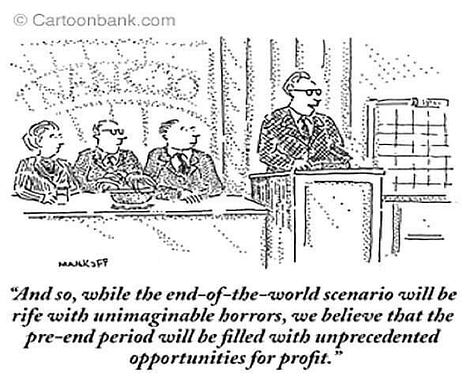

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. The Best Financial Headline Of 2025 (And More Long Drink)In an era of anything can happen, the Economic Times defeats all man.Dear Fellow Traveler: I love headlines. I don’t really “trade” them. I don’t always “follow” them. But I always dissect them… and try to figure out just how far the editors are willing to go just to get the click. It's like watching a journalism limbo contest where the bar keeps getting lower. And today, I think I’ve found my favorite headline of the year… Whatever the No. 1 headline was in the office pool (what was up on the bulletin board and people said… that it could not be topped…), one champion stepped forward with the confidence of Ivan Drago in Rocky IV and said… “I must break you… and your comprehension of reality…” This headline… Right here… It fills my heart with joy, confusion, and a desire to buy its writer a case of Long Drink. Where do we even start with this… It covers everything… the financial system on a bell curve… the bravado of Michael Saylor on Bitcoin mixed with the financial newslettter Doomsday prophecy that's endured longer than a Nokia 3310. This covers the first, second, third, fourth, and 14th standard deviations of possible outcomes for the financial system over the next… I don’t know… until the heat death of the universe? And it’s a reminder of my favorite (I believe it’s the) New Yorker cartoon of all time… It reads…

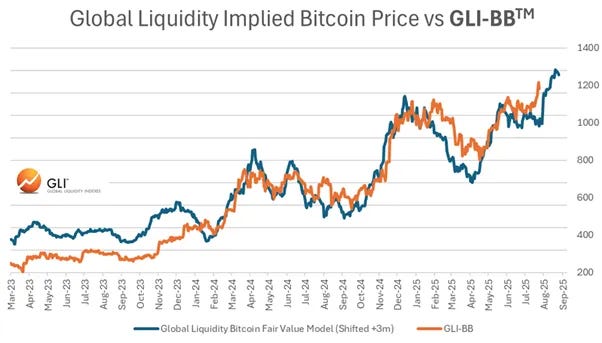

Sure… why not? Get rich… and then eat your Bitcoin like some sort of digital jerky… Or don't. Who cares… We'll all be trading bottle caps anyway. Bitcoin to the Moon?I’ve done a lot of reading on Michael Howell’s work at Capital Wars, and I highly recommend that you check out his new post on Bitcoin. Bitcoin is… at its core… a fundamental reflection of global liquidity. It's the financial system's mood ring. And as capital and leverage expand… it will rise… since all roads point to monetary inflation. But when the liquidity cycle stalls, that coincides with crypto winter. The question is whether this self-licking ice cream cone of a financial system is going to allow liquidity to stall out… or if we’ll just keep printing until the whole thing gives… like a piñata filled with Monopoly money. My argument goes that eventually the system will break. When is the question… I just believe that it can go on a whole lot longer than people think. In addition, be sure to sell your Bitcoin at $300,000… and buy land. Because you’re going to need… land. Eventually, this fairy tale market will go away. We all know it. It will be a lot less painful if you own the real assets that international funds are buying… Owning real stuff isn’t hard… The hard part of the markets… is the timing of asset price crashes and figuring out why everyone's pretending this makes sense... You can just leave that first part up to me… Finally… A Reminder…I keep seeing all of these blogs about people pouring grenadine into Miller High Life… and calling it a High Life Sunrise… or worse… the Drink of the Summer. I want to point something out. There is ONLY one drink of the summer… Ever… Forever, like a Solstice that never ends. It’s called Long Drink. It’s a Finnish treat, Miles Teller-backed, and it’s great for your knees and morale. This drink has VERY clear instructions… Here they are… Long Drink Instructions

The world is absurd. Your portfolio probably is, too. But at least the Long Drink is real. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "The Best Financial Headline Of 2025 (And More Long Drink)"

Post a Comment