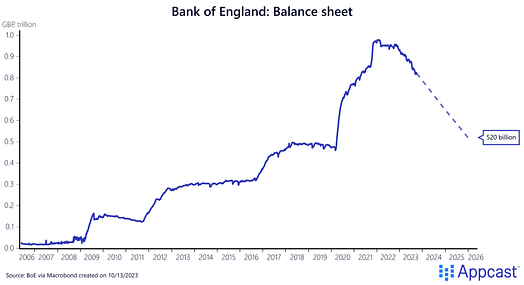

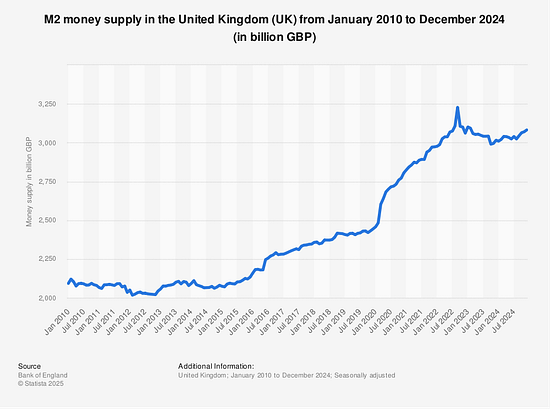

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Man Shocked to Learn That Qatar Owns A Lot of London"Worrying Trend Laid Bare..." Really? Where Have You Been?Dear Fellow Traveler, A member of the British media just "discovered" that Qatar's royal family owns more of London than his King. All total… 1.8 million square feet of prime real estate. The portfolio includes The Shard. Harrods. Canary Wharf. Parts of Heathrow Airport. Even a chunk of the Sainsbury's supermarket chain. And the headline reads that this revelation is a "worrying trend laid bare." Laid bare? My man… This "trend" has been streaking through Piccadilly Circus for over a decade. You're just now noticing? The world is for sale… and has been fire-saled… since the Great Financial Crisis… Welcome to 2010This worrying trend didn’t start last week. Let’s do some financial archeology on what happened in the last 17 years… 2008: The Great Financial Crisis hit, and central banks panicked. 2008-On: Global Sovereign Wealth Funds went on a buying spree... 2009-2015: Quantitative Easing (the central bank bought bonds and mortgages to unleash a wave of capital into the system) went BRRRRR for six straight years. 2010: Qatar started buying London properties like it's the Green and Dark Blue quadrant of the Monopoly board (the one with Park Place and Boardwalk). The value of all these assets, many of which are generating cash, has greatly appreciated. 2025: British journalist says: "Guys, I think something weird is happening!" This journalist’s report is like watching someone notice their house is on fire... after the fire department has already left. Where were these journalists when Qatar bought Harrods for £1.5 billion in 2010? Speculating on the time of Prince William’s engagement to Kate Middleton? When they grabbed 95% of The Shard? Covering the royal wedding? When they quietly accumulated a quarter of Mayfair… so much that locals started calling it "Little Doha"? Probably writing think pieces about Brexit. This Isn't Just About LondoThe Bank of England, like every other central bank, went insane after 2008, and most mainstream outlets didn’t understand what was happkening... The BoE “printed money” - Open Market Operations - like they were trying to wallpaper Westminster. While the M2 was pretty stable from 2010 to 2015, it surged after 2015 and went manic during COVID. All that freshly printed sterling had to go somewhere. Qatar was sitting on an ocean of LNG cash, watching Western central banks debase their currencies in real time. So they did what any rational actor would do… They traded their depreciating paper for hard assets in the world's financial capitals. Step Three was, apparently, over a decade later, to act surprised when you no longer own your own capital city. This Isn't Just About LondonWhile British journalists were apparently in hibernation, this same playbook rolled out globally. Pick a city. As I wrote last month, the UAE just announced $1.4 trillion for U.S. infrastructure plays. The pattern is always the same:

But this isn't just about foreign ownership. It's about the return of actual feudalism. Qatar doesn't just own buildings in London. They own stakes in the economic chokepoints. Heathrow Airport: 20% stake. Control passenger flow. Canary Wharf: Co-ownership. Control the financial district. The Shard: 95% ownership. Control the skyline. Harrods: 100% ownership. Control luxury retail. Sainsbury's: 14.3% stake. Control food distribution. This isn't about "ownership" in the traditional sense. It's about economic control. Qatar's investments employ nearly 160,000 people in Britain. They paid £3.4 billion in taxes last year. Their construction projects alone have generated £12.3 billion in investment since 2014. When your investments span from the airport people arrive at, to the hotels where they stay, to the supermarkets where they shop, to the financial district where they work, to the gas terminals that power their homes... That's not just portfolio diversification. That's infrastructure leverage. The Chicago Parking Meter Playbook Goes GlobalRemember when Chicago sold their parking meters to Abu Dhabi in 2008? $1.16 billion upfront for 75 years of cash flow from 36,000 meters. The sovereign wealth funds made their money back by 2021. They still have 60+ years of pure profit ahead. Qatar took that playbook and applied it to an entire city. Instead of just buying parking meters, they bought the airports, the skyscrapers, the hotels, the department stores, and the supermarkets. They didn't just buy cash flow. They bought leverage. When you control Heathrow Airport, you control who comes and goes. When you own Canary Wharf, you control where finance happens. When you own Harrods, you control luxury retail. It's the parking meter strategy scaled up to city-level dominance. And just like Chicago's deal, most Londoners have no idea it happened. This isn't unique to London or Chicago. It's the same story playing out globally - cash-strapped governments selling future cash flows to foreign sovereign wealth funds with infinite time horizons and harder currencies. The QE Insanity ParadeQuantitative easing was supposed to help regular people. Instead, it created the biggest asset bubble in human history, made housing unaffordable for an entire generation, and handed global infrastructure to foreign sovereign wealth funds. Mission accomplished, I guess? The Bank of England printed money to "stimulate the economy." In the end, Qatar stimulated London's real estate market right into its own portfolio. And when that "someone else" has different geopolitical interests than yours... Well, ask Germany how energy dependency worked out with Russia. While the media is finally waking up to trends that started during the Obama administration, smart money is already positioning for the next wave. Foreign sovereign wealth funds aren't slowing down. They're accelerating. The UAE's $1.4 trillion infrastructure framework is just getting started. Norway's oil fund is still buying. Singapore's GIC is still shopping. So what do you do? Follow that money. If sovereign wealth funds are buying infrastructure, utilities, and logistics networks, you should too. Think like a feudal lord. Buy the assets that generate contracted income. Toll roads. Cell towers. Data centers. Pipelines. Hedge against currency debasement. When central banks print money, hard assets appreciate against paper currencies. The British media just noticed that Qatar owns more of London than King Charles. They're calling it a "worrying trend laid bare." I'm calling it a Friday. This has been obvious to anyone paying attention since 2010. The money printer creates distortions. Foreign capital exploits those distortions. Domestic assets get bought up by foreign interests. Rinse and repeat. The only thing "laid bare" here is how oblivious financial media can be to the biggest trends happening right in front of their faces. But hey, at least they're only 15 years late to the party. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Man Shocked to Learn That Qatar Owns A Lot of London"

Post a Comment