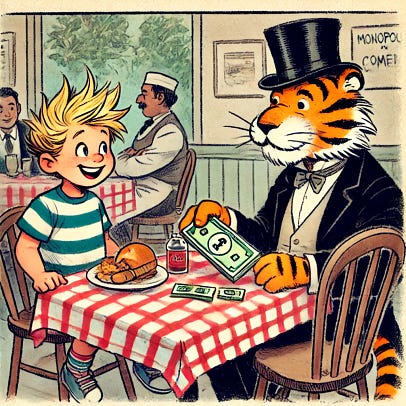

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. An Ode To Legal Tender... For All Debts Public and PrivateThe seven most powerful words in the global economy are hiding in plain sight on every dollar bill.Dear Fellow Traveler: You're at a fancy restaurant… When the check arrives, you announce you'll be paying with Monopoly money. The waiter laughs. You pull out a crisp $100 bill and point to the small print:

The waiter stops laughing. You've just witnessed the most understated declaration of financial dominance in human history. These seven little words control $100 trillion in global commerce. Yes… The money reads…

Most people read it like software or credit card terms of service. They skip right over it. Big mistake. Those seven words aren't a suggestion. They're a legal decree that every debt in America must be settled in Uncle Sam's green paper…. from your morning coffee to the national debt. But what does "legal tender" actually mean? It doesn't mean a store has to accept cash for your latte. It does mean any creditor… public or private… must accept dollars for what you're legally owed. If you offer them and they refuse, the debt's legally discharged. (I once enforced this at a Chinese restaurant when only paying in ones… it went bad…) Your mortgage company can't demand gold. The IRS can't insist on euros. Courts can't order restitution in Bitcoin. If you show up with dollars, the debt is legally extinguished. Period. This isn't capitalism. It's a government monopoly on debt settlement. The Debt EconomyAmerica doesn't run on money. We run on debt. Every dollar in circulation is someone's liability. The entire financial system is just people owing each other money. And every single obligation must be settled in dollars. What's worse, all of the existing debt in the system has to be refinanced. As Michael Howell notes, six out of every seven NEW dollars in global rotation now are used to refinance debt… Not finance growth. It's just a perpetual refinancing cycle. And as NEW debt enters the picture, there's a new dollar-based liability. Every business transaction, mortgage payment, credit card swipe, and lawsuit settlement in America creates a legal obligation payable only in dollars. Want to buy a house? Dollars. Pay it off? Dollars. Declare bankruptcy? The court liquidates your assets... for dollars. You cannot escape the system. It's A Trap"Private debts" trap Americans. But "public debts"? That's where we're all impacted… Every government bond, Social Security payment, and tax obligation must be denominated in dollars. The government made itself the ultimate debtor and creditor simultaneously. When you pay taxes, you're extinguishing a debt in dollars. When the government pays Social Security, it's settling a debt in dollars. When foreign countries buy Treasury bonds, they're accepting promises to be repaid in dollars. It's a closed loop where the government is the only entity that can both demand dollars (through taxes) and create dollars (through spending). Like owning the casino, printing the chips, and being the only legal place to cash them out. Then, there's the rest of the world’s reaction to all this… Other countries need dollars to trade with each other, not just with us. Brazil buying Saudi oil? Dollars. Japan importing Australian iron ore? Dollars. Germany buying Chinese electronics? Dollars. So foreign governments accumulate massive stockpiles of our debt to keep their economies functioning. They work and produce real goods... in exchange for our promises to pay them back in our currency. When we print money to solve our problems, that inflation gets exported globally. We create the problem, and the world pays the price. And that's why they want to offboard. This is why there's a shift to diversify… and why so many global central banks are hoarding gold. The Challengers' DilemmaIt’s not like other countries aren’t trying to challenge our debt… China promotes the yuan. Russia trades in rubles. The EU dreams of euro dominance. Crypto enthusiasts think digital currencies will replace everything. But here's the issue for the world: $300 trillion in debt. All those countries accumulated massive dollar debts over decades. Even if they wanted to switch currencies, they still owe trillions in dollars. You can't pay off dollar debt with yuan or Bitcoin. You need dollars. So even countries that hate the dollar system are trapped by their own borrowing. That's the evil genius of "legal tender for all debts, public and private." It doesn't matter if the dollar loses 95% of its purchasing power. It doesn't matter if inflation runs at 20%. It doesn't matter if everyone loses confidence in American economic management. Sure, inflation weakens trust. But as long as the courts enforce dollar-denominated contracts, demand stays intact… even if the money's melting. As long as debts exist, dollars will be needed. And in a debt-based economy, debts always exist. Americans aren't exempt. Add up all U.S. debt, and it’s $98 trillion… that's corporate, household, municipal, and federal debt combined, everything from mortgages to Treasury bonds. That's $98 trillion reasons why Americans need dollars, regardless of how they feel about monetary policy. You might think the Federal Reserve is incompetent. You might believe gold is superior money. You might think Bitcoin is the future. Doesn't matter. You still need dollars to pay your mortgage. Financial AlchemyWhat we've created is financial alchemy… We’ve transmuted legal words into economic reality. Seven words on paper became the foundation of global commerce in the 1930s... It's not backed by gold, productivity, or fiscal responsibility. It's backed by legal obligation. The most powerful force in economics isn't supply and demand. It's the law. Previous reserve currencies competed with other currencies. The dollar doesn't compete with currencies. It competes with the legal system. Of course, dollar dominance also rides on trade flows, global banking rails, and trust in U.S. institutions… but without the legal engine beneath it all, the whole machine breaks down. Good luck getting Congress to let you pay taxes in Bitcoin. Good luck getting courts to enforce gold contracts. Good luck getting banks to abandon the currency underpinning every loan they've made. America issues the debt… it sells it to the world… it then prints the money to pay it back… then it exports inflation… and still everyone needs more dollars. Have another drink… It's the only debt trap where the debtor controls the currency, the court, and the terms… and the creditor keeps coming back for more. When Systems BreakHere's the thing about traps… Eventually, the animal chews off its own leg to escape. Countries are already trying. Central banks are buying gold at record rates. China and Russia are building alternative payment systems. The BRICS nations talk about commodity-backed currencies. Digital currencies promise independence from the dollar system. The world wants off this ride. But wanting out and getting out are different things entirely. Here's what makes this trap diabolical: it's strongest right before it breaks. When confidence in the dollar system starts cracking, what happens? Everyone rushes to get more dollars to pay off their existing dollar debts before the music stops. A company with a billion-dollar loan doesn't think, "Great, now I can pay this back in yuan." They think, "Holy hell, I need to find a billion dollars before this gets worse." A sovereign debt crisis doesn't eliminate the debt… it makes the scramble for dollars more desperate. That’s what happens during every liquidity event… Even if the entire world loses faith in American monetary policy tomorrow, they still owe $300 trillion that must be repaid in dollars. Legal contracts don't care about your feelings. You can't escape a debt trap by losing confidence in it. You escape by paying it off. And you can only pay it off in the currency specified in the contract. Will the system eventually break? Probably. Will some new arrangement replace it? Maybe. Will it happen overnight? No chance. The transition away from dollar dominance… if it happens… will be measured in decades, not months. And every day of that transition, those seven words remain in effect. Legal obligations don't evaporate because of geopolitical shifts. Courts don't suddenly accept payment in gold because Bitcoin hits $200,000. Mortgage companies don't switch to euros because Congress makes bad decisions. The trap persists until every dollar-denominated debt is either paid off or formally restructured. With $300 trillion in global dollar debt, that's not happening quickly. So what's the endgame? We keep printing dollars… because we can. The world keeps needing them… because they have to. Foreign countries keep accumulating our debt… because their alternatives are worse. Americans keep borrowing in their own currency… because it's the only game in town. And those seven little words keep working their magic, even as confidence erodes, even as alternatives emerge, even as the system strains under its own weight. The dollar trap doesn't require your faith. It doesn't need your confidence. It doesn't even need your cooperation. It just needs your legal obligation. It's not the most sophisticated monetary system. It's not the most fair. It's not the most stable. But it is the most legally binding. And in a world run by lawyers and accountants, that might be all that matters… until the very moment it isn't. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "An Ode To Legal Tender... For All Debts Public and Private"

Post a Comment