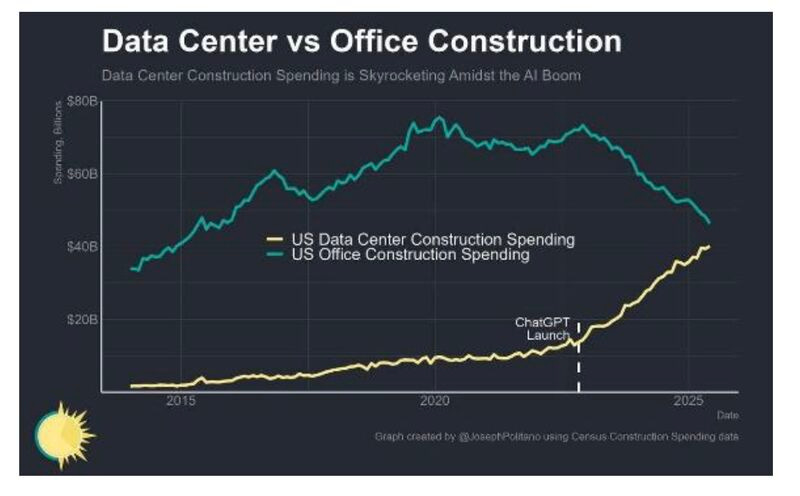

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Part I: Here Comes the AI Apocalypse for Grads and Middle Management...This is going to be a fascinating time to be alive...Dear Fellow Traveler, I graduated in 2004 with a journalism degree from one of the top programs in the country. You know what I found? Jack squat. No jobs. Anywhere. The internet had already torched my industry while I was still in class learning about inverted pyramids and AP style. Newspapers were dying. Magazines were shrinking. The smart people like Dave Weigel kept saying, "just start a blog." I went into competitive intelligence instead… I thought I'd seen disruption. I thought I understood what it meant when technology eats an industry. I was wrong. That was just the preview. What's coming now? Another level… don’t blink. So Long, Downtown OfficesI'm looking at a chart of data center construction spending versus office construction, and I'm wondering if I should laugh or start day-drinking. Data centers are going parabolic. The spending since ChatGPT launched has started to move on an incredible curve upward.... Meanwhile, office construction is flatlining and collapsing like my faith in Congress passing a law that prohibits their insider trading... You know what they're building in those data centers? The replacement of human ingenuity… Expect the next three years to be more economically radical than anything you’ve ever seen. I feel bad for anyone who is graduating from college now with a degree that they thought would lead them to six figures in their 20s. It’s probably not going to happen. Leaders told everyone to “learn to code…” They lied… Now, they’re going into debt with fewer options than ever… Tales from the TimesThe New York Times just ran a piece that should have been on the front page with sirens and flashing lights. Computer science majors… the golden children of the last decade… can't find jobs. They interviewed Manasi Mishra, who did everything right. She coded her first website in elementary school. She conducted advanced computing in high school. She got a computer science degree from Purdue University... The tech executives on social media promised her six figures, told her to "learn to code," and said it was the golden ticket. Her only callback? Chipotle. I’m not kidding… She got a call back to make burritos. She made a TikTok about it that went viral with 147,000 views, explaining her plight… Then there’s Zach Taylor. He went to Oregon State. He applied to 5,762 tech jobs. He got 13 interviews and zero offers. McDonald's (MCD) rejected him for "lack of experience." The New York Times found that CS and computer engineering majors now have unemployment rates of 6.1% and 7.5%. That’s DOUBLE the rate of art history majors. Art. History. Majors. (I’ve warned about this…) The college kids are just the appetizers… The main course is bigger… So Long “Yes Men” and “No Men.”If you know a guy who’s been saying “No” to every idea to innovate for the last 18 months, that guy is about to lose his job. Middle managers (the guys who are “GOOD AT DEALING WITH PEOPLE”) are going away. These are the people whose entire job is protecting their fiefdom, scheduling meetings about meetings, and creating PowerPoints about corporate initiatives. CEOs and others will say that they won’t be on the chopping block - because they’re so valuable to the culture of the company. But once CEOs assess the bottom line and see that ChatGPT can replace 12 of these… they’ll be gone… especially if the CEO is incentivized on the bottom line… These people are the “Yes men” to the executives… And the “No men” to everyone else who's been pushing big ideas at them for years… These corporate barnacles who've been coasting on information arbitrage and bureaucratic friction? They're done. AI can coordinate better, communicate better, and it never asks for a raise or complains about the coffee... The entire management layer between the C-suite and actual workers (who you know… do shit) is about to evaporate faster than my interest in MMT theories. The Deflationary Tsunami Is Also ComingNow here's where it gets really interesting.. This is going to be terrifying for the Federal Reserve and the banking system… We're about to experience wage and technological deflation that will make the 1990s look inflationary by comparison. Remember the '90s? The Berlin Wall fell, China entered global markets, and the internet created e-commerce. That triple whammy created the biggest deflationary force in modern history. This? This is going to be BIGGER. In the '90s, we still needed humans to do most things. We just got more efficient at moving goods and information. Now we're eliminating the humans entirely. A two-person startup with advanced AI skills can produce more content, more ideas, more videos, more anything than a large public company with over 400 employees… In three days, the startup company can achieve what the legacy one takes a month to do. The startups don't need HR departments, compliance officers, or efficiency consultants that meet once a month... They have code, AI, and maybe really good Rifle Coffee. Massive headquarters? Not needed. Middle management? No such thing… HR departments? Replaced by a chatbot named Susan. You think they spend weeks and months planning or fire away over and over again until something works… They hate the word “No.” Corporate hierarchy? Gone… replaced by lateral cooperation and pure profit shares… When your competitor has 1% of your overhead and 10x your productivity, you're not competing… you’re just an inefficient, bloated, meeting-obsessed corporation that thinks a moat will protect you. But spoiler alert: There is no moat. AI and talent just drained it. Get ready… In Part 2, I'll explain why the Fed is about to panic, why UBI isn't a progressive fantasy anymore, and what you need to own in the markets to survive what's coming... Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Part I: Here Comes the AI Apocalypse for Grads and Middle Management..."

Post a Comment