What to Watch for This Week

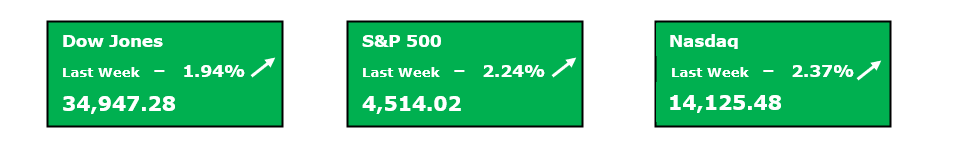

Investors believe they now see the path ahead much more clearly after last week’s cooler than expected CPI report. This report gave the markets confidence that the Fed has won the battle against inflation and will not pursue further hikes. This week is shortened as the markets will be closed on Thursday and will close early on Friday in observance of the Thanksgiving holiday. Despite the shortened week, investors will still receive a handful of key economic reports including updated U.S. Leading Economic Indicators & the new Initial jobless claims. Additionally, the Fed Minutes transcripts from their latest meeting will be made public.

- U.S. Leading Economic Indicators – On Monday morning, The Conference Board will release their November Leading Economic Indicators report. This report includes a variety of significant economic indicators and data that often serve as a good predictor of the U.S. economy’s trajectory. Ten main data points compiled by the Conference Board are conglomerated into an index called the Leading Economic Index (LEI), which in the past has served as a reliable recession indicator.

- In last month’s report, the LEI index posted its 18th consecutive monthly decline, dropping 0.7% from the previous month. October’s report expected on Monday is forecasted to post another 0.7% decline.

- Initial Jobless Claims – The Department of Labor provides a weekly report that records new Initial Jobless Claims in the U.S. Since troughing in September, initial claims have begun trending up, with the past four reports coming in higher than expected. Last week’s report was much higher than expected at 231K compared to an expectation of 220K. If Initial Jobless Claims continue to trend higher, this will put continued downward pressure on the U.S. Dollar & U.S. Treasury yields.

- Wednesday’s report is expected to show 229,000 new jobless claims, a slight decrease from the previous week’s report.

- Fed Minutes– On Tuesday afternoon investors will get their first chance to begin digesting the Fed Minutes from the latest FOMC meeting. After every FOMC meeting and decision, a few weeks later the Fed will release a transcript of their meeting so that investors can get a peek behind the curtain to see the reasoning that led to the recent policy decision. This look into the Fed’s rationale is closely watched as it can provide some helpful context into what the FOMC may do at their next meeting.

- If the Fed Minutes confirm that the committee plans to remain data-dependent at future meetings, this coupled with recent cooler than expected inflation data and softer economic data, should help solidify investors opinion that the committee will not raise the Fed Funds rate further.

Federal Reserve Watch

After last week’s lower than expected CPI print from October, the market seems to have confidence that the Fed has finished hiking rates in this cycle. We are expected to hear from at least one Fed President this week in addition to the Minutes from the latest Fed meeting being released. Despite the markets being convinced that this cycle’s rate hikes are over, most anticipate Fed messaging to remain hawkish.

- The CME Group now projects a 100.0% probability that at the next FOMC meeting the committee will opt to maintain the current target range between 5.25%-5.50%. Additionally, Fed Funds Futures are now indicating that the first rate cut could be as early as the Fed’s May meeting in ’24.

All About the Earnings

This week, investors will hear from the final ‘Magnificent 7’ company to reportas NVIDIA Corporation is set to report their earnings. Also, due to report their Q3 earnings this week is a mixed group of various retailers. Finally, the major industrial name, Deere & Company, is set to report their latest quarterly earnings.

- There is no question about what the most anticipated earnings report will be this week. On Tuesday after the market close, NVIDIA Corporation is expected to report their Q3 results. Given A.I. was a major theme in the market’s latest bullish run and NVDA is the biggest beneficiary of all things A.I., this will likely be the week’s most pivotal report.

- NVDA earnings are expected to come in at $3.01 EPS.

- Prior to the market open on Tuesday, a diverse basket of various retail ers are expected to post their latest Q3 results. Investors expect to hear from Lowe’s Companies, Inc., Best Buy Co., Inc., Dick’s Sporting Goods Inc., & American Eagle Outfitters, Inc. In addition to proving the performance of each company, these reports will be watched as they will provide some read-through into the current health of the U.S. consumer.

- LOW earnings are expected to come in at $3.05 EPS.

- BBY earnings are expected to come in at $1.19 EPS.DKS earnings are expected to come in at $2.43 EPS.

- AEO earnings are expected to come in at $0.48 EPS.

- Before the market opens on Wednesday, Deere & Company will report their third quarter earnings. DE shares have underperformed since mid-August. If DE can deliver strong earnings and communicate a bright outlook, this could help get the stock out of its current downtrend.

- DE earnings are expected to come in at $7.49 EPS.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

See Related Articles on TradewinsDaily.com

Heap of Economic Data Due on Shortened Week

Chart of the Day: Generac Holdings (GNRC) on the Move

Exploiting The SPY Move For Potential Profit

STX: Gaining Significant Momentum

© 2023 Tradewins Publishing. All rights reserved. | Privacy Policy | Terms and Conditions | Contact Us

Auto-trading, or any broker or advisor-directed type of trading, is not supported or endorsed by TradeWins. For additional information on auto-trading, you may visit the SEC's website: All About Auto-Trading, https://www.sec.gov/reportspubs/investor-publications/investorpubsautotradinghtm.html

TradeWins does not recommend or refer subscribers to broker-dealers. You should perform your own due diligence with respect to satisfactory broker-dealers and whether to open a brokerage account. You should always consult with your own professional advisers regarding equities and options on equities trading.

1. The information provided by the newsletters, trading, training and educational products related to various markets (collectively referred to as the "Services") is not customized or personalized to any particular risk profile or tolerance. Nor is the information published by TradeWins Publishing ("TradeWins") a customized or personalized recommendation to buy, sell, hold, or invest in particular financial products. The Services are intended to supplement your own research and analysis.

2. TradeWins' Services are not a solicitation or offer to buy or sell any financial products, and the Services are not intended to provide money management advice or services.

3. Past performance is not necessarily indicative of future results. Trading and investing involve substantial risk. Trading on margin carries a high level of risk, and may not be suitable for all investors. Other than the refund policy detailed elsewhere, TradeWins does not make any guarantee or other promise as to any results that may be obtained from using the Services. No person subscribing for the Services ("Subscriber") should make any investment decision without first consulting his or her own personal financial adviser, broker or consultant. TradeWins disclaims any and all liability in the event anything contained in the Services proves to be inaccurate, incomplete or unreliable, or results in any investment or other loss by a Subscriber.

4. You should trade or invest only "risk capital" money you can afford to lose. Trading stocks and stock options involves high risk and you can lose the entire principal amount invested or more.

5. All investments carry risk and all trading decisions made by a person remain the responsibility of that person. There is no guarantee that systems, indicators, or trading signals will result in profits or that they will not produce losses. Subscribers should fully understand all risks associated with any kind of trading or investing before engaging in such activities.

6. Some profit examples are based on hypothetical or simulated trading. This means the trades are not actual trades and instead are hypothetical trades based on real market prices at the time the recommendation is disseminated. No actual money is invested, nor are any trades executed. Hypothetical or simulated performance is not necessarily indicative of future results. Hypothetical performance results have many inherent limitations, some of which are described below. Also, the hypothetical results do not include the costs of subscriptions, commissions, or other fees. Because the trades underlying these examples have not actually been executed, the results may understate or overstate the impact of certain market factors, such as lack of liquidity. Simulated trading services in general are also designed with the benefit of hindsight, which may not be relevant to actual trading. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. TradeWins makes no representations or warranties that any account will or is likely to achieve profits similar to those shown.

7. No representation is being made that you will achieve profits or the same results as any person providing testimonial. No representation is being made that any person providing a testimonial is likely to continue to experience profitable trading after the date on which the testimonial was provided, and in fact the person providing the testimonial may have experienced losses.

8. The author experiences are not typical. The author is an experienced investor and your results will vary depending on risk tolerance, amount of risk capital utilized, size of trading position and other factors. Certain Subscribers may modify the author methods, or modify or ignore the rules or risk parameters, and any such actions are taken entirely at the Subscriber's own election and for the Subscriber's own risk.

|

0 Response to "Heap of Economic Data Due on Shortened Week"

Post a Comment