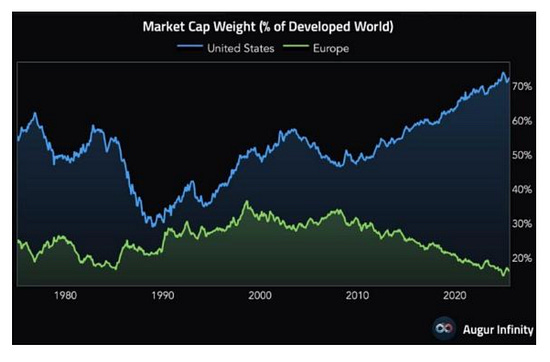

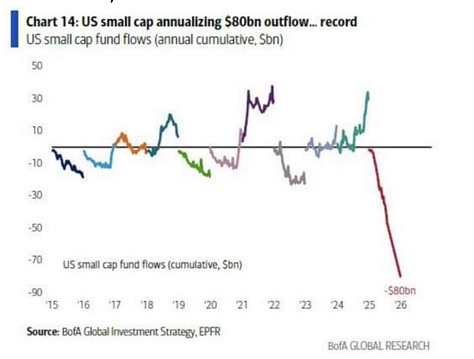

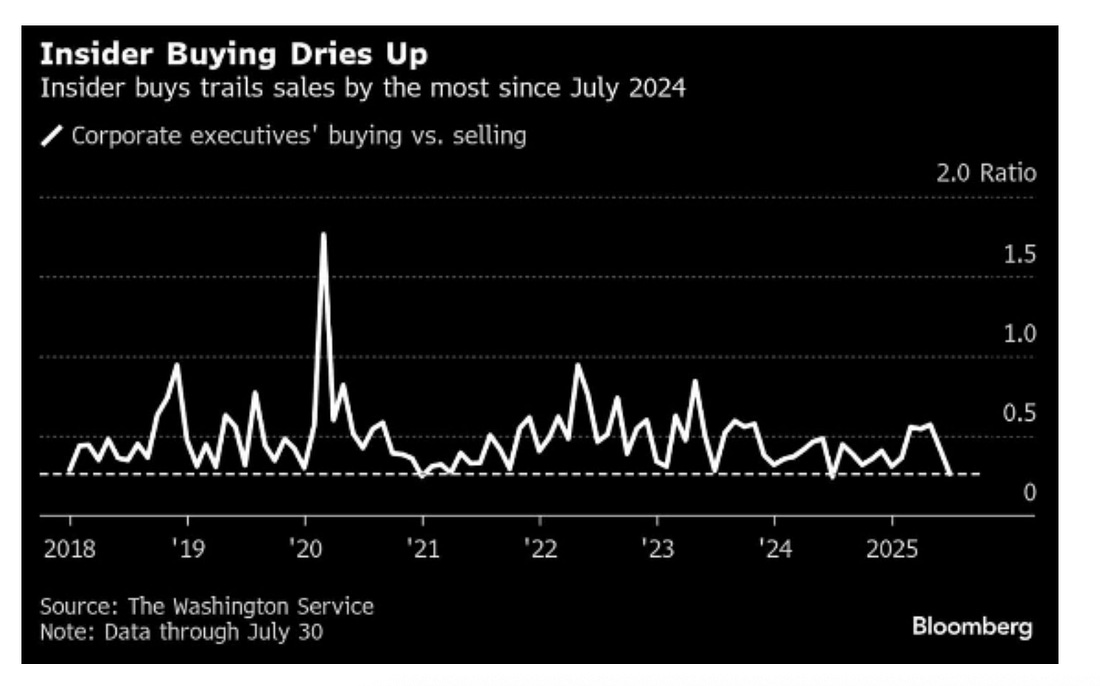

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. The Insiders Aren't Buying — In ReviewAmerica is the bubble... the Russell is floundering... and insiders aren't buying...Good morning: I hope your Sunday is going well. A few quick charts that set the tone for analysis over at The Capital Wave Report this week. We start with the impact of liquidity expansion. As I’ve said, global investors are chasing returns here. It’s gotten so out of hand now that the US equity market represents 72.5% of the entire developed world’s equity value, according to Augur Infinity. Europe? A measly ~16%. There was a period earlier this year where people said that the trade situation and tariffs would drive money out of the U.S… Nope… But it made for great headlines… The incentives are here because of the way the global financial system works post 2008… all fueled by a list of decisions made to combat global deflation in the 1990s… This isn’t American exceptionalism… It’s proof that America itself IS the bubble. Not AI or any single sector… Remember… 1993 is the year that changed everything on policy, personnel, and passive investing… It’s there on the chart… The price action is the story… you then have to do the archeology… which we did with the 1993 Series last year. While European politicians argue about regulations and green initiatives, American companies are eating the world because the Federal Reserve printed more money than everyone else combined, and now liquidity expansion is ongoing thanks to Treasury policies... The money printer didn’t just inflate US assets; it made them the only game in town. Foreign investors are piling into US stocks because everywhere else looks like a sideshow. When one country controls nearly three-quarters of global equity value, you're looking at a market anymore. You're looking at a bubble with an American flag on it. Elsewhere… turn your attention to WHERE that money ISN’T crowding. It IS NOT FLOWING to the Russell 2000. Small-cap stocks have seen an $80 billion exodus this year. That’s the biggest exit of all time. I've been following this issue all week in the Capital Wave Report. The Russell's momentum has turned negative and is signaling further pressure on the horizon. Why? Because in a world of infinite money printing and mega-cap dominance, who needs small companies? When you can buy Nvidia or Microsoft and ride the AI wave, why mess around with some regional bank in Ohio? Why buy any of the 30 plus energy producers on the Russell trading FOR LESS THAN THEIR BOOK VALUE!?!? The money is flowing where Federal Reserve liquidity goes: big tech, big pharma, big everything. Small caps represent the real economy, but in our financialized casino, the real economy is so 2019. And when all the leverage unwinds at once and cracks all those Magnificent Seven stocks, that regional bank in Ohio (cough… Buy TFSL) gets hit hard too. This isn’t a real stock market. It’s a leverage machine that hurts real investing… AND… Finally, you know that I’m always watching the actions of corporate insiders. They’re not buying their stock… Only 151 S&P 500 companies had insiders buying their stock last month. This is the lowest rate since 2018. The insiders know these markets are costly. Corporate executives are dumping stock like it's radioactive waste… When insiders won't even touch their stocks at current prices, that's your canary in the coal mine. We have to keep a very close eye on our S&P 500 momentum indicator and the FNGD right now. All eyes are on CPI this week and the Jackson Hole Symposium (Fed) on August 21. Now, let’s get to the week in review… Monday, August 4In Case You Missed It… my conversation with the great Josh Brown is broadcasting at The Compound at 5 pm… The link is here… Hope you enjoy… These are Public Companies?What, you don't want to invest your hard-earned dollars into fish farming? Tuesday, August 5The Best Financial Headline Of 2025 (And More Long Drink)In an era of anything can happen, the Economic Times defeats all man. Wednesday, August 6Don't Look at This Chart...Is it me, or is the Federal Reserve killing the food supply... Thursday, August 7An Ode To Legal Tender... For All Debts, Public and PrivateThe eight most powerful words in the global economy are hiding in plain sight on every dollar bill. Friday, August 8Things I Think I Think... (This Visual Capital Chart is Insane)A few thoughts as we wind down the week and turn our attention to inflation reports... Saturday, August 9Man Shocked to Learn That Qatar Owns A Lot of London"Worrying Trend Laid Bare..." Really? Where Have You Been? That tears it… I’ll be live at 8:45 at TheoTrade for anyone who wants to get out ahead of Tuesday’s CPI report. Bring your Long Drink if you’re in Dubai… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "The Insiders Aren't Buying — In Review"

Post a Comment