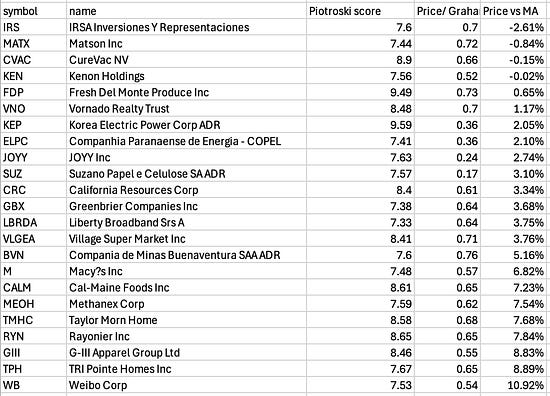

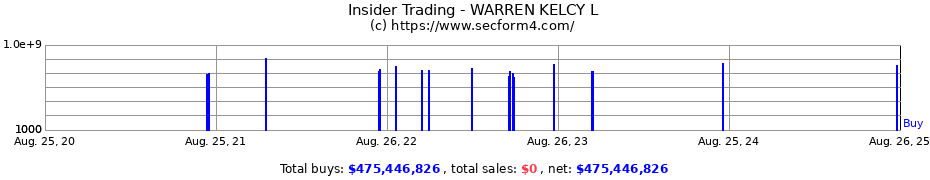

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: Greetings from the final days of summer… We’re at the pool… and there are no other kids here. My daughter goes back to school on Wednesday. And another summer slips away into the memory vault… She’s on the diving board… asking me what themed dives she should do. I’m out of ideas after 15 minutes. We did animals, then I just started naming NFL players. She did a great Lamar Jackson impersonation… running, and diving for a first down. The summers are long… but the days are short… I’ll miss this summer… it was fun. What else do I think? Thing I Think No. 2: Buy Strong, Buy CheapI was revisiting the F and Graham score stocks today… I have to say, I am a big fan of Fresh Del Monte Produce (FDP) when it cracks above its 20-day moving average. It keeps delivering 6% to 10% gains every few months before peeling back. I like this strategy for a simple reason. These are high-quality value stocks that occasionally catch momentum. That’s it… buy it when it breaks above that key moving average… and let it go when it runs 10%… and then just buy these same names over and over and keep your stops very tight. Simple, right? Thing I Think No. 3: Into the Top Five You Go…I’m a person who likes lists. I like to rank things. And for a long time, I’ve been very adamant about having a list of favorite things. A few weeks ago, my wife and I went and saw Rainbow Kitten Surprise. I’ve been a fan for a long time, but hadn’t seen them in concert before. My favorite song by them for a very long time had been a song called “Wasted.“ (It’s excellent…) But… I’ve long liked their song “Hide” - and the video that accompanies it. This is a video about drag queens… This opinion may impact some views on the end of the political bell curve. That said, I was rewatching the video the other day, and there’s a moment in the video where a man tells his step-son that no matter what he does, he’s his biggest fan. “You know, I understand why you don’t like to tell me a lot of things… cause of how I was raised,” he says to this young man dressed head to toe in a sparkly dress and full makeup. “But I’m your biggest fan, whatever you do. You know, whatever you do, I’m your biggest fan.” There’s a good punchline after that… But it would take me 50 years to come up with a perfect sentence like this… That embodies how I feel about my daughter… And the song is remarkable… Hide has moved into my top 5 favorite songs… and I scream it with conviction… Joining Condolence by Benjamin Clementine… Don’t Get Lost in Heaven/Demon Days by the Gorillaz, This Must Be the Place (Naïve Melody) by the Talking Heads. (A cover by the Lumineers was our wedding song…) and… Galaxie by Blind Melon… (my favorite song ever… by leagues… for so many reasons that can’t be quantified…) What fell out of the ranking for me? The greatest bass line of all time… CCR’s I Heard It Through the Grapevine. Sorry, John… you’re still my favorite front man ever… Thing I Think No. 4: Tough Sledding AheadToday’s a good reminder of what we’re up against as investors… The MAG 7 is crowded, and there’s a continued effort to climb into the high-leverage names. But look at the soft underbelly… Over 3,400 stocks are down on the day… And just 112 S&P 500 stocks are up… There is a structural problem that remains in place… the U.S. economy might be up from money printing and borrowing, but the exposure is significant. I’m with Spitznagel on the fact that by the time the Fed cuts rates, the real damage is there. Printing and borrowing is coming to a head… the real economy isn’t as strong as it appears, and the next jobs report could blow a hole in the narrative. And again, the market keeps going up while the economy remains sluggish. Why people think that borrowing 7% of GDP to effectively print 3% growth is strong… is beyond me. But hey… I just live here… Thing I Think No. 5: Kelcy Off the Top RopeAgain, I have favorites… I love JPMorgan (JPM) - because they are the U.S. financial system. I don’t love Salmon Stocks… I love Energy Transfer (ET). And so does Kelcy Warren - Executive Chairman of the Board of Directors… This guy is awesome… And he just keeps buying his stock. He has purchased nearly a half billion in stock since 2021… He started buying the stock at under $10. He just bought $34.6 million in stock… at $17.34. Do the math… he’s STILL BUYING after initial purchases at $9.35 back in 2021… I love this stock… I love Kelcy Warren’s conviction… I’m gonna add to my position… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Five Things I Think I Think..."

Post a Comment