish… again… at the Sphere. I don’t have that sort of time. But… I did see that No Doubt will be at the Sphere, and Gwen Stefani is my favorite front-woman of all time. So… tempting… Two years ago, I gave my wife and daughter two tickets to see Taylor Swift at the Hard Rock in Miami. It was a small fortune. In exchange, I have designated a one-week trip that I get to take - anywhere I want - with no complaints. I’d love to fly to Nepal, look at Mount Everest, and then get back on a plane and fly home. I did the math… I’d be there for about 14 hours. I looked at flying to Milan to go to the Olympics and watch the USA hockey team. But then I remembered, I can just go to the new All-Star format whenever I want… and it’s Italy in February. Milan is my second-favorite city in the world after Chicago… So I should just go to Chicago and be cold… But I did make a decision… I decided that I’ll go to the World Baseball Classic this year. I’m going to fly to Houston to see the USA team on a Saturday night, then fly to Miami to watch the Final Four. That’s a clean trip… and it’ll be warm. Gwen Stefani in Vegas would have been entertaining… but we’re 29 days from pitchers and catchers reporting… And the offseason has been very good to my two teams - the Orioles and the Cubs. Alex Bregman is now a Cub. Let’s make Framber Valdez an Oriole. What were we talking about? Oh… charts… Chart No. 1: The Vol…This is the CBOE Volatility Index, dating back to 2010, mixed with the U.S. policy uncertainty index. I’d say that this latter element matters, but it’s kind of an overstatement that policy uncertaintly show focus not on trade… but on liquidity. Every single one of these events could have fueled a deflationary Depression if the central banks hadn’t pumped more dollars into the system. That’s the world we live in… and the sooner you understand that we’re just a refinancing system, the better off you’ll be. Anyway, I showed you that chart to show you this one… Insider buying to selling in real dollars on the aggregate… Look how insider buying calls the bottom of every single spike. Why? Easing of economic conditions… Follow this chart like you’d follow Mel Gibson into an army of British archers… This isn’t hard, guys. They WANT to print money. It’s the only tool that suppresses volatility, which is, at its core, a reflection of liquidity expectations. Chart No. 2: Just a ReminderI love Spurious Correlations… there’s a whole website dedicated to them… and this chart is a reminder that one thing does not necessarily drive another's performance… Pork consumption and Lululemon’s stock price? Sure, the correlation is gorgeous. But unless bacon sales are secretly driving yoga-pant valuations, we’re staring at the financial equivalent of seeing Jesus in a grilled cheese. Correlation isn’t causation. It’s just two lines vibing together on a spreadsheet. If markets actually moved like this, every economist in America would be trading sausage futures in stretchy pants. Chart 3: Wait… WAIT! Stop. Hold On…I take back everything I just said… I’m enrolling my daughter in dental school… This seems legit… Shoot!!! Right when I was hitting my groove… my laptop went crazy… It is now doing this thing where the screen is acting up. And I can’t take screenshots of charts right now because they are blurry… See that? That’s what my screen looks like right now… Seems to be a GPU issue… So I have to go spend my day at Best Buy in a Bills jersey… I’m sorry that we have to cut this Chart Party short. I’ll make it up to you… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "If I Say Chart... You Say Party... Chart... Party"

Post a Comment