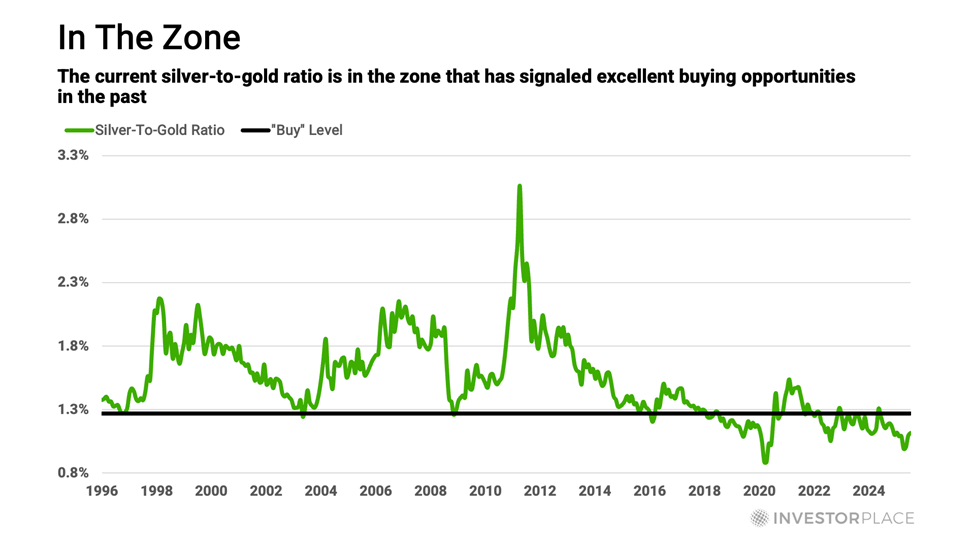

| WEEKLY ROUNDUP History Says Silver’s Next Move Could Be Explosive VIEW IN BROWSER Hello, Reader. Silver is as “good as gold.” Actually, it’s a better buy than gold right now. That’s not my opinion. It’s the “opinion” of an ancient trading indicator called the silver-to-gold-ratio, or SGR. Whenever this indicator falls to readings that are as low as they are today, the silver price rallies… usually a lot. For most of the last 30 years, the SGR has ranged between lows around 1.2 and highs around 3.1 – meaning that the price of silver has ranged from 1.2% of the gold price to 3.1%. The rare moments when this ratio traded below 1.27% signaled great moments to buy silver.

A reading that low has occurred only eight times during the last 30 years. In absolute numbers, here’s what the silver price did in each case. After the ratio hit… - 1.25% in 1996, silver advanced 60% over the next 15 months.

- 1.24% in 2003, silver tripled over the next three years.

- 1.26% in 2008, silver skyrocketed 370% over the next three years.

- 1.20% in 2016, silver bounced 38% over the next five months.

- 1.10% in 2019, silver nearly doubled in little more than a year.

- 0.9% 2020, an all-time low, silver doubled in less than six months.

- 1.05% in 2022, silver soared 79% in less than two years.

Incredibly, during each of these rallies, silver not only outperformed gold, but it also outperformed the S&P 500, which demonstrates silver’s value as portfolio hedge. Earlier this year, the SGR ratio dipped below 1.27% once again when it hit a low of 1.0% on April 21. Since then, the white metal has advanced 16.2% – a solid gain, but far behind the S&P 500’s 25.7% return over the same time frame. Nevertheless, if past is prologue, the silver price will continue chugging higher and surpass the S&P eventually. But today’s low SGR reading is not the only reason silver could soar over the coming months. Persistent silver supply deficits are also adding to the bullish cocktail. Additionally, silver could attract “safe haven” buying from folks who worry about simmering geopolitical tensions and/or rising U.S. indebtedness. These exact concerns are why I recommend an ETF that holds substantial assets in physical silver to my Fry’s Investment Report members. To help support that recommendation, I quoted the astute financial writer James Grant when he observed… Gold is a bet on monetary disorder – indeed, on other kinds of disorder, too, including fiscal, geopolitical and presidential. Although these three disorders are continually evolving, they’re still hanging around, which is probably why the gold price is still hanging around its record high. This suggests the yellow metal “sees” trouble that is not yet visible to the human eye. Bottom line: A confluence of influences are combining to drive the silver price higher. To learn how to access my silver recommendation, simply click here. Now, let’s take a look back at what we covered here at Smart Money last week… |

0 Response to "History Says Silver’s Next Move Could Be Explosive"

Post a Comment