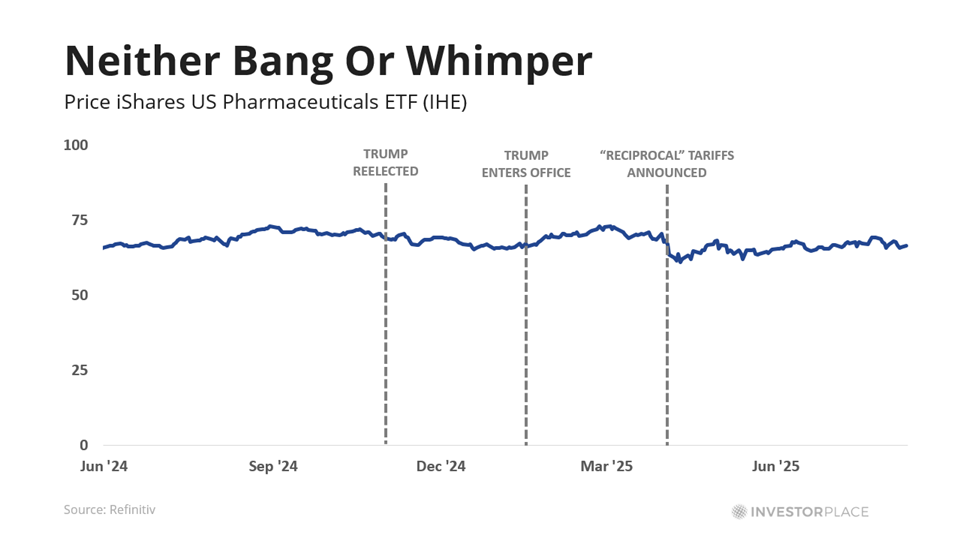

| DAILY ISSUE Drug Pricing in the Trump Era: Where to Invest Now VIEW IN BROWSER Tom Yeung here with today’s Smart Money. Most filmgoers will recognize this quote from the Lord of the Rings movie trilogy… You have no power here, Gandalf the Grey. The iconic line is a vivid reminder that even the most powerful figures can seem powerless in certain situations. This idea is common across movies, books, and other storytelling mediums. Think about when Glinda the Good Witch of the South informs “The Wicked Witch of the West” that she has no power in Munchkinland in The Wizard of Oz. This year, this trope has jumped from the silver screen to the biopharmaceutical sector, where pharma stocks behave as if President Donald Trump’s threats to cut drug prices hold no power. Shares of healthcare firms have barely budged under his administration. Even the president’s declaration on August 5 to impose 250% import tariffs on pharmaceuticals was met with a yawn. The iShares US Pharmaceuticals ETF (IHE) fell just 1% that day and have traded flat since President Trump won the 2024 election, as the chart below shows.  While not a bloodbath, that’s still not very impressive. However, we believe that certain healthcare companies can do a lot better than flat under the Trump administration. So, in today’s Smart Money let’s take a closer look at how drug prices are set, and what power the president has to influence them. Then, I’ll point you toward the right healthcare stocks to invest in – ones that will continue to rack up gains. | Recommended Link | | | | Eric Fry here. I just delivered an urgent report from ground zero of the greatest technology project in human history. An invention so far beyond our current technology — even artificial intelligence — that some believe it will create millionaires overnight. Click here for the details. |  | | How Are Drug Prices Set? America’s healthcare and drug system is surprisingly straightforward, once you realize it’s made up of about a dozen separate overlapping programs. It only looks complex because we have so many of them. A partial list includes… - Employer-sponsored insurance

- Medicare

- Medicaid

- ACA insurance (aka Obamacare)

- Department of Veterans Affairs (VA)

That means drug pricing is also relatively straightforward. To simplify, pharma companies can set whatever list price they want for approved drugs. They can also offer better rates through secret rebates to any of these programs. For example, the list price for Eliquis, an anticoagulant drug from Bristol-Myers Squibb Co. (BMY), is $606 per month; after rebates, it’s closer to $513. Starting in September, Eliquis will be available to consumers for $346. But America’s system also means that our average drug prices are higher than elsewhere. Drug companies charge more here because the United States is richer (an economic concept known as eliminating consumer surplus). They also stick to high prices because there is no centralized authority to demand lower ones. This drug-pricing scheme has historically suited both political parties. Today, once-chronic diseases like hepatitis C are now curable. HIV is no longer a death sentence. And we’re tantalizingly close to “cancer vaccines” that use the immune system to kill off tumors. In addition, employer-sponsored healthcare costs are largely paid by employers, which shifts the burden away from employees… and, more importantly, away from government balance sheets. So, what power does the Trump administration have to change drug prices? Politics and Pharma The answer is “quite a lot, but only with Congressional cooperation.” In 1990, for instance, Congress added upper payment limit (UPL) provisions for Medicaid, the government-run healthcare program for low-income households. Under these rules, Medicaid only pays roughly 45% to 80% of a drug’s average selling price, rather than 103% to 106% that Medicare does. This illustrates the predicament the Trump administration finds itself in. On the one hand, the current administration and Congress have an immense amount of power to regulate drug prices, especially within government programs. On the other hand, the government knows that America’s pharma industry is only as good as regulators will allow it to be. If U.S. drug prices are suddenly capped, moneymaking incentives would disappear, halting approvals for therapies. That’s why the White House has already started walking back threats to America’s pharma industry. In May, President Trump signed an executive order that called for “Most Favored Nation” pricing. But on July 31, he sent letters to 17 pharma CEOs that reduced the order’s demands. Under these new terms, pharma firms would only have to provide lower-cost drugs to Medicaid… a system that already pays very little for existing drugs. Then on August 10, he promised to slash drug prices by 1,500%, highlighting how much of his threats are bluster. We believe that the Trump administration will continue the pattern of its predecessors: We’ll see performative gestures to reduce drug prices, and then a quiet reversal to reduce the real-world impact of these efforts. Still, our point is clear: President Trump himself has significant power to coerce pharma companies to lower prices, and he can turn to Congress if he wants to steamroll through legal challenges. However, the president might not want to disincentivize America’s pharmaceutical industry. Here’s why… Our Strategy for Healthcare Stocks The U.S. is still the global leader in drug development, but it needs funding to stay ahead… Especially as we’re already seeing some threats to America’s biotech dominance. Since 2022, Chinese biotechs have developed 639 first-in-class drug candidates, a fourfold increase from the 2018-’22 period. Clinical trials in China are cheaper, and the Chinese government recently made it far easier for small biotechs to raise capital. No administration wants to be blamed for America’s pharma industry falling behind China’s, and Donald Trump clearly understands that cutting drug prices at the knees is a sure way to do just that. So, we expect money to continue flowing into American pharma companies to develop new therapies, especially non-vaccine therapies. After all, the Trump administration made it clear from Day 1 that it intends to de-emphasize that category in favor of others. So, Eric maintains significant investments in vaccine-light healthcare companies in his Fry’s Investment Report service. And since President Trump took office on January 20, shares of one of our longtime biopharmaceutical holdings has grown 19%, while another one of our drug discovery and development companies has risen 15%. This only reinforces our strategy: We’ll stay invested in proven healthcare companies while the political debates on drug pricing continue to run their course. To find out which healthcare stocks Eric recommends at Fry’s Investment Report, click here. Regards, |

0 Response to "Drug Pricing in the Trump Era: Where to Invest Now"

Post a Comment