You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: Last week, we watched as Artificial Intelligence speculation took a baseball bat to the valuations of software companies. Goldman says the worst is over… I disagree. That theme story pops up every month or so. The white-collar job worries are building. And people are right to be concerned… This morning, Above the Law noted that super law firm Baker McKenzie planned a “massive staff layoff” across its entire global offices. The firm wrote:

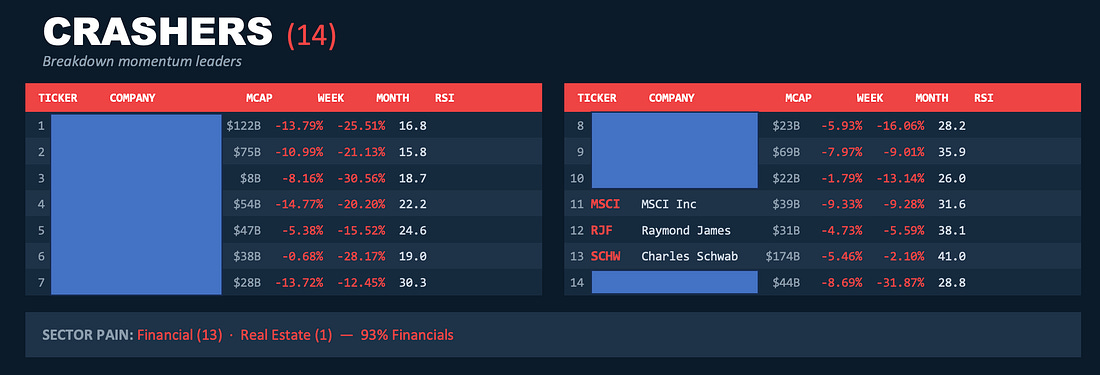

Ah.. yes… Efficiencies… and client’s needs. But really efficiencies… More than 700 people from the firm’s IT, knowledge, admin, DEI, leadership & learning, secretarial, marketing, and design teams are heading home... A lot of people are writing and talking about the ongoing story. Elon Musk thinks that AI and associated productivity growth are the only things that can pull us out of debt. But others wonder… would you take 15% productivity growth with a 15% unemployment rate (even though about 25% of Americans are ALREADY underemployed, according to alternative figures)? I'm focused on two different things. First, the psychological toll… what does it mean if we replace so many jobs and people might lose purpose? What do people do now? How do they handle this shift? I covered that issue over at Postcards last month. Second… what is the market telling us? And how will we catch the warning signs on valuations… Out of the SkyOver at Capital Wave Report… we’ve moved Yellow at the end of the day… But without even looking at the news today… one could tell that something was suddenly wrong. You’re looking at a list of the hardest momentum stocks on the other side of the bell curve… The names that could easily keep selling off as more investors throw in the towel. The thing about momentum… it creates more momentum, like a snowball rolling down a hill. Today, two names popped on there and I just said… okay… this is probably an AI move here… isn’t it? And it was… Raymond James and Charles Schwab. Both were getting torched today… The news? Well… there’s a new AI platform that can help users achieve greater tax efficiency. And when that happens… the whole idea around money managemenet gets shaken up. Schwab dumped 8% today, and hit our screen around 11:30. Raymond James followed. Here’s the story out of Bloomberg [emphasis mine]:

On the “off guard comment,” of course… Nobody saw this coming! Except… It’s been at the center of our analysis since ChatGPT launched in the fall of 2022… and keep a nice reminder every six months. Why This Revolution is Going to Be IntenseIt’s coming fast… Need evidence? The latest iteration of the AI platform Claude is pretty intense. It’s clear that creative thinking is going away for a lot of people in this world… and the No. 1 skill to have over the next 18 months will be advanced prompting, reasoning, and on-the-fly abilities to create outcomes from AI. I’ll estimate that 98% of all written content will be generated and/or influenced by AI in the next 18 months. Have you met Americans? They can’t wait to outsource their work to the robots… Claude could have written about 57 articles about the very subject I’m explaining to you right now… likely in my voice… in the time if took me to provide the first draft of this. What’s spooky is whether you would even know the difference… David Shapiro said that AI destroyed at least 200,000 jobs in 2025… Already 92% of Fortune 500 companies are using generative AI in some way… That’s nothing… USING AI… What matters is who turns their entire business around to center on a concept called “AI-First.” That’s the idea that companies must shift toward AI being the leading driver of their business. Not their people… not their patents. The use of AI. And they’ll have to… because three guys with Claude can now create more content than a traditional legacy publisher in a week. All while the latter people are sitting in meetings, telling others “No” to ideas. Every no… every pass… every “let’s talk again next week…” is a blow the balance sheet. Any culture that doesn’t believe in failing fast won’t bleed out. They’ll turn the lights out by next summer. Powerful and Strong… All At OnceThe reason why this is such an interesting moment in time has everything to do with the technology’s two major elements. It’s powerful… and it’s fast. Historically, technological revolutions unfold slowly. Coinage was extremely powerful when it hit Europe over 2,000 years ago. Instead of bartering, people could have a store of value and exchange those coins for something else later. Coinage was powerful. But adoption took two centuries. The steam engine was very powerful. It knocked out the work of human muscle power, animal labor, wind, and water mills. Transportation and textile work got replaced. It was powerful… and took decades to find widespread adoption. The internet has been very powerful… You might recall the Dot-Com boom and bust. And one reason for the bust was that the infrastructure couldn’t keep up with the hype. It took at least two decades for widespread adoption. Powerful… but not fast. Well… AI is both fast and powerful. It’s operating under Moore’s Law, which means it doubles in power every 6 months. And you know the speed, because again, Claude can put together a PowerPoint presentation in four minutes that would take me more than two hours. It’s an exponential technology… and it’s coming full bore. The next 18 months will bring radical changes to business… And the funny part is that people are still thinking that companies will “Do the right thing” and keep people. Or that AI is still a hype. Or that AI is just a tool. Wrong. It’s going to be the center of strategy for the winners come 2028. Where’s the Opportunity?Now… I don’t like being the messenger for stories like this. But the reality is that we’re going to find ourselves in very interesting economic times. Historically, technology has been deflationary… And AI should become the most deflationary technology ever if it undercuts the U.S. workforce. Bigger than China’s joining the global labor force. Bigger than the fall of the Berlin Wall. And of course, bigger than the Dot-Com Revolution. What will likely happen as a policy response? I expect that the central bank will look to paper over deflation with more monetary expansion in the future. A fiat system requires new capital to refinance and recharge. That’s going to impact the value of real assets. I’ll talk tomorrow about the importance of productive and scarce assets in a portfolio. But on the other side, while everyone else will be wondering which sectors will be disrupted next, we’ll be focusing on how to trade the disruption and look for sizable swings as the algos and liquidity push equities in all directions. The opportunity isn’t in the disruption… It’s in trading the disruption. Now is the most important time for you to learn about technical indicators, understand conservative options trading strategies, and stay focused on signals that reflect the ups and downs of a financial cycle. There will be ample opportunities ahead. Don’t fear the machines. Trade like them… Trading and the associated arbitrage of information is more important than ever. Learn to trade… and take what the market is giving you… And wait for the money printer to turn on when the time comes. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Out There on the Edge..."

Post a Comment