2 Stocks to Buy… and 1 to Sell Immediately VIEW IN BROWSER “The only thing I want to know,” investment guru Charlie Munger once quipped, “is where I'm going to die so I never go there.” Warren Buffett’s right-hand man was onto something. Imagine if someone could avoid every possible car crash and physical disaster. Their life would last significantly longer, even if not indefinitely. The same is true for investing. If you had a magic sorting hat that could separate every stock that goes down, the remaining companies would consist entirely of winners… making it virtually impossible to underperform. It’s much like the Eat This, Not That books that suggest readers consume Big Macs (540 calories, 29g fat) instead of the Cheesecake Factory’s Chicken and Avocado Salad (1,830 calories, 130g fat).

Fortunately, we don’t need to be in a magical world (or on a diet) to obtain that kind of advice. Consider bond ratings – a relatively objective view of a company’s financial health. Of the 376 S&P 500 companies rated by Moody’s in 2020 that still actively trade, here’s how they have performed: - Prime-1 (Aaa through A3): +74.7%

- Prime-3 (Baa1 through Baa3): +53.1%

- Not Prime (Ba1 and lower): +52.2%

Simply avoiding companies rated “Not Prime” would have meant achieving far better returns at lower risk. The outperformance is even greater if you consider the junk-rated firms that went bankrupt and no longer trade, such as Pioneer Natural Resources and Rite Aid. In a new presentation, legendary investor Eric Fry puts this concept into overdrive – recommending stocks that will soar while getting out of companies set to plummet. Essentially, he believes we’re entering an Age of Chaos, where previously reliable, household names are upended by a surge of dynamic, surprising companies that are poised to grow faster than we’ve seen before. You can watch that presentation here. In the meantime, I’d like to illustrate this concept with three companies in the basic materials sector, the industry that mines the earth for raw materials. Through this, it will become clear how Eric’s “Buy This, Not That” strategy can provide strong long-term returns, no matter how obvious the thesis might seem. | Recommended Link | | | | Elon Musk says his upcoming innovation could be the “biggest product of all time”… And by the looks of things, it could turn out to be one of the biggest profit opportunities we’ve ever seen… So much so that NVIDIA’s CEO Jensen Huang says it could be the “next trillion-dollar industry”. But if you want a shot at astronomical returns… You have to make this simple move. Because it might be the best way to potentially profit from Elon’s upcoming launch if you’re not an insider. |  | | Buy This… When I consider basic materials companies, the most important factor I consider is whether demand for the underlying commodity is: - Going up

- Staying the same

- Going down

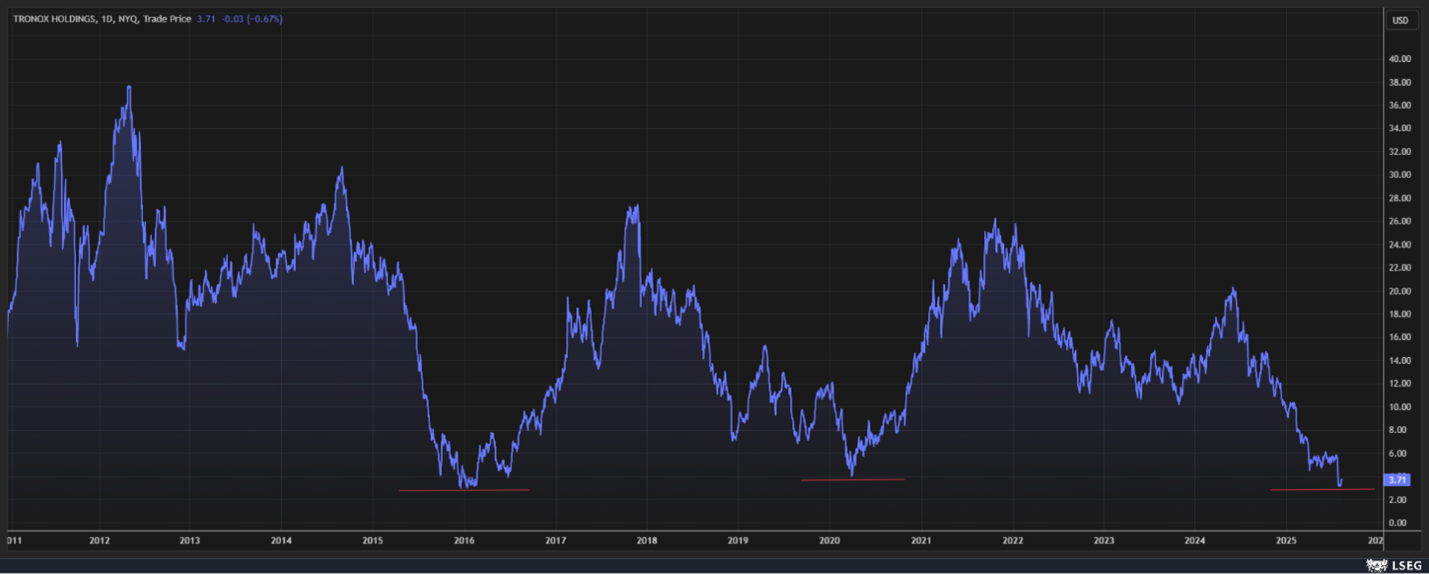

Poorly run extraction firms with high-cost assets can succeed if the world needs more of a product. (In fact, high operating leverage means the fundamental value of high-cost miners typically rises faster than low-cost ones during a commodity boom.) Meanwhile, even the best-run miners with low-cost assets will suffer when commodity prices fall. That leads us to Tronox Holdings PLC (TROX), one of the “Big 3” American producers of titanium dioxide (TiO2). TiO2 is a whitening compound found in paints, plastics, paper… and even in toothpaste and sunscreen. It is also widely used in coatings and industrial greases for its heat stability and wear resistance. This industrial exposure makes TiO2 a relatively cyclical commodity. If consumers are buying fewer new cars and houses, there’s far less demand for the white paints and coatings that companies like Tronox provide. The vertical integration of the “Big 3” producers further exaggerates these cycles, because this reduces supply elasticity. Today, shares of Tronox trade as if the underlying demand for TiO2 will entirely disappear. Shares trade at under $4, well below the more typical $15 to $20 range of normal periods. We saw similar drawdowns during the 2016 and 2020 market cycles.

Tronox stock, 2011 to present Yet, we all know that the world has not moved on from TiO2. Houses still need to be primed and painted. Cars need protective coatings. One might even argue that the AI data center boom is benefiting TiO2 sales as operators seek to cut cooling costs with white roofs. We haven’t found a substitute yet for the titanium-based pigment.

A before-and-after photo of a data center reroofing project That should benefit Tronox, which has seen a flurry of insider buying over the past several weeks, a typically bullish sign. - Three members of the Board of Directors bought 70,000 shares between August 5 and August 13

- The Chief Financial Officer bought 37,000 shares on August 1

- The Commercial and Strategy Officer bought 12,600 shares on August 1

- The CEO bought 100,000 shares on August 1

And so, despite the risks surrounding Tronox’s leveraged balance sheet and junk-bond rating, shares should recover 3X in the coming two to three years as demand normalizes. The stock may have a 20% chance of going to zero if the down-cycle persists longer than Tronox’s cash can hold out… but it also has an 80% chance of rising back into double digits. If you’re willing to make that kind gamble, then TROX is a bet worth taking. … And This… Meanwhile, the three materials-focused firms I recommended in early July are already up double digits: - Albemarle Corp. (ALB): +23%

- Plug Power Inc. (PLUG): +17%

- USA Rare Earth Inc. (USAR): +76%

That’s because these three companies all have one thing in common: The AI robotics revolution. Over the coming decade, the world will be seeing far more self-driving cars, humanoid robots, and AI-powered machines. And that means far greater demand for the lithium-ion batteries and hydrogen fuel cells that power these devices. After all, no one will want a gas-powered robot operating in their house. I’d like to reiterate a “Buy” in Albemarle this week. Last Monday, news broke that China’s largest battery maker, Contemporary Amperex Technology Co. Ltd. (CATL), was forced to halt production at its biggest mine after a license expired. The disruption fueled a lithium rally that began in late June, and prices are up 30% since the start of the rally. At the same time, industrial firms are accelerating the shift from traditional lead-acid batteries to lithium-ion. On Tuesday, forklift maker Raymond Corp. unveiled a new “drop-in” lithium iron phosphate battery system, enabling forklifts to swap power packs in seconds. This innovation could also speed adoption of lithium-ion in industrial robots. Coupled with rising solar power generation, these developments signal that lithium demand will rise, not fall, as AI technology advances. With low-cost Chilean assets and a fortress balance sheet, Albemarle is well-positioned to benefit, even if the recovery takes longer than expected. … but Not That On the other hand, not every basic material company is benefiting from the AI Revolution. And among the companies to avoid here is Alliance Resource Partners LP (ARLP), America’s second-largest coal producer. The coal industry in the Eastern U.S. is not healthy. Decades of extraction mean that the lowest-cost deposits in the Appalachian region have already been mined. Firms in Pennsylvania and West Virginia must contend with digging ever deeper (at higher cost) to extract the remaining anthracite coal. Meanwhile, coal from the Illinois Basin has become increasingly cost-prohibitive as well. These high-sulfur, lower-grade deposits gained popularity in the 1950s as a substitute for Appalachian coal but have since lost competitiveness to newer reserves from Wyoming’s Powder River Basin. “Twenty years from now, most of the Illinois Basin coal industry will be gone,” analysts for the Institute for Energy Economics and Financial Analysis (IFEEFA) wrote in 2019. Alliance Resource Partners has the misfortune of operating in both high-cost regions. The company expects to mine 25.4 million short tons of Illinois Basin coal this year, and 8.0 million short tons of Appalachian coal. Earnings per share fell 40% last year and are expected to slide another 20% this year. Some may hope for a turnaround. America’s power grid has become strained by added demands from AI data centers, and President Trump has promised to “Reinvigorate America’s Beautiful Clean Coal Industry” through an April executive order. However, high-cost producers like Alliance Resource Partners will face stiff competition from cheaper rivals in the Powder River Basin, where strip-mined coal costs less than one-third the price of Illinois Basin coal and about one-sixth that of Appalachian coal. It’s no surprise that other Illinois Basin operators, including Murray Energy and White Stallion Energy, have recently filed for bankruptcy. ARLP will also face substitution from natural gas, which typically has low extraction costs. So, investors shouldn’t hold their breath for a recovery in ARLP. No matter how well-managed a mining firm is, it can’t escape the basic economics of unattractive “sunset” assets. An Immediate Buy Tronox and Albemarle only scratch the surface of the AI Revolution. After all, these companies sit at the very top of supply chains. Most value is usually gained further down. That’s why I highly recommend you watch Eric’s latest presentation. In this new free broadcast, Eric shares seven free “Sell This, Buy That” recommendations – complete with names and tickers. Among these ideas are one company to replace Amazon.com Inc. (AMZN), another to rival Tesla Inc. (TSLA), and a third to upset Nvidia Corp. (NVDA). These little-known stocks are poised to overtake these three reigning AI darlings, Eric says. He believes you can use them to protect and multiply your money in these make-or-break markets. Check it out here. And I’ll see you back here next week. Regards, Thomas Yeung, CFA

Market Analyst, InvestorPlace |

0 Response to "2 Stocks to Buy… and 1 to Sell Immediately"

Post a Comment