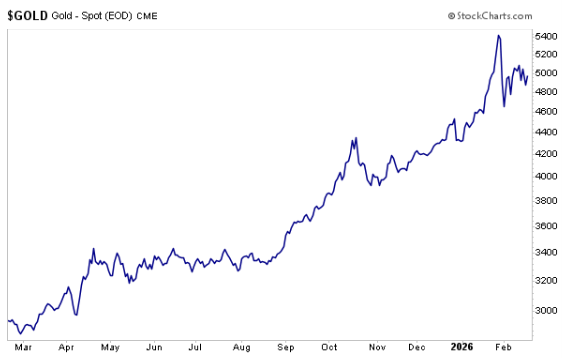

There Is No Alternative: Why Gold Could Hit $10,000 by 2030 VIEW IN BROWSER Gold recently did something that caught a lot of people off guard. After President Trump named Kevin Warsh as the next Federal Reserve Chair on January 30, traders dumped the metal almost instantly. Why? The short answer is simple. Warsh is seen as a serious candidate who commands respect from both sides of the aisle. In other words, he won’t be a political puppet used by President Trump to force lower interest rates. On the face of it, that’s bad news for gold, so prices dipped by around 6% immediately. Then panic set in. All told, gold fell about 16% before recovering a bit in recent weeks. And since this came after a furious run in which gold prices shot up by as much as 85% over the past year, many investors started asking the same question: Is the run over?

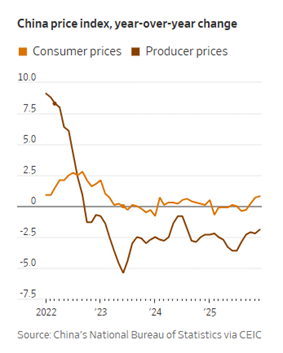

I’m here to tell you that nothing could be further from the truth. In fact, prices should continue to meander higher throughout this year, with Yardeni Research predicting gold will hit $6,000 per ounce. (You can view a recent chat I had with Ed Yardeni here.) But what’s really exciting is that gold could go even higher over the next several years. Yardeni anticipates gold prices will reach $10,000 per ounce – nearly double current prices – by the end of the decade. That’s because gold’s rally isn’t about who chairs the Fed. It’s rising because investors are running out of places to hide. In a previous Market 360, I broke down the factors driving gold prices higher: deflation, economic uncertainty, global central bank purchases, potential currency devaluations and the collapse in cryptocurrencies. But really, it comes down to one simple fact: There are very few real alternatives to gold. So today, let’s break down those alternatives and discuss why they’re not viable right now. Then, I’ll tell you how to pair gold stocks with the next market leaders to prepare – and profit from – the “hidden crash” that’s slowly unfolding in today’s market. No Other Safe Havens Cryptocurrencies: Due to poor performance in 2025 and accelerating losses in 2026, more cryptocurrency investors are likely to shift to gold, given its superior performance. Also, many crypto exchange-traded funds (ETFs) have had wide bid-ask spreads, causing further losses for investors. Chinese Yuan: Deflation has enveloped China since May 2022, with wholesale and consumer prices declining rapidly. Chinese interest rates are now lower than Japan’s. Due to shrinking households from the “one child” policy enacted decades ago, China’s domestic economy is in a terminal decline that cannot be reversed. The only way China can possibly stop its deflationary spiral is to devalue the yuan, which it did before it joined the World Trade Organization (WTO).

Japanese Yen: Japan now has the highest birth rate in Asia, but it is not high enough to offset its population decline. Japan is not very open to immigration, so it is losing households and its economy is shrinking. That makes paying off its government debt nearly impossible. I should add that the new Prime Minister is spending more money. That is hindering the Bank of Japan, which is expected to print more money via quantitative easing to make ends meet. The result will likely remain ultralow interest rates and a weaker Japanese yen. British Pound: The U.K. has historically been better at assimilating immigrants, helping boost its population and productivity. However, the country has struggled in recent years with some immigrants who have no intention of assimilating or being British. So, even with an influx of immigrants, the U.K. still faces a shrinking household problem, especially given its aging society. Other issues that are plaguing the U.K.: 1) around half of its residents need subsidies to pay their electric bills; 2) its quest to be NetZero by 2050 has caused a manufacturing exodus; and 3) wealthy Brits have moved to Guernsey, Jersey and other offshore centers. When you add it all up, there is a government budget shortfall, and middle-class Brits face higher taxes. The Bank of England also has little choice but to cut key interest rates and resume quantitative easing, which undermines the value of the pound. The Euro: The European Union (EU) now has 27 member countries after the U.K.’s departure. More countries could leave after the 2027 elections if more anti-EU parties gain power. Brussels is no longer just a monetary and trade union. It has become a bureaucratic octopus, systematically destroying many industries like farming and automobiles. It’s also comprised of shrewd political operators that have meddled in elections in Romania, France, Germany, Italy and Poland. Long term, the euro is likely to erode due to weak GDP growth and constant infighting. Many member countries also face debt problems and shrinking populations, like France. That will continue to pressure the euro. U.S. Dollar: As I’ve mentioned many times, the U.S. is demographically superior to other developed countries. Part of our secret sauce is that the U.S. is younger, has a higher birthrate and does a better job assimilating immigrants. The other key element is that our 50 states compete with each other, which creates constant economic momentum. Yes, the U.S. has substantial government debt per capita (about $109,000). But we also have substantial assets, including natural gas, crude oil, gold and other commodities. There is also a vast amount of valuable federal land. Thanks to the AI boom, the U.S. economy continues to expand and could hit a 5% annual pace this year – and possibly 6%. As a result, I expect the U.S. dollar to strengthen over time. The Bottom Line Given the lack of alternatives, investors today have two primary safe havens: gold and the U.S. dollar. Since U.S. interest rates are expected to decline over the next few years – and I still anticipate multiple rate cuts in 2026 – gold should remain in demand. As a result, I agree with Yardeni and believe gold could hit $10,000 per ounce by 2030. That’s great news for all of the gold-related stocks in the Accelerated Profits Buy List. All of our current gold plays have bounced back impressively from the recent pullback and are now up an average of more than 15% year to date. Some of these gold mining stocks have been in our portfolio for a couple of years – others just a couple of months. And we’re currently sitting on five triple-digit winners. With gold likely to meander higher for the foreseeable future, I recommend viewing any dips as a great buying opportunity. But there’s another reason to consider owning gold right now. Many of the well-known AI stocks that carried this market for years are beginning to show signs of fatigue. In a recent presentation, I explained why several popular AI stocks face serious downside risk. I’m not predicting a dramatic crash. What I see instead is a slow rotation. Money will quietly move out of crowded trades and into new leadership. That’s more dangerous than you may think – which is why I call it a Hidden Crash. It doesn’t grab headlines. But it can quietly damage portfolios. So, alongside gold stocks, you need exposure to a small group of emerging AI leaders that are already starting to break out. To see what’s coming next, which AI stocks are at risk and where to find the next AI leaders, click here to watch my full presentation now. Sincerely, |

0 Response to "Must Read: There Is No Alternative: Why Gold Could Hit $10,000 by 2030"

Post a Comment