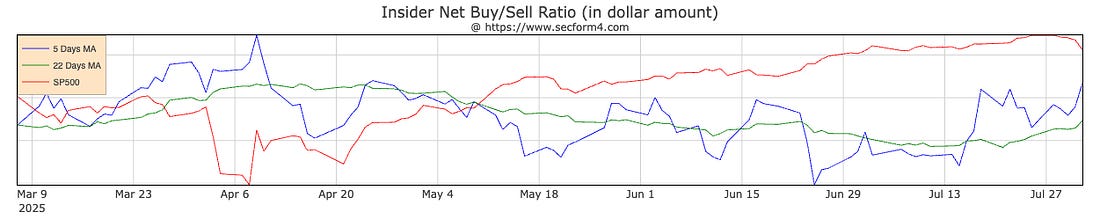

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Rough Seas...The Russell is under pressure, and the underbelly of the S&P 500 is exposed. But the view is lovely inside the eye of a storm...Dear Fellow Traveler: My day will consist of taking my daughter somewhere spontaneous… Then, trying to figure out how to get off Bonobos’ text marketing lists… And wrapping up this note to you. On Wednesday, we had a market narrative shift emerge, and it wasn’t very pretty. Selling pressure in the Russell 2000 exploded, driving that index into negative momentum conditions on Thursday morning. The Russell cracked under its 50-day exponential moving average (EMA) on Friday. Whether this is just a retest and some risk-off behavior after a two-month momentum run remains to be seen, but I’ll be keeping a close eye on the Aggregate Insider Buying to Selling Ratio over at SECForm4.com. The strongest levels of insider buying in dollars compared to selling in dollars came back during the cancellation of Liberation Day. We’re seeing an uptick in purchases… This would be a contrarian signal - and suggest that the narrative could swing back on the weak job numbers and potential expectations that the Fed must cut rates in September. Isn’t the market a wonderful wealth machine, everyone? Our reading on the S&P 500 is Yellow as well. We’ve seen our core FNGD signal tick above its 20-day moving average. There are certainly other things that have this market on edge. Consumer cyclicals are dumping in tandem… regional banks have been showing recent weakness… and momentum in technology that isn’t the Magnificent Seven has been weak (especially software applications… a signal of concerns about the labor markets.) And AIG (AIG)? At its lowest levels since the Liberation Day fiasco… If you haven’t watched The Wave Speech, today’s the day to do it… You know me… I’m going to tell you that an opportunity to buy will come at some point… because all roads point to monetary expansion, the likelihood of greater quantitative support efforts by the Fed, and the reality that monetary policy abroad has been easing while Michael Howell’s liquidity measurement expands to new highs. Keep your eye on the dollar… it rises when people start to hoard it and there may be an underlying refinancing issue emerging somewhere. As always, I expect we’ll wake up one day in the future and have another event in Japan, similar to last August. I’m not in the room with policy makers, and life’s too short to worry about SoftBank. Here are My Articles from the Week… With Links… Monday, July 28: If Interest Rates Fall... My Dog Could Be Rich... Tuesday, July 29: Ladies and Gentlemen... Jerome Powell Wednesday, July 30: S&P 500…. 10,000? Thursday, July 31: Growing a Backbone, America Style Friday, August 1: Four Money Printing Stocks for This Selloff I’ll be back tomorrow… Have a great day… and… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Rough Seas..."

Post a Comment