You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Pt. 2 - The Money Printer's Last Stand on AIWhat happens when AI rips through this economy and wipes out middle management and new jobs? What happens if deflation comes fast and furious.... BRRRRR...

Hope you've had time to pour yourself something strong. In Part 1, I explained how AI is about to make the dot-com disruption look gentle... Now let's talk about what happens next… and why your portfolio is about to get weird. If the real strength of deflation from AI hits… it should benefit society. It should make the things that matter more abundant. (Can’t believe it’s been four years since I wrote this piece on Deflation and the Fed’s reactions to it…) Deflation should give us MORE for less… But that’s not how the debt system works. The Fed always panics in the face of deflation... They always do. There aren’t enough dollars to go around to pay off all the existing and expanding debt… What’s worse… There isn’t enough money to refinance existing debt. As Michael Howell notes, six out of every seven new dollars go to REFINANCING existing debt in the global financial system. Only one contributes… to financing growth. If AI-based deflation hits hard (and I’m talking the real wage impact), this fast, they'll have exactly one move: print money like it's going out of style. But here's the thing… this time it won't work the same way. You can't print your way out of technological uselessness… You can't Quantitatively Ease your way back to needing humans for tasks that machines do better. The Fed had to print trillions to offset the deflationary forces of globalization and the internet. It printed monstrous amounts of money after the deflationary spirals became apparent in 2008 and 2020… But those were short-term… Look out longer… The Fed has maintained a very loose monetary policy since the 1990s, largely due to the international labor impact of communism’s fall and China’s rise, and the impact of technology. That was just moving jobs around the planet and making commerce more efficient. This? We should eliminate a lot of college degrees… and colleges in general. This coming era will eliminate jobs and entire industries, just like the internet and industrialization… but faster… They're going to have to offset deflation that makes the China shock look like a rounding error. We're talking about the possibility of at least 30% of white-collar work evaporating. The velocity of money will get walloped because AI doesn't shop at Target. This is your last warning in the event the Money Printer Goes Nuclear. Might not come today… but it will eventually… because the real issue comes if AI disrupts wage bargaining power… BRRRRR won't even describe it. We're going to need a new onomatopoeia. Maybe BRRRRRRRRR…ZZZZZAAAAPPPPY. The UBI InevitabilityWe're going to see policies that would've been called socialist just five years ago. Universal Basic Income? That's not a progressive pipe dream anymore… I expect that the center and parts of the right will start to embrace it… quickly. Like they did bailouts and capital injections back in 2008… It could become the only thing standing between social order and complete chaos if massive job displacement comes and there’s zero preparation for it… The government will try everything:

None of it will stop what's coming. It's like trying to stop a tsunami with a sand castle. But they'll print anyway because that's all they know how to do. What This Means for Your MoneyForget everything you know about investing. Seriously. The playbook from the last 40 years? Throw it out. Set it on fire… and dance on its ashes. This is the next 36 months… Here's what you need to own:

What you DON'T want:

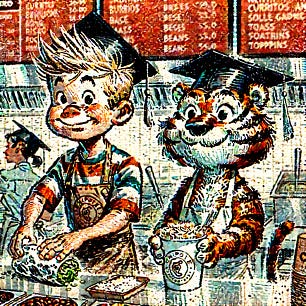

The Next 36 Months Will Not Look RecognizableI'm not being hyperbolic here. The world in 2028 will look as different from today as 2020 looked from 1990. Maybe more. The economic models are on quicksand... The social contracts will buckle… The entire concept of "work" will be redefined. I've been watching the money printer for years. I've seen every flavor of fiscal insanity, every monetary experiment, every attempt to deny economic reality. This is a paradigm shift. If I’m right… the deflation will come first… brutal, swift, and merciless. Then the panic. Then the printing. Then the inflation. Then... something we haven't seen before. Your assumption that your job is safe? Definitely want to rethink that. Axios hammered away on this point in April. Don’t “learn to code”… learn to prompt… now. Your belief that things will "return to normal"? That data center construction chart I mentioned? It's not showing growth. It's showing replacement. Every data center they build is an office building they'll never need again. The New York Times article about CS grads working at Chipotle? That's not a labor market hiccup. It's a canary in the coal mine having a heart attack. The Fed will, in the next few years, be unleashing open market operations that will make 2020 look conservative. I think that the balance sheet is going over $10 trillion. Not because they want to, but because when half the economy becomes obsolete overnight, you either print or watch a revolution start… There’s a reason why the socialist mayors are taking over the cities. And the reason after enough archeology is BRRRRR… People know something’s wrong. They just won’t put their finger on the pulse of how central banks address technological deflation with more money printing that offsets the deflation but drives up the price of everything else. And if you think I'm exaggerating, bookmark this article. Then send me a note about how I underestimated it. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Pt. 2 - The Money Printer's Last Stand on AI"

Post a Comment