This Tailwind for Precious Metals Looks Ready to Reverse By Larry Benedict, editor, Trading With Larry Benedict Gold and silver prices are soaring to record highs. Gold prices hit over $5,200 per ounce. That’s up 164% from just two years ago. The move in silver has been even more impressive. Silver prices recently jumped as high as $117 per ounce. Silver has gained nearly 200% in just six months and has soared by 59% this year alone… and we’re not even one full month into 2026. Naturally, investors riding the precious metals wave higher are feeling giddy. But a key catalyst behind the move is approaching a pivotal point. Here’s why you need to closely follow the action in the U.S. dollar – and what its next move could mean for gold and silver prices… The Dollar Tailwind The action in the U.S. dollar plays a major role in driving precious metal prices. When the dollar is selling off, the eroding value of the world’s reserve currency can cause investors to flock to precious metals as a store of value. And since commodities are priced and traded in dollars, a weakening dollar increases the purchasing power of non-U.S investors. That’s another source of demand for gold and silver when the dollar is pulling back. The U.S. Dollar Index (DXY) is a good way to track the value of the dollar against a basket of other major currencies like the euro, pound, and yen. As precious metals started accelerating higher in 2025, DXY was experiencing its worst annual decline in nearly a decade. Likewise, the dollar was having its worst run in over 50 years at one point during 2025. That served as a massive tailwind for precious metals, including the hot start to 2026. After a small rally to start this year, DXY has declined sharply in the last two weeks as gold and silver surged on this most recent rally phase. But the decline has the dollar testing a key level that has sparked a reversal on two other occasions in the last six months. Given the stretched upside in gold and silver, a recovery in the dollar could spark a pullback in the precious metals trade. Here’s the key level you need to watch… Tune in to Trading With Larry Live

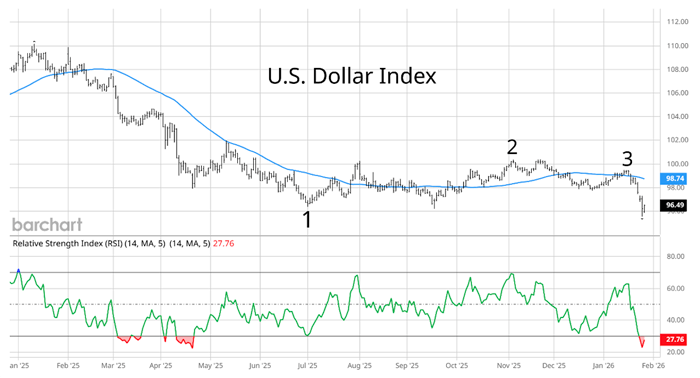

Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. | DXY Testing Support Following a historic weak start to 2025, DXY finally found traction near the 96 level at the start of July. Here’s the DXY chart:

(Click here to expand image) DXY’s weakness was concentrated in the first half of 2025. After falling to the 96 level at “1,” DXY started a period of sideways trading. Resistance in the trading range emerged at 100, which DXY tested most recently at “2” at the start of November. From there, DXY started drifting back lower. The downside really picked up in mid-January at “3,” where DXY reversed lower following a failed breakout above the 50-day moving average (MA – blue line). That reversal coincided with the most recent jump we’re seeing in both gold and silver. But just as the dollar’s action has been a key tailwind for precious metals, that catalyst could soon fade away. Take another look at the DXY chart:

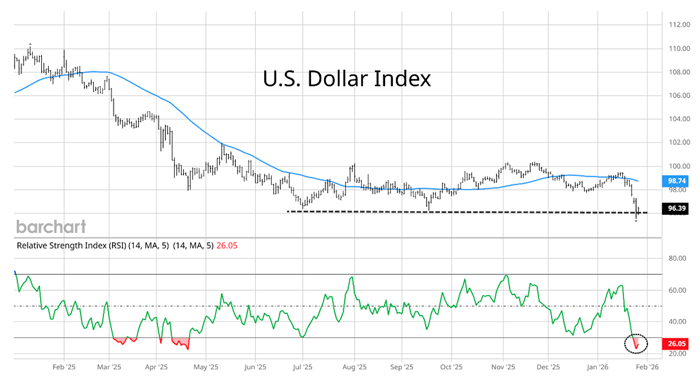

(Click here to expand image) The decline in DXY has brought it right back to the key 96 support level shown with the dashed line. As you can see, DXY has bounced off this level on a couple of occasions. At the same time, the Relative Strength Index (RSI) has fallen into oversold territory with a move below 30 for the first time in nine months (circle). DXY is also stretched far below its 50-day MA. A test of key price support along with oversold conditions is a ripe opportunity to see a reversal higher. If we see DXY bounce off these levels, that could remove an important catalyst helping boost precious metals. So if you’ve taken part in the gold and silver boom, pay close attention to the dollar’s moves in the coming days… It might be a good time to lock in some profits. Happy Trading, Larry Benedict

Editor, Trading With Larry Benedict Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. | |

0 Response to "This Tailwind for Precious Metals Looks Ready to Reverse"

Post a Comment