This Quant Tool Turns the Tables on Wall Street VIEW IN BROWSER

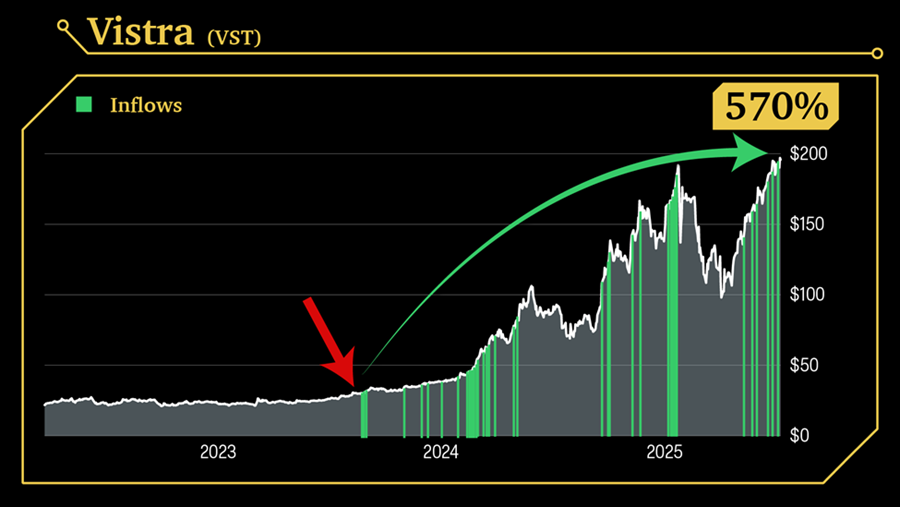

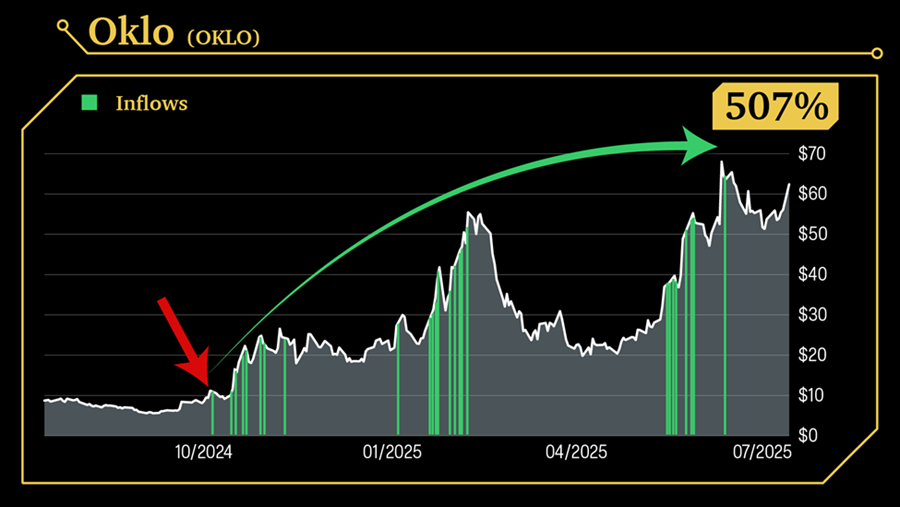

Wall Street is watching you… I don’t mean in a creepy surveillance-camera kind of way. It’s a type of financial surveillance that – without your knowledge – radically tilts the playing field in Wall Street’s favor. And it happens every time you buy or sell a stock on Schwab, E-Trade, Fidelity, and other brokerage apps. High-frequency trading (HFT) firms engage in something called “payment for order flow.” They pay your broker to see your trades. Then they use sophisticated algorithms to exploit your every move – often by getting ahead of the trade you just made and taking the other side. As you can imagine, this surveillance strategy has been a gold mine. Payment-for-order flow king, Ken Griffin, used it to post a $16 billion profit at his hedge fund Citadel in 2022. No one on Wall Street has ever made that much, that fast. Or take Virtu, which went public in 2015. It executes millions of trades a day based on order flow. And its public filings showed just one trading day of losses across 1,238 trading days from January 1, 2009, to December 31, 2013. It’s no wonder Virtu reportedly spends about $75 million a quarter on buying up order flow. It isn’t pleasant… But you need to know the truth. For decades, you’ve been the product – and Wall Street has been the predator. But what if you could turn the tables and see which stocks Wall Street is scooping up? What, if instead of being the watched, you could also become the watcher? As I’ll show you today, there is a way. In fact, this breakthrough system could have helped you drastically outperform the market by more than 5 to 1 going all the way back to 1990. I’ll be showing how it works, how you can profit, and how we partnered with a former high-level trader to make it happen in a new presentation. If you’re interested in learning more, register instantly for free here. Once you do, you’ll get the chance to try out our money flow tool on your favorite stocks. Then read on for more on how you could have used this money flow tool to spot winning trades this year. How to Spy Back on Wall Street TradeSmith is a leading U.S. fintech platform headquartered in downtown Baltimore. We have a staff of 36 data scientists, software engineers, and investment analysts. And we’ve spent more than $22 million and more than 50,000 hours developing cutting-edge investing and trading systems to help everyday investors level the playing field with the elites on Wall Street. These systems help more than 120,000 people around the world track about $30 billion in assets. And because of our breakthroughs, we’ve been profiled in Forbes, The Wall Street Journal, and The Economist. It all started in 2005 with our TradeStops risk-management tool. It makes 9,250 calculations a day on more than 6,000 stocks to help our members get in and out of stocks at the optimal time. And you may have seen me talk recently about two new breakthroughs— one that taps into the power of AI to find optimal profit windows for trading stocks and another that uncovers hidden seasonality patterns in the market. But the Wall Street money flow tool we’re discussing today is different. Those systems look for repeating patterns in past stock market data to stack the odds in your favor. Our money flow tool picks up on trades Wall Street players are making as they move in and out of trades. If you knew a hedge fund was about to pump $100 million into a specific stock ahead of time, would you buy it? Or if you knew a hedge fund was selling $100 million worth of stock and you owned it, would you sell it? Our system helps you answer those kinds of questions using data from Wall Street that most regular investors don’t know exists, let alone have access to. Here are some examples of recent Wall Street trades our tool picked up on before most individual investors caught on. These weren’t official recommendations. But they show how powerful our money flow tool can be for spotting winning trades. | Recommended Link | | | | When Tim Cook stood in the Oval Office last week, all eyes were on the “unique 24K gold gift” he presented to President Trump. But many viewers missed an even more important moment in that 30-second clip. One that unmistakably singled out what Futurist Eric Fry calls “possibly the best AI investment anyone could make right now.” Eric believes this little-known partner to Apple could go crazy over the next 12-24 months, potentially leaving well-known AI stocks like Nvidia, Microsoft and Google in the dust. Click to get full details on the company. |  | | Early Notice on the Nuclear Rally A couple of months back, President Trump signed an executive order to jump start the nuclear power industry. Here’s a May 23 headline from global newswire service Reuters.  That’s when most folks got wind of a rally in nuclear stocks. But our system picked up on this trend ahead of time. A big winner was power generation company Vistra Corp (VST), which operates America’s second-largest nuclear fleet. As far back as August 3, 2023, our tool picked up on unusually large Wall Street money flows pouring into Vistra. See those vertical green bars on the chart below? They show large institutional money flows into the stock.  At the time, Vistra shares traded at about $28. Today, they’ll set you back about $198. So, if you got in on the day our system flagged Vistra, you’d be sitting on gains as high as 570% in two years Another stock that’s been experiencing unusually large money flows over the past year is Oklo (OKLO). It designs and makes “micro” nuclear reactors. This stock is up 224% in 2025 and now trades at $71. But our system started picking up unusual buying activity in October 2024, when the stock was at about $11.  We’ve known that this was a hot stock among Wall Street elites for nearly a year. But most folks are just starting to wake up to this trend now. We Couldn't Have Done It Without Our "Inside Man" As I mentioned, we didn’t build our money flow tool without help. For this project, we needed someone on the inside – someone who knows how Wall Street players operate down to the financial “plumbing” level of how they execute trades. Thankfully, we had help from one of the few people on Wall Street authorized to make trades of $1 billion and up. He worked for Cantor Fitzgerald under President Trump’s Commerce Secretary, Howard Lutnick. His job there was to build multimillion-dollar positions in stocks on behalf of clients so that other Wall Street firms couldn’t see the trades they were making. There are few people in the world today who know more about how to track giant Wall Street trades than he does. That’s why I’m so excited about my new presentation beginning June 14 at 10 a.m, so click here to immediately secure your spot. And I’ll be lifting the lid on how this system works... and how it can help you 5x the performance of the stock market by getting in front of the billions of dollars of institutional money. So, if you’re tired of being Wall Street’s prey. And want to become a predator instead, join us. I hope to see you there! |

0 Response to "Must Read: This Quant Tool Turns the Tables on Wall Street"

Post a Comment