Ticker Reports for May 27th

What is a Short Call Butterfly Spread? Explanation with Examples

The short call butterfly spread is also referred to as a short butterfly with calls or a short call butterfly trade. This is an advanced options trading strategy used to capitalize on a medium to large underlying price move in either direction. This strategy is also conducive to volatile and trending markets, especially with high implied volatility (IV).

A short call butterfly spread limits your downside risk while capping upside gains. You receive a credit once the trade is executed and all 4 options positions are established, which means you receive the profit upfront. While brokerage platforms may enable you to place the trade simultaneously, yours may require you to place it manually.

Components of the Short Call Butterfly Spread

A short call butterfly utilizes 3 equal distant strike prices: 1 high strike in-the-money (ITM) call, 2 middle strike at-the-money (ATM) calls, and 1 low strike price out-of-the-money (OTM) call. Like a butterfly, there is a body, which is the middle strike price and 2 wings, which are the high strike and low strike prices.

A short call butterfly spread is executed by shorting/selling 1 high strike ITM call, 1 low strike call OTM, and buying 2 long mid-strike ATM calls. For example, if we wanted to execute a short call butterfly spread on XYZ, we would short 1 XYZ $70 call, buy 2 XYZ $65 calls and short 1 XYZ $60 call. All options have the same expiration date.

Another way to a short call butterfly is to consider it a combination of 2 strategies, which include a bull call spread and a bear call spread. The bull call spread is comprised of buying 1 lower strike call and selling 1 higher strike call. A bear call spread is comprised of selling 1 lower strike call and buying 1 higher strike call. The final result is a short 1 higher strike call, short 1 lower strike call, long 2 medium ATM strike calls, and 2 wings and a body in the middle. It is the opposite of a long call butterfly spread, which is meant to capitalize on range-bound stocks.

Practical Examples of Short Call Butterfly Spreads

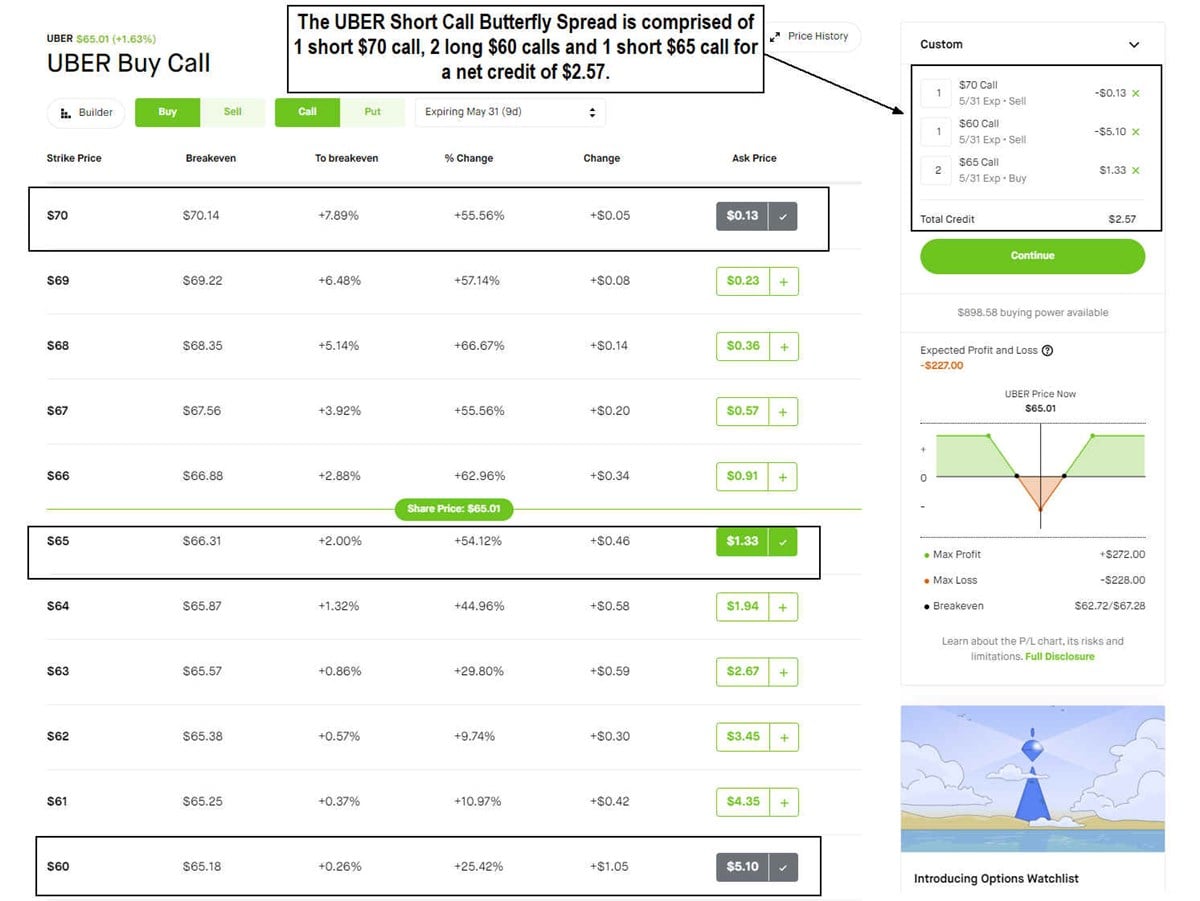

Let's use a real-world example with a computer and technology sector stock, Uber Technologies Inc. (NYSE: UBER).

On May 22, 2024, UBER was trading at $65. Let’s assume we want to construct a short call butterfly spread, which would require two wings and a body.

How to Execute a Short Call Butterfly Spread

Now that we know how to construct a short call butterfly spread, it’s time to execute the strategy. Let’s break it down into 5 steps:

Step 1: Assess Market Conditions

The macro market conditions can directly and indirectly affect your trade. Since 70% of a stock's move is often attributed to the macro market conditions, we want to be mindful of the benchmark indexes like the S&P 500 or Nasdaq 100. Ideally, we want to have volatility and a strong trending market to have the best chance for the butterfly spread to play out. You can also check the VIX, which is the volatility index for the S&P 500. A VIX reading above 20 is considered high volatility. The medium VIX is between 13 to 19. A low VIX reading is 12 or below. A low VIX reading doesn't rule out a short butterfly spread trade. It just means the wind is not blowing heavily on our backs.

Step 2: Select the Right Strike Prices

Since UBER is trading right at $65, we can use that as the middle or mid-point ATM strike or the body. The wings would entail equidistant strikes from the middle strike price. If we choose a 5-point spread, then we would select the $70 and the $60 strikes since they are both 5 points away from the $65 mid-point strike.

As a rule of thumb, the wider the spreads, the higher your potential profit, but the probability of reaching max profit or even breakeven drops. On the flip side, your profit potential shrinks as spreads get tighter, and the probability of achieving breakeven to max profits rises.

Step 3: Set Up the Options Trades

To set up the trade, we can see the quotes for the UBER May 31, 2024, expiration calls. We decided to use the $65 ATM calls for the midpoint and body and the $70 and $60 strikes as the wings. The strategy will consist of three trades comprised of four options positions.

The short call butterfly spread would be comprised of the following:

Short 1 UBER $70 strike call at 13 cents

Long 2 UBER $65 strike calls at $1.33

Short 1 UBER $60 strike call at $5.10

The 1 UBER short $70 strike call and 1 UBER long $65 call is a bull call spread. The 1 UBER short $60 strike call and 1 UBER long $65 call is a bear call spread. It's 4 positions that share 3 strike prices.

The resulting short call butterfly spread results in a $2.57 credit or $257 paid to us upfront.

Step 4: Monitor and Adjust the Spread

Once your short call butterfly spread is constructed and executed, you will have to monitor the position. The underlying stock will also be moving. The breakeven price levels are at $62.72 and $67.28. This means UBER needs to fall below $62.72 or rise through $67.28 or higher on expiration to be profitable trades. If UBER rallies to $70 or falls to $60, you may consider closing out the trade before expiration. Keep in mind that Theta is your friend, so closing out the trades before expiration will cost you some premium. Also, remember that Theta erodes quickly from one week before expiration.

Potential Risks and Rewards

The maximum profit potential on the trade is $257, which is the credit received upfront when we execute the short call butterfly spread. With credit spreads, you receive the good news first with a payment upfront, and it can only go down from there. The max profit occurs if UBER closes at or above the $70 upper strike or at or below the $60 lower strike on expiration. The max profit is calculated by subtracting the cost of the 2 long calls ($2.66) at the center strike from the credit received on the 2 short calls ($5.23) at the upper and lower strike prices. Each contract is worth 100 shares, so the $2.57 max profit equates to $257.

The maximum loss potential on the trade is $243. This occurs if UBER stays at the $65 mid-point or center strike price on expiration. The max loss is calculated by the spread between the lowest and center strike price of $5 minus the premium received of $2.57, resulting in $243.

Breakeven levels occur at $62.72 and $67.28 on the upside. As UBER moves beyond the breakeven levels, the position starts to earn profits. While it would be nice to hit maximum profit by having UBER close at or beyond the wing strikes, it only has to move beyond breakeven to start making profits.

Conclusion

You're all set! In this article, we reviewed what is and how to construct a short call butterfly spread, which is basically a combination of a bull call spread and a bear call spread. We reviewed the 5 steps to executing a short call butterfly spread using UBER as a real-world example and covered the risks and potential outcomes of the trade. Take your time and practice on a demo account if you can before risking real cash.

Advance Your Investment Game with MarketBeat

For further education and tools on your stock market journey, check out the products on MarketBeat.

Exposed: 3 CENT Crypto to Explode June 24th?

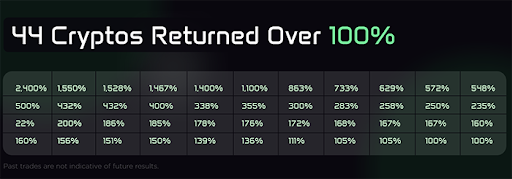

Chris Rowe – the man who recommended Amazon in 1998… Bitcoin and Ethereum in 2017…

And has spotted 44 different coins that have returned over 100%...

Today, he is now making the biggest crypto call of his ENTIRE career…

First Quarter Wrap-Up Reveals Retail's Shifting Sands

The retail sector was once characterized by predictable earnings seasons and long-established retail giants seemingly unshakeable in their dominance. However, the sector finds itself in a period of evolution with the rise of eCommerce. Electronic commerce has fundamentally reshaped the retail industry, ushering in an era of volatility and heightened competition. Persistent inflation continues to reshape consumer behavior, driving a heightened emphasis on value and affordability.

Simultaneously, spending patterns have started to reflect a shift away from goods, which dominated during the pandemic's peak, toward services, perks and experiences. Despite these evolving sector dynamics, the retail e-commerce arena continues its relentless expansion, intensifying competition and forcing traditional players to adapt or be left behind. The new era of ruthless competition means that companies must constantly evolve their strategies, consumers gain more power and choice than ever, and investors must navigate a landscape of heightened risk and significant opportunity.

Walmart: Value-Driven Growth and Omnichannel Power

Walmart (NYSE: WMT) is widely considered the undisputed titan of retail. Walmart’s earnings report shows that the company continues to show its strength. Walmart’s financial report showed consolidated revenue of $161.5 billion for the first quarter of 2025, a robust 6% increase compared to last year. This sustained growth underscores the effectiveness of Walmart's unwavering focus on value. The value-oriented strategy resonates deeply with price-sensitive consumers navigating an environment of persistent inflation.

A key driver of Walmart's success is its multi-pronged omnichannel approach, seamlessly blending its physical store network with a rapidly expanding digital presence. This strategic synergy is most evident in the remarkable 21% surge in global eCommerce sales, demonstrating the company's ability to capture a growing share of online shoppers. Walmart's well-developed fulfillment system, especially its in-store pickup and delivery options, addresses the increasing consumer demand for convenience. It empowers customers to make purchases based on their preferences, whether in-store, online, or through a blend of both channels.

However, even giants face headwinds. While Walmart's overall performance remains strong, comparable sales growth in the U.S. has decelerated compared to the previous year, signaling potential saturation in its core market. Furthermore, while partly attributable to timing factors, a decline in operating cash flow warrants close attention as it could indicate underlying pressures on profitability. Despite these challenges, Walmart remains optimistic, updating its fiscal year 2025 guidance to reflect confidence in meeting or exceeding the high end of its previous projections for net sales and operating income growth. This positive outlook underscores the company's belief in its ability to leverage scale, efficiency and a deep understanding of its customer base to navigate a changing market.

Macy's "Bold New Chapter"

Macy's (NYSE: M), the renowned department store chain, is poised at a critical turning point in its corporate journey. Macy’s earnings report revealed a strategic shift for the company as it embarks on a strategic transformation aptly named "A Bold New Chapter." Macy’s ambitious turnaround plan seeks to revitalize the brand by moving away from its traditional discount-driven model and toward a more curated, premium shopping experience. However, as with any significant transformation, the path is rarely linear, and the first quarter's results reflect the inherent challenges of such a strategy shift.

Macy’s financial report showed a net sales decline of 2.7%, reaching $4.8 billion for the quarter. The decline indicates the ongoing work needed to win back consumers who have grown accustomed to promotions and discounts. This overall sales decline is further emphasized by a dip in comparable sales, signaling a need to fine-tune the balance between premium offerings and value propositions to resonate with a broader audience.

Despite these top-line challenges, hope emerges from specific segments within the Macy's portfolio. The company's "First 50" locations, strategically chosen to pilot this new premium approach, have shown encouraging results. These stores, representing a model for future expansion, achieved a commendable 3.3% growth in comparable owned sales, suggesting that the strategy, while still in its early stages, holds promise. Furthermore, the positive performance of Bloomingdale's and Bluemercury, brands that cater to the more affluent demographic, demonstrate the strength of segments within the broader Macy's brand.

Macy acknowledges the considerable work ahead in fully implementing its "Bold New Chapter" strategy. Macy’s revised its full-year earnings guidance for FY 2024. The company now projects earnings per share (EPS) between $2.55 and $2.90, with revenue anticipated to fall between $22.3 billion and $22.9 billion. This revised outlook met with a mix of hold and buy ratings from equities research analysts. The ratings underscored Macy's challenges as it navigates persistent inflationary pressures, evolving consumer preferences, and a dynamic competitive landscape. Despite these challenges, Macy's dividend announcement of $0.1737 per share of Macy’s stock, payable on July 1st, signals confidence in its ability to navigate these shifting sands and deliver returns to its investors.

Target: Balancing Between Challenges and Strategy

Target (NYSE: TGT) faces a challenging environment as inflation squeezes consumer discretionary spending. This pressure is evident in Target’s earnings report, which reveals a 3.7% decline in comparable sales. Although concerning, the quarterly decline in performance indicates an improvement over the previous quarters, offering investors a glimmer of hope that the most severe challenges might be conquerable.

Despite the headwinds in the consumer discretionary sector, Target's digital channels have demonstrated resilience, with digital comparable sales growing by 1.4% in the quarter. This positive trend highlights the enduring importance of e-commerce and Target's ongoing efforts to enhance its online shopping experience. Further emphasizing its commitment to customer engagement, Target successfully relaunched its popular Target Circle loyalty program to cultivate brand affinity and drive repeat purchases. Target aims to solidify its position as a destination for value-conscious consumers by offering personalized deals, recommendations, and an improved digital interface.

In addition to the ongoing pressure on discretionary spending, Target is grappling with increased selling, general and administrative (SG&A) expenses. These elevated costs, partly attributable to strategic investments in their workforce and marketing initiatives, could further erode profit margins if not carefully managed.

Despite a challenging first quarter, Target projects a return to growth, forecasting a 0% to 2% increase in comparable sales for the second quarter. This cautious optimism is also reflected in their full-year guidance, which anticipates a similar 0% to 2% comparable sales increase and earnings per share ranging from $8.60 to $9.60. Achieving these targets will require adept execution, demanding Target effectively manage rising costs, optimize inventory levels, and strike a delicate balance between price competitiveness, which attracted its core customer base, and the brand desirability it has cultivated in recent years.

A Comparative Lens on Performance

It is essential to look beyond top-line figures to better understand these retail giants' performance. By examining key financial ratios, we can gain insights into their financial health, efficiency and risk profiles, providing a good comparison for the retail investor.

A key indicator of profitability is the gross margin rate, which reflects the percentage of revenue retained after accounting for the cost of goods sold. Walmart maintains a clear advantage in this area, reflecting its scale and efficiency in procuring and distributing goods. In the middle of its strategic shift, Macy's faces pressure on its gross margin as it seeks to balance premium offerings with competitive pricing. Impacted by a higher mix of discretionary goods and increased promotional activity, Target also lags behind Walmart in this metric.

Another crucial measure is the operating margin rate, which provides insight into a company's ability to control operating costs and convert revenue into profit. Here again, Walmart's operational prowess shines through, boasting a higher operating margin than Macy's and Target. This superior performance stems from a combination of efficient supply chain management, a lean cost structure and the ability to leverage its vast scale to negotiate favorable terms with suppliers.

Inventory turnover is the metric that measures how efficiently a company manages its inventory, revealing another aspect of operational efficiency. A higher inventory turnover ratio generally indicates that a company is selling its products quickly and efficiently, reducing the risk of obsolescence and minimizing storage costs. In this regard, Walmart demonstrates its prowess again, boasting a significantly higher inventory turnover rate than Macy's and Target. This superior inventory management reflects Walmart's sophisticated supply chain capabilities and focus on high-volume, essential goods.

Finally, examining the debt-to-equity ratio offers a glimpse into a company's financial leverage and risk tolerance. A lower ratio indicates that a company relies less on borrowed funds and more on shareholder equity, generally signifying lower financial risk. In this aspect, Macy's stands out with the lowest debt-to-equity ratio, suggesting a more conservative approach to financing its operations. While carrying more debt, Walmart boasts a strong cash flow, mitigating some risks associated with higher leverage. Target falls somewhere in between, balancing utilizing debt to fund growth initiatives and maintaining a manageable debt load.

The Digital Frontier: Three eCommerce Strategies

The digital part of the equation continues to reshape retail, demanding constant adaptation and innovation. Despite its massive size, Walmart has demonstrated remarkable agility, rapidly scaling its e-commerce operations to become a formidable force in online retail. Its strategy centers on leveraging its vast store network for fulfillment, enabling convenient pickup and delivery options that rival dedicated online retailers.

Traditionally committed to brick-and-mortar retail, Macy's has been slower in embracing the digital shift. However, its "Bold New Chapter" plan acknowledges the importance of a robust online presence. Macy's is investing in enhancing its website and mobile app, expanding its online assortment and improving the digital shopping experience. Furthermore, the company is exploring marketplace opportunities, allowing third-party sellers to offer products on its platform, potentially expanding its reach and attracting a broader customer base.

With its strong digital foundation, Target continues refining its omnichannel approach. The company's investments in store-based fulfillment, including its popular Order Pickup and Drive-Up services, demonstrate its commitment to seamlessly blending its physical and digital channels. Additionally, Target's strategic partnerships with delivery services like Shipt further expand its reach and provide customers with flexible fulfillment options.

The Q1 2024 retail earnings illustrate the multifaceted dynamics shaping the retail industry. Despite each company's unique approach, specific commonalities have emerged. These recurring themes encompass the imperative significance of value-oriented offerings, the unstoppable growth of eCommerce, and the imperative for agility and innovative strategies in a constantly changing market sector. The retail earnings season has taught investors that success, despite an uncertain future, belongs to those who can anticipate and adapt to the changing needs and desires of the consumer. Investors seeking to capitalize on the opportunities within this market must stay informed about these evolving trends and carefully assess each company's strategic choices and risk profiles.

Just $9 for a Year of Winning Market Insights

Today, I'm offering you the chance to receive a PLATINUM BTM subscription for up to 90% OFF! If you want to see just how much your mystery discount is...

You can UNCOVER YOUR MYSTERY DISCOUNT HERE!Williams-Sonoma Stock Forecast to Hit $500? Here's How

Williams-Sonoma’s (NYSE: WSM) stock price is heading to $500 for three reasons: its market, operations, and technical outlook. All else aside, the technical action has been robust for the last year and shows little signs of slowing. The latest earnings report has the market up to a new high, breaking out of a consolidation range and heading higher, driven by sustainable operations, margin strength, cash flow, and capital return. Because the rally preceding the breakout is worth nearly $200 or 200%, it could advance by those figures again, putting the minimum target at $500 or more than 50% from the $330 level.

Williams-Sonoma had a Cosy Quarter, Widening Margin and Outperforming

Williams-Sonoma’s Q1 results are mixed, with revenue aligning with the consensus and earnings outperforming. The top line contracted by 5.7%, which is not good, but the contraction was expected due to post-COVID normalization and the impact of high interest rates and inflation on retail.

However, results are mixed segmentally, highlighting the company’s diversification and resilience in core markets. Pottery Barn was the weakest link, with a contraction of 11%. West Elm also contracted by 4%, but the core Willams-Sonoma brand and Pottery Barn Kids grew. WSM grew by 0.9% and PBK by 2.8%, but the big news is the margin.

Williams-Sonoma’s earnings results have shown brand strength, pricing power, and consumer resilience for years, but the new data surpasses the high end of expectations. Even when adjusting for an out-of-quarter event, the margin widened at the gross and operating levels on favorable merchandise margin and supply chain efficiency. The GAAP EPS of $4.07 beat by $1.37, including the out-of-quarter addition; adjusted for it, EPS of $3.48 is $0.80 better than last year and nearly $0.80 above the consensus, leading the company to raise its guidance.

Williams-Sonoma reiterated its revenue guidance but raised the outlook for earnings. The company now expects an operating margin of nearly 18%, which is at the high end of its long-term goal. The news was well-received because it puts the consensus estimate reported by Marketbeat.com well below the new range and plays into the capital return outlook.

Williams-Sonoma is a Fortress That Pays you to Own it

Williams-Sonoma’s cash flow is robust and allows for solid capital returns. The Q1 results provided enough operating capital to pay dividends, repurchase shares, and build cash on the balance sheet. Cash is up roughly 6X compared to last year, with inventory down but only marginally compared to the cash build. Cash and inventory are now equal in size; the company is in lean shape and prepared to invest as it needs. Balance sheet highlights also include increased current and total assets, total liabilities down, no debt, and a 50% increase in equity.

The dividend is worth about 1.45% with shares at their new high, which is not a large payout but reliable and growing. The company is on track to equal Dividend Aristocrat quality within the next ten years and is increasing the payout at a substantially high 16% CAGR. Repurchases benefit shareholders, reducing the diluted count by a 2% average for the quarter, and are expected to continue through year-end.

Williams-Sonoma Hits New High on Margin Strength

Williams-Sonoma’s stock price surged more than 5% on the news and hit a new high. The bad news is that profit-taking gripped the market, causing it to sell off from the opening high. The move does not negate the power of the breakout, but sellers may cap gains in the near term. The critical support target is the previous all-time high. If that level holds, a rebound should form soon. If not, WSM stock could fall to $300 or lower before resuming the uptrend.

0 Response to "🌟 Williams-Sonoma Stock Forecast to Hit $500? Here’s How"

Post a Comment