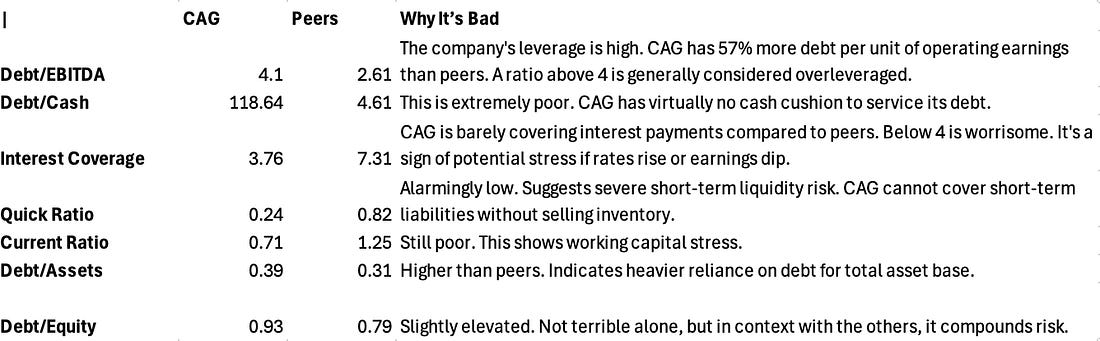

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: Today, over at Theotrade, a viewer asked me what I thought of several consumer staple stocks. One of the names: Conagra Brands (CAG). This is the company behind Orville Reddenbacker, Slim Jim, and Reddi-Wip. You know… the bare essentials. So, I pulled up the chart… And this one hit my reality like a brick to the head. When you’re constantly watching the high-flying technology stocks that are detached from their valuations… You start to forget that real companies operate on real financial metrics. The working capital metrics and interest stress on a lot of these stocks aren’t that great… Many people will look at the headlines and argue that Conagra is under pressure because of tariffs. But that trend line from the top of 2022 tells the real story. As we see, when we’re in the back half of a liquidity cycle, the shift goes into defensives in the final stages, before people start buying up duration and preparing to eat out of bean cans… Then, when the liquidity cycle bottomed out and fiscal and monetary accommodation started… money rotated to higher beta stocks. That because with each market crisis, more capital gets injected and money chases the highest outcomes possible… That’s not in defensives… That’s in NVIDIA and META… The money instantly rotates back into the Magnificent 7 - the leverage, too. All the while, with higher interest rates remaining elevated… Now, here’s Conagra, and ratios that just make me feel like something’s really off… This company makes stuff… they don’t engage in financial engineering or reach into another person’s pocket… I understand that this is still a great company. I eat a lot of their popcorn. And I can understand some of their ratios and why they are where they are. They’re an inventory-heavy model in grocery and frozen foods. I accept that… I know that leverage is supposed to be high in this sector and it’s high based on all those books that I was forced to read. Cash flow is stable. Lenders aren’t freaking out. Bankruptcy isn’t happening… but here's what stopped me cold. That Altman Z-Score is sitting at 1.54… squarely in the distress zone. For context, anything under 1.8 signals potential bankruptcy within two years. Yes, the liquidity numbers are tolerable. But my lord, if interest rates GO UP somehow, that debt-to-cash is kind of crazy. They’ve got to cover their debt. So, they’re fine… so long as nothing goes wrong… But what can go wrong? Refinancing problems. Consumer spending. Floating-rate debt. Their next major test? Refinancing anything from five years ago that was sitting in the ZIRP era in the 6% range. This is the case study of what happens when the money printer runs. When they bail out the system over and over again, and there’s this inability to realize that when they’re bailing out leveraged hedge funds to ensure stability in the bond markets (as Conagra might face more problems), This is the long tail of the zero-rate era. Years of borrowing cheap… now crashing into a wall of yield. While Tesla trades at fairy tale multiples, companies that actually make things – and feed people – are getting strangled by the Fed's war on inflation. Conagra borrowed cheaply for a decade, and now the music has stopped. This isn’t just a Conagra story. This is what happens when the system injects trillions to save the leveraged class, prints 40% of all dollars in existence, blames inflation on “supply chains,” and then chokes the economy with short-term T-bill spikes. We’re watching the slow-motion consequences. One balance sheet at a time. Conagra – maker of Slim Jims and frozen dinners – might be the canary in the coal mine for what's coming to the entire leveraged economy. It’s gonna get interesting when the liquidity cycle peaks next year… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Don't Look at This Chart..."

Post a Comment