Dear Reader,

Can you still profit from the current stock market?

According to Weiss Ratings, the answer is yes …

IF you invest in the right stocks.

Keep in mind, Weiss Ratings was ranked #1 by both the SEC — the authority that regulates the stock market — and the Wall Street Journal, the world's foremost stock market publication …

And for good reason …

Because when it comes to profits for investors, nobody can beat the Weiss Ratings track record:

|

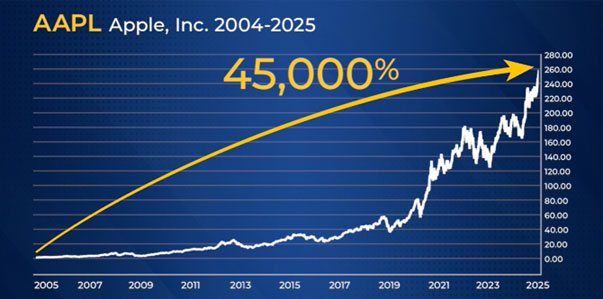

It identified Apple at 50 cents — it's up over 45,000% since …

|

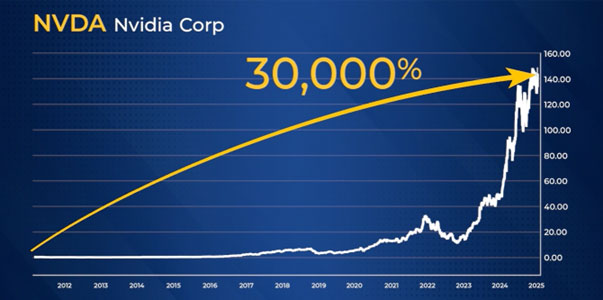

Nvidia at 40 cents — up 30,000% today …

|

And Netflix at $3.70 — now up more than 27,000% …

But this is just a small sample …

For over 20 years, Weiss Ratings' picks have made an average gain of 303% — including the losers.

And now, this eerily accurate system is flashing green on a new set of stocks …

Specifically, it identified three under-the-radar picks that could thrive in 2025 and beyond …

And we're giving away their names and ticker symbols — FOR FREE.

That's right, if you missed out on the 3x … 5x … or even 10x gains of the past years …

This could be your best chance to make it right.

Make sure you don't miss it.

Sincerely,

Eliza Lasky

Weiss Advocate

PS:

Every time Weiss Ratings flashed green like this, the average gain on each and every stock has been 303% (including the losers!).

Click here for the names of our three top stocks to own this year (no purchase necessary).

Amazon Stock Sets Up for Breakout After Bullish Crossover

Written by Sam Quirke. Published 8/21/2025.

Key Points

- The recent MACD crossover confirms that fresh upside momentum is in place after Amazon's post-earnings pullback.

- Supporting this is the fact that the company's fundamentals remain solid with broad-based growth and reports that are crushing expectations.

- As we've highlighted in recent weeks, the vast majority of analysts consider Amazon a red-hot buy, with fresh price targets as high as $300.

Shares of tech giant Amazon.com Inc. (NASDAQ: AMZN) have been trading a little softly this week, slipping about 2.5% from last Friday's high.

However, what's important is that the stock remains more than 7% higher from the start of the month, when some post-earnings profit-taking briefly pulled it lower.

And what matters even more now is that momentum appears firmly back in the bull camp, with a major technical signal having just started to flash green.

For those watching from the sidelines, this could be the perfect entry point ahead of a rally into the autumn. Let's jump in and take a look.

Why the MACD Crossover Matters

The moving average convergence divergence (MACD) indicator measures the relationship between two moving averages of a stock's price, most commonly the 12-day and 26-day exponential averages. When the shorter average crosses above the longer one, it indicates that recent price action is accelerating upward compared with the longer trend.

Traders then watch the MACD line against its nine-day signal line. A move above it is called a "bullish crossover," a classic sign that momentum is shifting back in favor of buyers.

That is precisely what happened for Amazon late last week.

The bullish crossover often confirms that short-term weakness has likely run its course and buyers are stepping back in. This is about as clear as they come for investors who have been watching closely and waiting for a technical entry point.

The Fundamental Backdrop: Amazon’s Growth Justifies the Premium

It should go without saying that technical signals alone are rarely enough to justify diving into a stock headfirst. What makes Amazon's current setup attractive is that the MACD is flashing green amid strong fundamentals.

Take the company's most recent earnings report, for example, it topped Wall Street expectations across the board, and showed its key AWS unit growing at an impressive clip.

Valuation will almost always form part of the debate too, and with a price-to-earnings (P/E) ratio of roughly 35, the stock is not the cheapest of the mega-caps.

Yet Amazon has rarely traded like a value stock, and its investors have always been happy to pay a premium for its growth potential. Add in the fact that the bears look to have just raised the white flag, and we could be looking at the start of the next leg of the rally.

Analyst Sentiment Supports the Buy Signal

The final point to consider is that while the MACD may have just had its bullish crossover last week, the analyst community has, for a long time, been almost unanimous in its bullish stance on Amazon.

Just last week, the teams at Morgan Stanley, Citigroup, and Evercore all reiterated Buy or equivalent ratings, adding to those that came before and after July's report.

The most recent price targets range as high as $300, which points to more than 30% in potential upside from where the stock closed on Tuesday.

Compared to Qualcomm Inc (NASDAQ: QCOM), which continues to divide analyst opinion. In a market where big-cap tech is increasingly being picked apart for valuation risks, Amazon remains a near-universal Buy, which makes this entry point all the more appealing.

What to Expect Next for Amazon

There's a growing sense that Amazon is setting up for a retest of July's high, around the $235 mark, in the near term. For investors getting involved, this is the first level to watch, and a close above it would clear the path to February's all-time high around $242.

As long as the broader market sentiment remains risk-on and the major indices keep hitting new highs, very little could get in Amazon's way.

This email content is a paid advertisement sent on behalf of Weiss Ratings, a third-party advertiser of MarketBeat. Why was I sent this email?.

11780 US Highway 1,

Palm Beach Gardens, FL 33408-3080

Would you like to edit your e-mail notification preferences or unsubscribe from our mailing list?

If you need help with your account, feel free to email our South Dakota based support team at contact@marketbeat.com.

If you would no longer like to receive promotional emails from MarketBeat advertisers, you can unsubscribe or manage your mailing preferences here.

© 2006-2025 MarketBeat Media, LLC.

345 North Reid Place #620, Sioux Falls, SD 57103. USA..

0 Response to "REVEALED FREE: Our three TOP stocks of 2025 are …"

Post a Comment