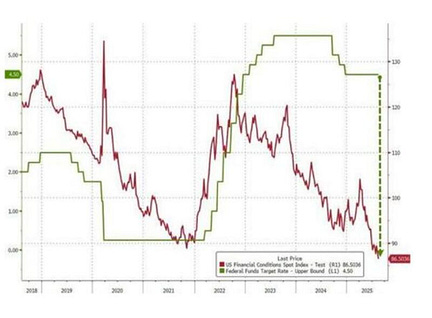

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. One More Time for the People In the Back...Stop talking about the dual mandate... that stopped mattering in the 1990s.Dear Fellow Traveler: I’m watching people bark on LinkedIn about how the Fed is looking at murky data… and how they are “Stuck”… And the importance that the Fed balance its mandate of stabilizing employment and inflation… And Jerome.. and… ugh! And how their policy initiatives trap… My God… stop. This is all theater. None of that matters. The Fed’s end goal is to stabilize debt systems and financial markets. That’s it. MY GOD… PLEASE STOP TALKING ABOUT THE DUAL MANDATE. Stop. I’ve studied this stupid stuff for so long and challenged my own beliefs so many times that I felt like I was having a tea party with stuffed animals after I watched Fed Chair Jerome Powell speak on Friday… It went like this… Math For Manics…This happened… “Mr. Frog,” I asked. “How do you feel about the Fed’s ongoing structural efforts to contain inflation in an era of fiscal repression?” “Well, Garrett,” I say in a frog voice while flapping his mouth with one hand and scratching my forehead until I bleed. “The Federal Reserve’s shift from its 2020 mandate had proven that it’s incapable of managing inflation expectations when repo operations reward leverage in short-term duration and Magnificient 7 stocks...” Insightful… “I agree,” I reply. “But I once believed that Quantitative Tightening would have solved this inflation situation long ago. Rate hikes are supposed to be the primary tool to cool the economy and ensure that financial conditions slow… not balance sheet runoffs....” “Well, you’re an idiot,” says Miss Bear. “We’re in the loosest economic conditions in the post-COVID era. Have you ever looked at a chart in your life, you stupid sack of…” “Hey, calm down,” says Mr. Owl. We all drink out of our cups and stare across the room for a moment. It’s silent. Okay. I tap my daughter’s table. “Can you explain to me the situation, Mr. Owl?” I ask. He’s missing an eye, but that doesn’t prevent him from sharing wisdom. In fact, it only helps. He leans in… “Basically, you’re failing to account for expanding liquidity conditions in an era of greater yield curve control efforts - without that ever being announced as official policy.” He leans down and drinks out of his cup. It goes silent for a moment. Then… “Excuse me,” interrupts a stuffed lemur named Morrice from the fifth chair. He’s holding up a teacup, and he seems pretty pissed off... “This whiskey isn’t working…” Everyone, Everywhere…I know that everyone became a Fed expert over the weekend, but no one seemed to have studied WHY the Fed exists in the first place… why central banks exist… Want to explain San Francisco to me in 1907? What happened with bimetallism in 1893? Or what happened in Italy in like… 1498… Our conversation goes like this… Tell me more about the long Depression after the Civil War? Take me through Jekyll Island, Basel I, the 1971 Gold Standard… the 1993 inflation targeting, LTCM, the Dot-Com Bubble… Cuomo’s pressure on housing… Just talk at my face for like two hours while I nod. I’m aware. In the words of Smokin Jay Cutler… We as a people have to adapt and move on now… We just went from capitalism in the 1980s… to technological feudalism in the 2010s, and now we’re back to 18th-century mercantilism in 2025…. with socialists running our cities. Can everyone please… catch up? We are moving at the speed of technology light… and we’re 20 years behind... Emotionally… We don’t get what is happening… If you want to understand where we are… and why… The markets are at all-time highs… while we’re seeing a shit-show labor market… not only because Amazon-like companies don’t want to pay health insurance… There’s a fiscal issue… driving these K-shaped moves. We’ve moved our debt issuance from 11% in 2017 to 21% in 2025 to maintain strong demand for our debt. T-Bills are cocaine. They’re jet fuel. Go down the rabbit hole of “Rehypothecation.” T-Bills are the official sponsor of U.S. market leverage. They’re the tool of leverage in the repo markets. I can take $100 million tomorrow (DOES ANYONE PLEASE WANT TO GIVE ME $100 MILLION… PLEASE…) and leverage that up to $2.5 billion… And I can repo T-Bills and Mag 7 stocks over and over… But the problem… now… Not a lot of people are left who want the 10-YEAR TREASURY BOND AT 4.3%. Why the hell would I want to loan a government that will be $50 trillion in debt in 10 years with a clear willingness to accept inflation (hello, Keynesians)… into 2035? The 10-year bond should be at 7% to stop all this inflation. But if we did that… Bank of America would be insolvent on paper… The market is at all time highs BECAUSE IT’S DESIGNED THAT WAY. If we allow the market to go to hell, the unwinding of the leveraged funds isn’t just on bonds. They are unwinding pension funds and they are unwinding 401ks… This is going to end so badly… SO BADLY. And people will blame… poor people? Immigrants? You do understand how irrational this all is, right? You do see what is happening? (If you don’t, watch this…) They screwed up… and they’re trying to cover it up… and they suck at it. The Fed kept rates low too long, and the government printed too much money. And instead of being honest about it… they keep blaming supply chains, engaging in financial engineering, and trying to pretend that a market bubble is just - normal. Stop listening to all this shit. STOP. My god. Please. Stagflation appears imminent… and even if the miracle happens, follow what the foreign governments are doing. We live inside this system - and we want to be patriotic and pretend that we’ll resolve. You know who else did that? Pre-Weimar Germans. They clung to their money… and they got smoked because they didn’t adjust for inflation and monetary nonsense... So… focus on what the foreign funds are doing. They see what’s happening… We operate in a world where we don’t report on what’s happening… Follow the money. Other nations DON’T WANT OUR DEBT. They are onto something. SO ONE MORE TIME… This is not that complicated. I don’t want you to wake up one day and have a combination of high inflation and collapsing small-cap stocks. That’s coming… Fast… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "One More Time for the People In the Back..."

Post a Comment