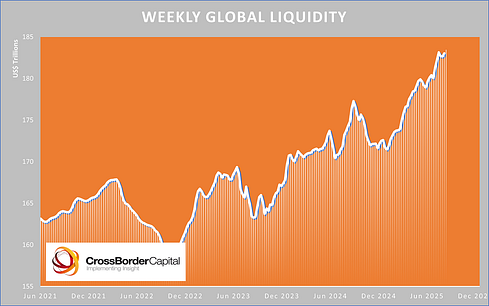

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Surfing, Soccer, and Money Sloshing About...I continue to argue that if you're going to trade in these markets, treat them like the ocean. Be cautious and follow the locals at all times...Dear Fellow Traveler, I'm coaching under-8 girls' soccer this year... I’ve got no idea what I'm doing. I’m just glad the other coach was a D-1 soccer player… But he couldn’t make the first practice… So, Tuesday night, I'm standing on a field in Maryland where the humidity makes you question life, watching seven-year-olds chase a ball like a swarm of killer bees. Our jerseys are light blue. So, we're the “Dolphins.” Well, mostly. One kid wanted to be the Penguins. She got really sad when we voted. She started tearing up. I'm standing there thinking... how do I fix this? Do I change the team name? Do I explain democracy to children when most adults don’t even understand it? Do I just let her be a Penguin while everyone else is a Dolphin? I wanted to be at my desk. Anywhere but managing the emotional crisis of a seven-year-old who really wanted to be a flightless bird. The parents said the practice went well. They must have been checking their phones… One kid's picking dandelions. Another's doing cartwheels. My goalkeeper just sat down in the middle of practice to tell me about her cat. But standing on that field, completely out of my element, watching chaos unfold... It's exactly like watching the markets right now. Everyone's running around. Nobody knows where the ball's going. And the people yelling the loudest have no idea what they're talking about. At least in the markets, I know how to read what's happening. To explain… I’ll keep it all very simple. It all starts with understanding the ocean - where dolphins actually live… Let me explain… The Three Market Forces That MatterWhile I'm trying to explain to the Penguin girl that dolphins are cool too, the market's been sending signals that most people are too distracted to notice. I follow the same three forces I've been tracking since the Fed turned on the Money Printer in 2009... The same three forces that tell you everything while CNBC tells you nothing (except for when Tepper explained how all of this works…) Here they are… Liquidity… The Tide of the MarketBefore you obsess over another earnings report or draw another resistance line, ask yourself… Where is the liquidity coming from? Is fiscal and monetary policy supportive? And not just here in the United States, but also in China, Japan, and Europe? How is bond market volatility treating us? Markets are at an all-time high globally for a reason.

There’s more capital than ever sloshing around… The tide is HIGH. When that tide is high, even zombie companies can and will rally. At low tide, the liquidity going out (receding) is very bearish. (See 2022). That’s where leverage unwinds. That’s where higher bond yields are impacting collateral quality… That’s where the MAG 7 gets crushed. Where insurance companies and reinsurance companies get hammered… Where people squawk about valuations… when it’s really capital doing the work… This is Stanley Druckenmiller…

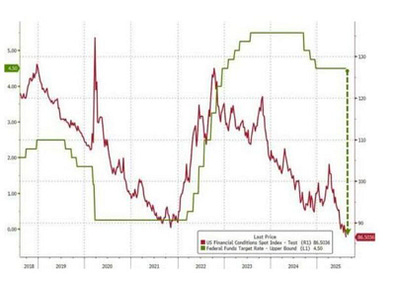

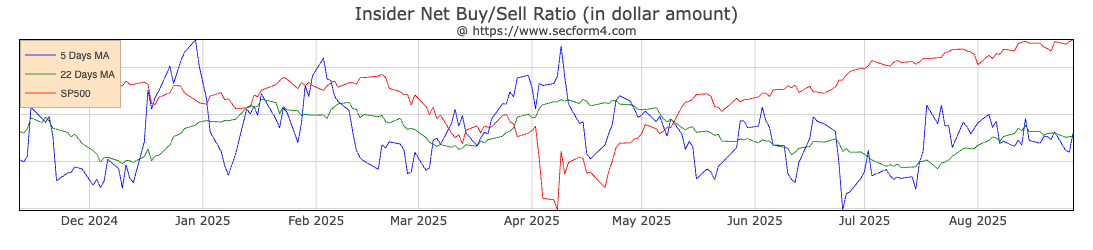

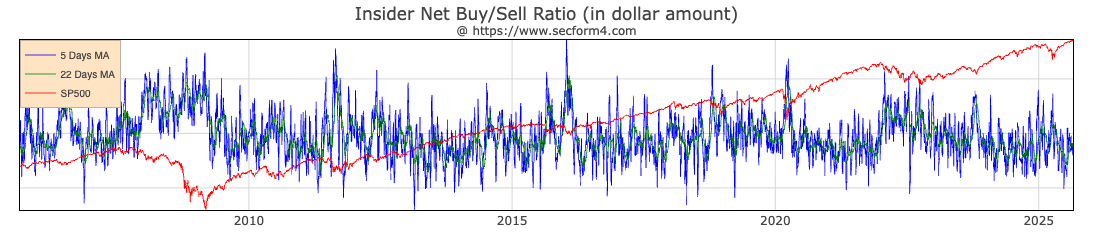

Right now, things are accommodative, even when everyone thinks the Fed has been engaging in Quantitative Tightening… The reality? We’re in the loosest financial conditions since COVID. The Treasury's been running refunding operations. The Fed's talking tough while still keeping the system liquid through various "definitely-not-easing" programs with creative names. China is accommodating… Japan hasn’t created a crisis… Buffett has been right… But fewer people are paying attention to the tide… People are too concerned about whether AI is a bubble, instead of examining the underlying financial conditions that created a financing bubble. It’s the leverage and liquidity… not the PE ratios… that matter. High tide means the S&P 500 continues to peel above its 20-day and 50-day moving averages… and everyone looks like a genius. It’s when refinancing becomes a problem, and liquidity tightens, that we all have to pause… This leads us to how we measure when the tide is heading out… Momentum: Stop Predicting, Start WatchingYou know what doesn't work in Under-8 soccer? Complex plays. Neither does strategy. I can’t assume anyone will be where they're supposed to be. You know what doesn't work in markets? Predicting. Drawing Fibonacci retracements… yikes… To put it into perspective. Don’t think you're smarter than the ocean. So, we bring it down to a single equation… something you can test… something you can measure. Actual math… not a model… Our momentum gauge, which we think of as a sort of surf report, has warned us before every major downturn since February 2020. Just because we’ve gone Red doesn’t mean that we’ve experienced a massive downturn each time. But it’s certainly been a warning… and a place to hedge against the hellscape that has been the six worrisome events that hit our markets over the last six years… I’m talking COVID (February 21, 2020), Archegos (March 2021), the GILT Crisis (signal negative in late August 2022), SVB Crisis (signal negative March 7, 2023), The Nikkei Crash (warning signs on July 17, 2024, negative August 1, 2024), and the most recent April crash (our signal negative on Feb 21 and March 26). When this turns negative, we sit on the beach. The perma-bulls call us cowards. Then the market does what it does. When real momentum returns, you'll know. We break above the break key moving averages, we see the number of breakout stocks surpass the number of breakdown stocks on a bell curve of performance analysis… We also tend to see one more major thing happen… We see the locals return to the water long before we do… Insider Buying: The Locals Always KnowEvery surf break has locals. They know when it's about to get good. When should tourists stay on the beach? Corporate insiders are the market's locals. Remember April 8-9 this year? There was massive insider buying. There were record TQQQ purchases. They were paddling out hard before policy shifts none of us saw coming. They knew something. They always do. Insiders sell for a thousand reasons… It could be divorce, yacht payments, their kid's Stanford tuition, or, in my case, youth soccer registration fees and whatever therapy I'll need come November… But they only buy for one reason. They believe that when stocks are going up (and when buying is massive, with everyone doing it at the same time), it can signal a policy shift or accommodation that will expand liquidity and drive markets higher. All three things are directly connected at the macro level… And the five-day moving average of Insider Buying to Selling (in real dollars) has been one of the best contrarian bottom signals in the market since… QE started in March 2009… See those spikes? That’s the bottom of every major event that has happened since the Great Financial Crisis. Don’t Overcomplicate It…Most people are playing a game they don't understand, following rules they've never read, screaming instructions that make no sense. Sound familiar? That's every fund manager who missed the April rally. That's every advisor still preaching 60/40 portfolios. That's everyone who thinks the Fed's going to normalize policy. We're no longer in a real market. We haven't been since 2008. We're in a liquidity casino where the Fed controls the oxygen and algorithms do 70% of the trading. It's like under-8 soccer… pure chaos. Except in markets, when the whistle blows, you lose real money. We know how to read the ocean, and we know how to read these markets. And right now, they're telling us something. The question is... are you listening? Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Surfing, Soccer, and Money Sloshing About..."

Post a Comment