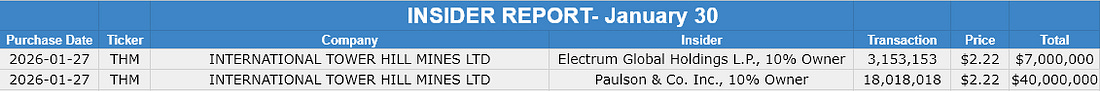

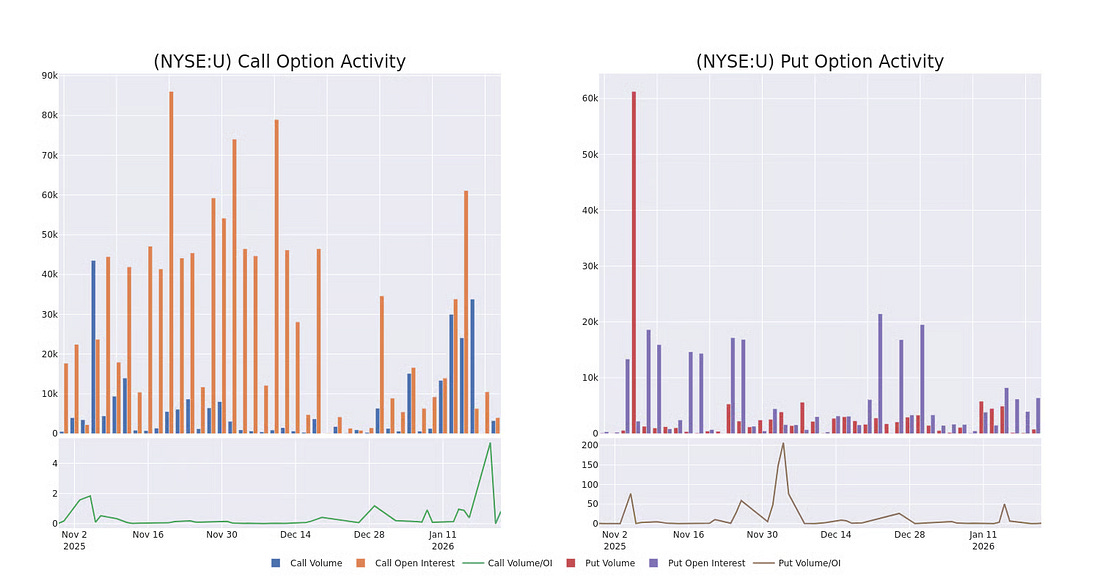

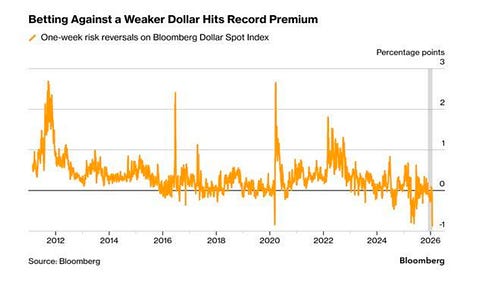

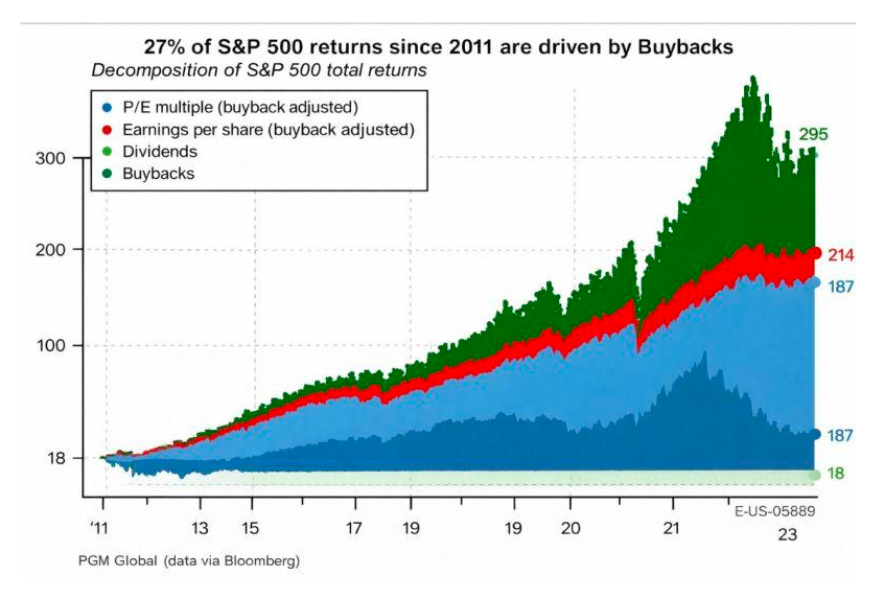

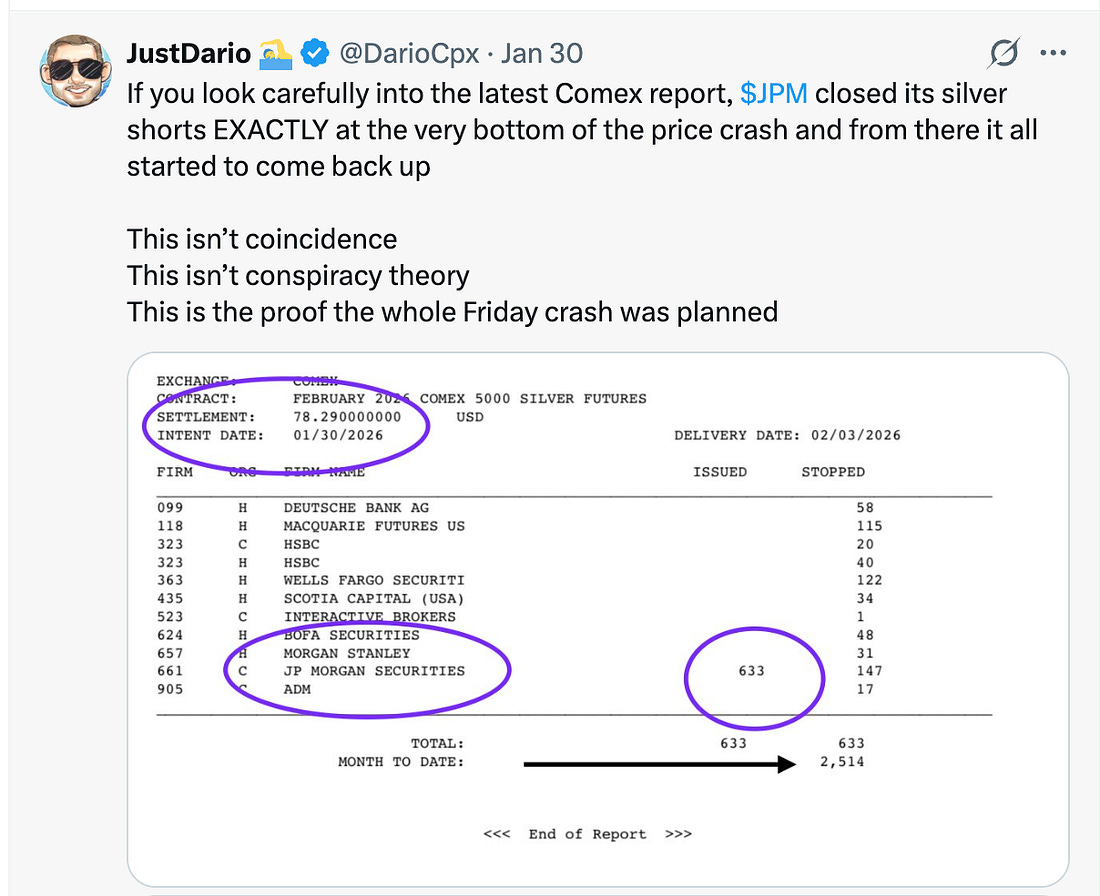

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: Well… the first event in the Money Pit came yesterday at the Edge of the World Farm. For the last few days, in the plunging Maryland cold, our HVAC was kicking out some colder air. The heat wasn’t going through, and the Heat Pump was constantly spinning into defrost mode… So, we called an HVAC emergency guy… He came over… touched a few wires, and went on his way. And it worked… for 15 minutes… just like socialism. Everyone was happy… the promise of heat and “warmth” if you will. Then it shockingly stopped working… just like socialism. (Couldn’t help myself.) The HVAC fuse blew… sparked… and kicked off a fish-like smell that meant it was time to shut off the heat. An emergency electrician (and a plunge in the house to 51 degrees while waiting) followed. He just kept saying… “You’re not gonna like what I charge…” as if his statements about service inflation in America were going to come as a shock to me. We’re on electric-only heat now, which is going to go great come our next BGE bill in March, in a state where they are still convinced wind and solar are the future. We’ll next pay for a new fuse box with all the bells and whistles. And, ain’t it funny… every repairman who comes in here is trying to sell me a maintenance plan… It’s almost like they’re actively engaged in the very extraction I explained over at Postcards for the last two months. The joy of homeownership… The American Dream. The land is still beautiful… which is what I really care about… From the Insider Buying Desk: John PaulsonI actively watch insider buying because nothing speaks louder than someone putting their own money where their mouth is. This week’s standout: John Paulson dropped $43.3 million on International Tower Hill Mines (THM), bringing his stake to roughly 42% of the company. The thesis? THM’s Livengood project in Alaska... one of the largest undeveloped gold deposits in the U.S. But the deposit also contains significant antimony reserves. Antimony was just added to the critical minerals list, and China controls over 80% of the global supply. Paulson made his name timing the 2008 housing collapse. When he moves this aggressively into a name, I pay attention. The gold-plus-antimony angle makes this particularly interesting from a supply security standpoint. For more, be sure to check out Insider Buying Report. Unusual Options Activity: The Smart Money’s FootprintsIt’s not just insider buying that matters… Tracking Unusual Options Activity (UOA) is one of the most important clues we can follow. Large, unusual options trades often signal what institutional money is doing before it becomes obvious in the stock price. This week, Unity Software (U) saw 11 extraordinary options activities hit the tape, with a sentiment split of 27% bullish and 45% bearish. That kind of heavy activity suggests someone knows something... or thinks they do… What’s the right way to approach this? For the best UOA analysis I’ve found, I recommend my friend Andrew Keene over at Alpha Shark Trading. Andrew has been in the options trenches for decades, and his ability to spot institutional flow is second to none. He was all over the big USAR activity back in October... caught it before anyone else. If you’re serious about following the smart money’s footprints, his research is worth every penny. So… Time to Go Long Dollar, Right?Traders couldn’t be more bearish against the dollar right now… So… go long dollar right? We’re seeing the premium paid for bets against the currency at its highest levels since Bloomberg began tracking in 2011. It’s now the most bearish on the dollar since May of last year… Feels like a fun contrarian play on the Invesco DB USD Index Bullish Fund ETF (UUP) for February 20. The $27 call for UUP on February 20 is… $0.15. Are you saying the dollar can’t move a little more than 1% over the next three weeks? For 15 cents, I’m willing to find out. The Buyback Industrial ComplexRemember all our conversations about financialization over the past few weeks… Here’s another example of what it is and how it drives markets… Since 2011, share buybacks have fueled 27% of S&P 500 returns. That’s not earnings growth or innovation. This isn’t about expanding multiples based on future cash flows. Where were you, DCF analysis, and all those MBA courses? Yeesh… It’s just corporations buying up their own shares (largely with cheap debt after COVID) and reducing that share count. This is fine. Pay no attention to the financial engineering behind the curtain. The market is totally healthy and definitely not propped up by accounting tricks. Nothing to see here. Is This What Happened to Silver? (Probably)Silver crashed a stunning 39% from Thursday’s highs... at one point nearly wiping out its YTD gains. It did bounce back solidly above $85 late in the day. JustDario notes that JPMorgan closed its silver short positions against the metal near the day's low. There are plenty of people arguing that this was intentional manipulation to help banks get out of short positions, especially given that some of these banks have paid massive fines in the past for manipulating the silver markets... Meanwhile, spot prices in Shanghai are 50% higher than what’s happening in the U.S. Won’t be surprised to see JPMorgan make a fortune going long from here… Here’s the thing… no one really cares. “Someone should do something!” screams the retail investor. “Investigate.” The lobbyist, economist, and regulator shrug… Even if they were caught doing something that seems sketchy… no one goes to jail… maybe a company pays a small fine. A cost of doing business… Hate to be that cynical about it… But that’s basically the history of the markets. So, I control what I can control. That’s why I focus on technicals, and momentum, and get out of the way when it seems like something is off… (What I said and did on Monday, January 26.) Anyway… we’re going to see more volatility to the upside and downside… And based on the fact that I just watched people walk into a coin shop and load up on silver at a frantic pace compared to sellers… I’ll assume we’re still in the early innings. I think we’ll find a range between $90 and $100 soon…. and forget about all of it… Bitcoin Remains a Liquidity VesselSo… I saw this on Twitter… and it reminded me that even if you have the highest IQ in the room, you can still misunderstand things… It also highlights that predictions are rather futile… and an exercise for media… The reality is that liquidity conditions don’t support a move to $276,000. I keep hearing these wild predictions, and it’s a question of what exactly will flow into this so aggressively and where from? This really feels more like a safety valve for the global markets than a proxy of risk. Someone’s going to have to prove me wrong on that thesis… The Week In ReviewMonday, January 26Raising the Yellow Flag... (It Shouldn’t Be THIS Easy)On Monday, I started selling my paper silver positions once we got above $110, and we saw moves that were reminiscent of Bitcoin volatility. When things stop making sense, it’s smart to take gains. Looking back, it was the right move… but it was also clearly linked to what our data set was telling us. Read more, right here. Tuesday, January 27It’s Okay to Sell (That’s the Purpose of a Market)On Tuesday, I reflected on why it’s important to take gains, especially when markets start making irrational moves. The gains probably won’t pay for an Epcot vacation… they’ll probably now have to pay for a new HVAC and panel. Read more, right here. Wednesday, January 28Super Dry Federal Reserve AnalysisWhat happened on Wednesday with the Federal Reserve? Exactly what we expected. No chance of a rate cut, and we’re now looking deeper into the year before we even think about looser policy there. But, hey, I gotta do analysis. Read more, right here. P.S. We went red on Wednesday… days before the metals selloff and spike in vol. Thursday, January 29Things I Think... And Still ThinkI ranked my favorite songs of all time, but also dug into what’s happening in the world with the Bank of Japan and other questions around these markets. We have lots of policy support to keep this Viagra and Popsicle stick market going. Read more here. Then, I appeared on StockTwits on Thursday. In our a conversation with Michele Steele, I said I expected gold to hit $5,000 from $5,500 before it rocked higher… a day later, here we are. But the monthly RSI on gold was sitting at a stunning 94. Easy call. Friday, January 30Six Rules for Negative Momentum (Back To Our Roots)With our signal red and markets showing continued weakness, we remind traders how to approach a market that requires liquidity and technical support to function with confidence. I lay out all the rules for the weeks ahead here. Saturday, January 30Postcards from the Edge of the World (Vol. 10)What is the ultimate thing that our financial system extracts from people? It’s not money… or emotion… or stress… or fear. It’s TIME. And not just our present. It takes from our past and our future as well. Let me explain how… right here… All right, everyone, enjoy the rest of your Sunday. Apologies for the delay today, I was running around trying to get the dogs “warshed.” More on the Kevin Warsh nomination on Monday. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Let's Talk Commodities, Crypto, and Insider Activity..."

Post a Comment