A message from Chaikin Analytics Dear Reader, 50-year Wall Street legend Marc Chaikin, has come to be known for one thing in recent years... Predicting the big moves in the stock market, using what he calls, "the most powerful stock cycle indicator I've ever seen, based on more than 100 years of data." And just days ago, Chaikin went public with details on: The exact month the next big stock market crash is most likely to begin. Will Marc Chaikin be right yet again, in predicting the next big market move? I would NOT bet against him. He used this same cycle indicator in 2018 when he said stocks would fall on live TV...

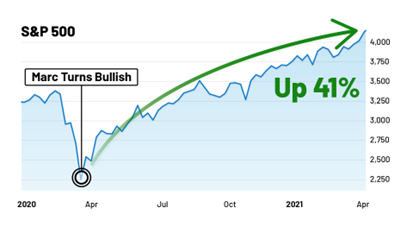

He used it in 2020 to help folks get back INTO stocks...

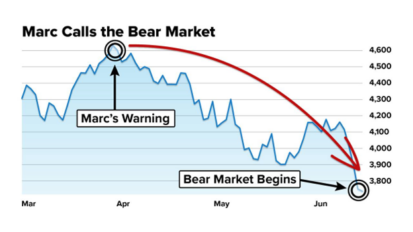

And in March of 2022 to predict a crash, when he wrote: "Millions of investors are about to be blindsided by a wave of stock crashes..."

And then again to predict huge bull markets in both 2023 and 2024...

And now, Marc Chaikin is using the exact same cycle indicator again to detail when he believes the next market crash will begin. He says it's going to catch millions off-guard. Which is why he recently produced a brand-new presentation detailing everything you need to know, including where to be invested now, and exactly when to the next crash is most likely to start. Chaikin even reveals the name and symbol of one of his favorite investments to buy right now. To get the full story and access Chaikin's presentation for free on his website, click here... Regards, Vic Lederman

Editorial Director, Chaikin Analytics

Today's Bonus News A Huge Bet on Uranium: Why Traders Are Piling Into the URNM ETFWritten by Jeffrey Neal Johnson

Key Points - The global push for clean, reliable power combined with the energy demands of artificial intelligence is fueling a nuclear resurgence.

- Upcoming earnings from key industry players and recent high-grade discoveries are providing immediate positive momentum for the uranium sector.

- The URNM ETF offers investors concentrated exposure to leading miners and direct exposure to the physical commodity price.

On Monday, July 21, the uranium market experienced a notable event. Traders acquired over 25,000 call options on the Sprott Uranium Miners ETF (NYSEARCA: URNM), driving volume up by 873% compared to its daily average (approximately 3,519 options contracts per day). For investors, this translates to a clear message: a significant amount of capital is making a strong, leveraged bet that the value of uranium mining stocks is poised for a substantial upward move. The details of the trading make the signal even more distinct. The activity was heavily concentrated in out-of-the-money September 2025 call options, suggesting an expectation of a sharp price increase in the coming weeks. This sudden, focused activity raises a critical question for investors: What are these traders anticipating, and what are the fundamental drivers that could propel this ETF higher? Why the Sudden Urgency? This surge in bullish activity appears to be a calculated response to multiple near-term events that directly impact the valuation of the Sprott Uranium Miners ETF. - The Cameco Earnings Factor: URNM's largest holding, Cameco (NYSE: CCJ), accounts for approximately 18% of the fund's assets and is scheduled to report its second-quarter earnings on July 30. Market participants are likely positioning ahead of what is anticipated to be a strong report, driven by higher realized prices from its long-term contract portfolio. A positive earnings surprise from URNM's largest asset would immediately lift the ETF's Net Asset Value (NAV).

- A High-Grade Discovery Halo Effect: Positive sentiment was further boosted by a July 21 announcement from Denison Mines (NYSEAMERICAN: DNN), another key URNM holding. The company announced a new, high-grade uranium discovery in Canada's Athabasca Basin, a premier global mining jurisdiction. Success in exploration by a major player increases the intrinsic value of its stock, which in turn boosts the value of the ETF's overall portfolio and generates excitement across multiple sectors, including the uranium and renewable energy sectors.

- Supportive Commodity Price Momentum: The uranium spot price has shown renewed strength, recovering toward the $80 per pound level, representing an 18% increase from four months ago. A higher commodity price directly translates to higher potential revenue and profitability for the miners held within the URNM portfolio, supporting higher stock prices across the board.

The Multi-Decade Nuclear Supercycle While immediate catalysts provide the spark, the fire is fueled by powerful, long-term fundamentals. The options activity is a bet on a durable, multi-decade supercycle for nuclear energy. This revival is driven by three foundational pillars. First is the global imperative for 24/7 carbon-free power. As grids struggle to balance intermittent renewables like solar and wind, nuclear energy is being recognized as an essential source of reliable, clean baseload electricity. Second, the push for energy security has put a premium on resources from stable western jurisdictions, a key characteristic of many companies in the URNM portfolio. The third pillar is the explosive growth of artificial intelligence (AI). The massive data centers required to power AI are creating a new and staggering demand for electricity. Nuclear power is one of the few carbon-free sources capable of meeting this demand. This structural shift in energy needs is occurring after years of underinvestment in new uranium mines, creating a supply-demand imbalance that strongly supports a “higher for longer" price environment for the commodity. The Uranium Investor's Chosen Vehicle The focus of this bullish activity on URNM is intentional. The ETF is designed to be a concentrated, pure-play vehicle for investors seeking direct exposure to the uranium sector. Its portfolio construction makes it particularly sensitive to the positive catalysts currently unfolding. The fund's top holdings are dominated by industry leaders, but its structure offers a unique advantage. Beyond its significant stake in miners like Cameco, URNM also holds approximately 12% of its assets in the Sprott Physical Uranium Trust (OTCMKTS: SRUUF). This provides investors with direct exposure to the price of the physical commodity itself, in addition to the operating leverage of the mining companies. It is a dual-pronged approach that can amplify returns in a rising uranium price environment. Further strengthening the bullish case is the waning conviction among bears. Short interest in the ETF is low, at just 1.94% of the float as of the end of June. This suggests that few investors are betting against the sector, reducing potential headwinds for the ETF's price. A Calculated Wager on the Future of Power The 873% surge in call option volume on URNM is more than just market noise; it appears to be a well-timed and calculated wager on the uranium sector's bright future. This bet is anchored by specific, value-driving catalysts, such as Cameco's upcoming earnings, and supported by the powerful, multi-decade tailwinds of the global nuclear revival. This potent combination of short-term momentum and long-term structural demand creates a compelling narrative. The recent market activity serves as a powerful signal that investor conviction in this investment thesis is accelerating, with the URNM ETF positioned as a primary vehicle for participating in this unfolding opportunity.

|

0 Response to "The day and month stocks are most likely to crash next"

Post a Comment